In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/05 Report--

After Lifan Automobile was revitalized by Geely Automobile, Beiqi Yinxiang, which is deeply in debt crisis, is also expected to "revive". Recently, the second creditor meeting of the reorganization case of Beiqi Yinxiang Automobile Co., Ltd. and Chongqing Beiqi Magic Speed Automobile Sales Co., Ltd. was held on the National Enterprise Bankruptcy Reorganization Case Information Network. Finally, all voting groups passed the draft reorganization plan with high votes. This means that Beiqi Yinxiang, which is deeply in debt crisis, is expected to usher in new development opportunities.

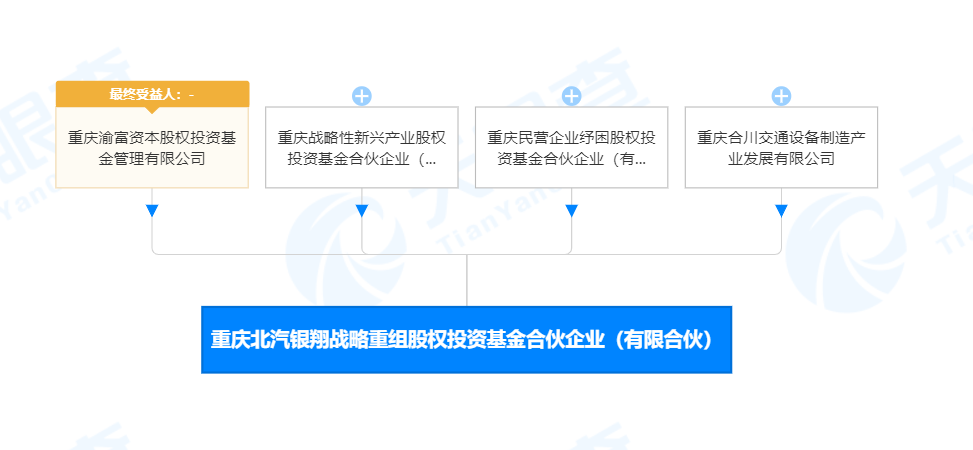

It is revealed that after the reorganization of Beiqi Yinxiang, the four shareholders contributed in the following ways: the special fund contributed RMB 1.2 billion yuan in currency; Yinxiang Group contributed RMB 487 million yuan in currency; Hechuan Transportation Company and its Chongqing Changhe Company contributed RMB 320 million yuan in equity; Beiqi Group and its Chongqing Changhe Company participated in the investment with engine and vehicle technology products. Among them, the special fund refers to Chongqing Beiqi Yinxiang Strategic Restructuring Equity Investment Fund Partnership (limited partnership).

According to Sky Eye Information, Chongqing Beiqi Yinxiang Strategic Restructuring Equity Investment Fund Partnership (limited partnership) was established on October 12,2020. The four shareholders of the fund partnership are Chongqing Strategic Emerging Industry Equity Investment Fund Partnership, Chongqing Private Enterprise Rescue Equity Investment Fund Partnership, Chongqing Yufu Capital Equity Investment Fund Management Co., Ltd. and Chongqing Hechuan Transportation Equipment Manufacturing Industry Development Co., Ltd. Equity penetration shows that the actual controller of the fund partnership is Chongqing City SASAC.

According to the data, Beiqi Yinxiang is an automobile company established by Beijing Automobile Group and Chongqing Yinxiang Business Group in 2011, among which 26% of Beiqi Group is the single largest shareholder, 12.65% is held by its National Development Exhibition Fund Co., Ltd., and 61.35% is held by Chongqing Yinxiang System as the actual controlling shareholder. Beiqi Magic Speed is a brand launched by Beiqi Yinxiang in March 2014. By 2017, the annual sales volume of Beiqi Yinxiang has reached 300,000 vehicles and reached its peak. By 2018, the sales volume of Beiqi Magic Speed declined sharply, and problems appeared in the capital chain. The news of employee holiday and factory shutdown continued to spread. Although it was backed by BAIC Group, it still failed to escape the trend of brand decline.

In April 2019, a number of BAIC Yinxiang dealers went to the headquarters of BAIC Group to defend their rights in order to recover hundreds of millions of yuan of prepaid car purchase money paid by dealers to BAIC Yinxiang. In August 2019, Chongqing City Government and BAIC Group signed a strategic restructuring agreement between BAIC Yinxiang. In September 2020, Beiqi Yinxiang entered bankruptcy reorganization proceedings. In February 2021, Beiqi Yinxiang bankruptcy reorganization plan was passed.

After the bankruptcy reorganization plan of Beiqi Yinxiang is passed, how will it "return" to the market? It is understood that BAIC Yinxiang will set up a new company, which will rely on the product R & D system of BAIC Group, and the products will be oriented to new energy, intelligent and high-end development. Meanwhile, the new company will launch a brand-new brand.

According to the new product publicity previously announced by the Ministry of Industry and Information Technology, Beiqi Yinxiang declared three van transport vehicles and three multi-purpose passenger vehicles, and applied for the trademark of "Beijing Brand". According to the declaration drawing, the new product adopts a brand-new brand LOGO, which is obviously different from the current Beiqi Magic Speed logo. In addition, the rear of the car is also printed with the brand name "Beiqi Boteng","Apollo 01","Apollo 02" and other vehicle names. It is unclear whether the above brands and models will become the brands and models launched after the reorganization of BAIC Yinxiang, and whether they will give up the brand of BAIC Magic Speed.

At present, the adoption of BAIC Yinxiang reorganization plan, relying on the technical support of BAIC Group and the support of Chongqing City government, may get different development situation. However, relevant data show that the total amount of creditor's rights involved in the reorganization of Beiqi Yinxiang and Beiqi Magic Speed is as high as 12.911 billion yuan, which has great pressure on the reorganization of Beiqi Yinxiang and Beiqi Magic Speed, and is also a major difficulty in returning to the market.

Since 2018, China's automobile market has begun to change. The development of new energy vehicles and the high-end transformation of independent brands have become two major development directions. In this process, automobile brands such as Cheetah Automobile, Zhongtai Automobile and Lifan Automobile have finally been ruled bankrupt and restructured due to lack of competitiveness of products, design failing to keep up with trends and imperfect after-sales service. As far as Beiqi Yinxiang is concerned, although it is backed by Beiqi Group and Chongqing City Government, there are still great variables whether it can be activated.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.