In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/03 Report--

Since Brilliance Auto Group was ruled bankrupt and reorganized by the court, there has been no substantial progress. On Feb.3, media quoted sources as saying FAW Group was considering acquiring BMW's main Chinese partner Brilliance China Automobile Holdings Co., Ltd. for a total price of $7.2 billion.

According to the plan currently under discussion, FAW Group will first acquire a 30.43 percent stake in Brilliance and an 11.89 percent stake in state-controlled Liaoning Province Communications Investment Group, and then FAW Group will make a mandatory takeover offer for the remaining stake in Brilliance Group, the sources said. Meanwhile, FAW Group is considering setting up an offshore investment vehicle and is looking for other investors in order to close the deal.

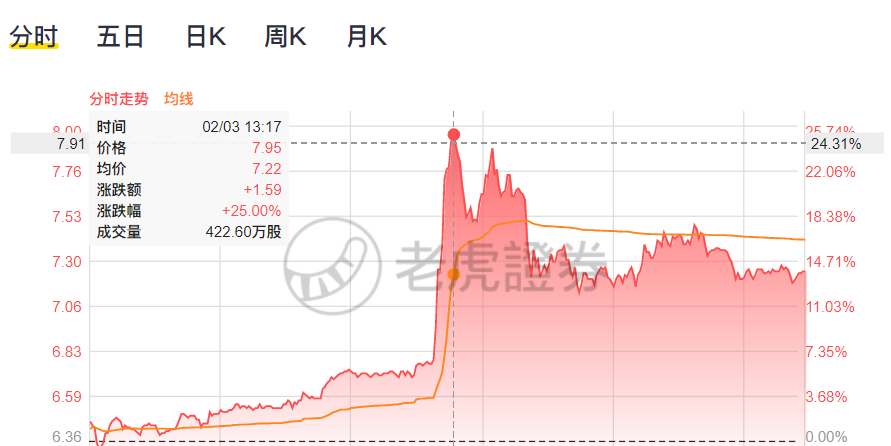

Affected by the news, Brilliance China shares rose 25.0% intraday to HK $7.95/share, with a turnover of 4.226 million shares. By the close of Hong Kong shares, Brilliance China was up 13.99%, closing at HK $7.25/share, with a total market value of HK $36.6 billion.

In response to relevant reports, Brilliance China issued a clarification announcement today,"Some media published a number of reports about China FAW Group's possible acquisition of shares in the Company and privatization of the Company. The Board wishes to clarify that to the best of the Company's knowledge, information and belief, having made all reasonable enquiries, the Company has no knowledge of the source of the information contained in the media reports."

Li Yanwei, a member of the expert committee of China Automobile Circulation Association, said that Brilliance Group needs to deliver 25% of the equity of Brilliance BMW Joint Venture Company to BMW Group in the future, while 50% of the shares are placed in Brilliance China, a listed company in Hong Kong stocks. Both parties have clearly agreed when signing the agreement that the 50% equity shall not be transferred or mortgaged before the completion of delivery.

Over the past year, the operating conditions of Brilliance Group's self-owned brand plate have deteriorated day by day, and the long-term accumulated debts finally broke out in the second half of the year. On November 20,2020, Shenyang City Intermediate People's Court ruled to accept the creditor's application for reorganization of Brilliance Group, which means that Brilliance Group formally entered bankruptcy reorganization procedure. However, the reorganization of Brilliance Group only involves the self-owned brand plate of the headquarters, and the joint venture brands Brilliance BMW and Brilliance Renault will not be affected.

As Brilliance Group is in the stage of bankruptcy reorganization, the business of subsidiaries including Brilliance's self-owned brand passenger cars and parts has stagnated, its terminal dealers have no cars to sell, and some dealers have resold other automobile brand products.

In the process of bankruptcy reorganization, the business of some subsidiaries, including Brilliance's self-owned passenger cars and parts, has fallen into stagnation, the terminal dealers of corresponding brands have no cars to sell, and some dealers have switched to other brands.

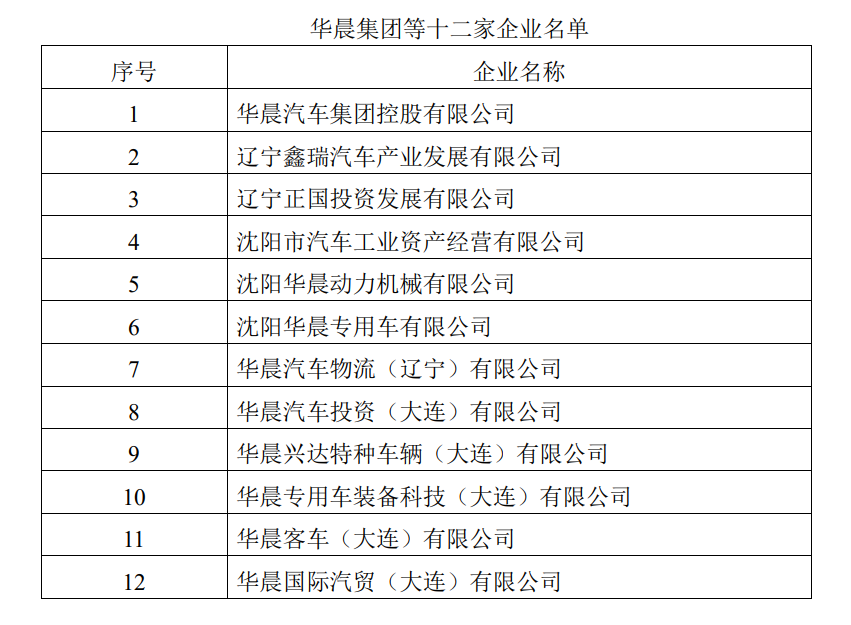

On January 27, Jinbei Automobile and Liaoning Shenhua Holdings issued an announcement saying that the controlling shareholders received the Notice from Shenyang City Intermediate People's Court on January 26 respectively, and the manager of Brilliance Automobile Group Holdings Co., Ltd. applied for substantial merger and reorganization of 12 enterprises including Brilliance Group for trial. The announcement said that it is uncertain whether the substantial merger and reorganization application put forward by the manager of Brilliance Group can be accepted by Shenyang Intermediate People's Court, and whether the controlling shareholders of the two companies have entered the substantial merger procedure, and said that the relevant parties have not yet launched specific plans and schemes for the reorganization of Brilliance Group, and it is uncertain whether Brilliance Automobile can be successfully restructured.

According to the data, Brilliance Group is a large-scale vehicle manufacturing enterprise controlled by SASAC of Liaoning Province, and its main operating income is vehicle manufacturing. Brilliance Group directly or indirectly holds and shares four listed companies, and through its listed company Brilliance China and BMW jointly established Brilliance BMW Automobile Company. At present, Brilliance Group owns three independent brands, namely Zhonghua, Jinbei and Huasong, and two joint venture brands, namely Brilliance BMW and Brilliance Renault.

Data show that in the five years from 2015 to 2019, Brilliance lost a total of 3.5 billion yuan after excluding Brilliance BMW's profit share. The semi-annual report shows that in the first half of 2020, Brilliance has a net loss of 340 million yuan after excluding the profit share of Brilliance BMW. Before being filed for bankruptcy reorganization, Brilliance Group was already heavily in debt. As an old automobile manufacturer, it was really sad.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.