In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/18 Report--

Hillhouse Capital spent $200 million to participate in the latest round of private placement of BYD shares, according to media reports citing people familiar with the matter. For this purchase, Hillhouse Capital plans to participate in the subscription for a higher amount, but did not get a positive response from BYD, and finally decided at US $200 million.

In response to the news, Li Yunfei, general manager of BYD Automotive Brand and Public Relations, posted a Weibo response: "We thank and recognize Hillhouse Capital for participating in this round of growth." It is believed that the combination of forward-looking capital and advanced intelligence will bring better development prospects to the enterprise. "

It is worth mentioning that when participating in BYD's latest round of directional share purchase, NIO, Xiaopeng and ideal car manufacturers have just encountered the clearance of Hillhouse Capital. According to Hillhouse's filings with the Securities and Exchange Commission (SEC) through the end of the fourth quarter of 2020, Hillhouse holds shares in 95 companies with a total value of $12.578 billion. Hillhouse Capital reduced its position in about 30 stocks in the fourth quarter, including NIO, ideal, Xiaopeng and so on.

It is understood that Hillhouse Capital is an important investor in NIO, Xiaopeng and ideal. Previous data show that by the end of the third quarter of 2020, Hillhouse Capital held about 1.6 million shares of ideal Automobile, 2.41 million shares of NIO and 900000 shares of Xiaopeng Motor. By the end of the third quarter of 2020, Hillhouse had a market capitalization of $100 million in three car brands, but Hillhouse no longer held stakes in three car companies by the fourth quarter.

Why did Hillhouse choose to abandon the three major car brands and switch to BYD? First of all, under the influence of the chip crisis, a number of car companies around the world have cut production or stopped production because of the loss of supply of chips. BYD is not only a traditional domestic automobile manufacturer, but also a leading manufacturer of domestic specification-grade semiconductor chips, which can not only be self-sufficient but also external supply. BYD seems to be investing in BYD semiconductor chips.

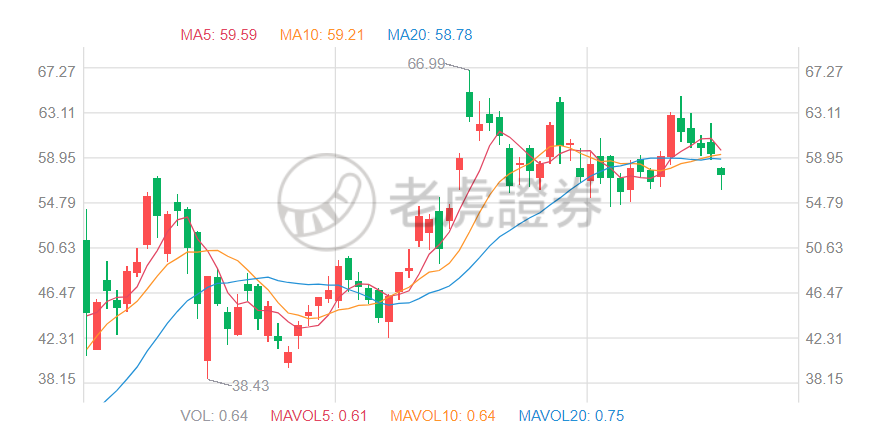

In addition, under the influence of the new energy vehicle market last year, the share prices of car companies dedicated to the development of new energy vehicles, such as NIO, Xiaopeng and ideal, soared. However, after entering 2021, the share prices of the three car companies, NIO, Xiaopeng and ideal, have obviously "remained unchanged", the share prices have entered a pullback, and stocks such as the clearance of Hillhouse Capital are also expected value, at least for a period of time in the future.

BYD has also risen a lot in the past year, and its current market capitalization has surpassed that of Lulai to become the highest market capitalization car company in China. Under the guidance of new energy vehicles and without the production capacity worries brought about by the chip crisis, BYD's share price still has some room to rise in the future.

It is understood that the relevant movements of BYD this year are also relatively big. Zhao Changjiang, former general manager of BYD Automobile sales Co., Ltd., will be transferred to a high-end brand, responsible for the construction of high-end brands. In addition, BYD will also become the four major business departments, responsible for dynasty net, e-network, brand and public relations, after-sales and other four core sectors.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.