In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)02/24 Report--

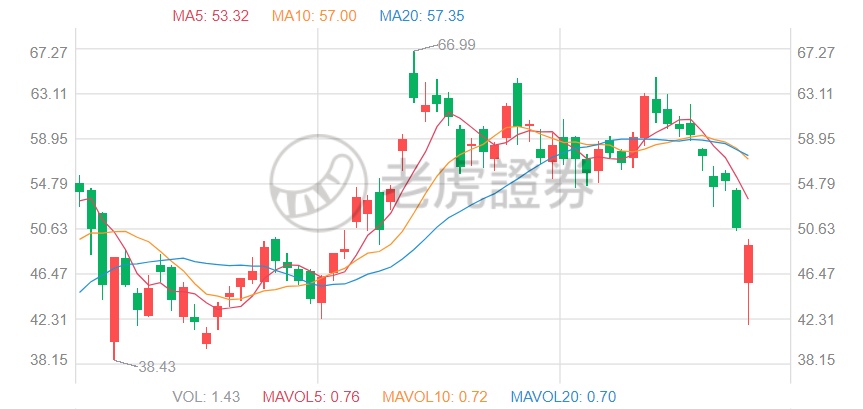

When American stocks opened on February 23rd, Tesla's share price fell by more than 13% at one point, and then quickly rebounded. As of the day's close, Tesla fell 2.19% to US $698.84 per share, with a total market capitalization of US $670.784 billion. It is worth mentioning that this is the fourth consecutive trading day that Tesla has declined.

Entering 2021, Tesla stock price trend can be said to be ups and downs. In January, Tesla's share price continued its 2020 growth trend, reaching as high as $900.40 per share, an increase of 12.45 per cent. In February, Tesla's share price fluctuated continuously, closing up 5.83% on February 1 and 3.93% on February 2, respectively, and then the stock price fell more than rose less, especially after February 8, Tesla's share price plummeted, from $863.42 on February 8 to $698.84 on February 23. According to statistics, Tesla's share price fell 19% in two weeks, and its market value shrank by nearly $160 billion.

According to Tesla's SEC filing, Tesla bought $1.5 billion worth of bitcoin in January. Since then, the price of bitcoin has continued to soar, breaking the $50, 000 mark. According to analysts, Tesla has made a profit of more than $1 billion after buying Bitcoin, surpassing the profit of selling cars in 2020.

However, Bitcoin has fluctuated sharply recently, with its price falling by more than 10 per cent in the past few days. With regard to the continued decline in Tesla's share price, some analysts said that after investing $1.5 billion in Bitcoin, Tesla's share price is now directly linked to the Bitcoin price.

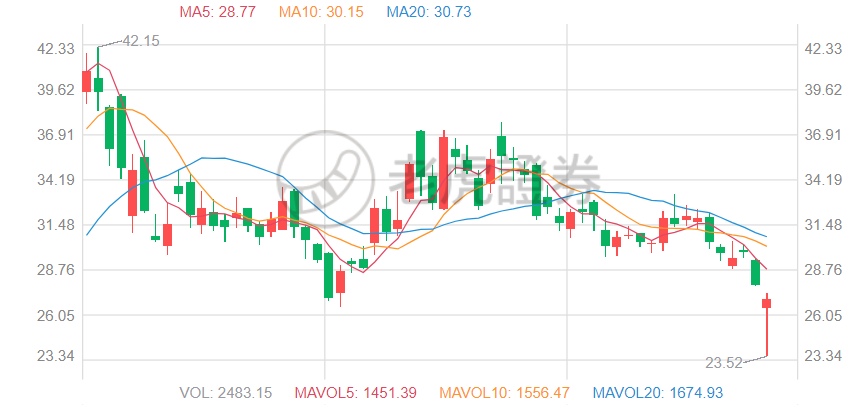

It is worth mentioning that, in addition to Tesla, the three major domestic car brands, ideal, Xiaopeng have also had a hard time recently, frequently not as expected in the capital market. Lulai Motor fell 19.8% from 61.2 US dollars per share on February 10 to 49.11 US dollars per share on February 23, while Xiaopeng Motor shares fell 20.5 per cent from 47.7 US dollars per share on February 10 to 47.7 US dollars per share on February 23. By contrast, the decline of ideal Motor was relatively low, falling 14.3% from $31.5 on February 10 to $26.99 on February 23. Based on this calculation, the market capitalization of NIO, Xiaopeng and ideal have lost $19 billion, $7.73 billion and $4.05 billion respectively in the past two weeks, and the three major car brands have lost a total of $31 billion.

NextEV

Xiaopeng automobile

Ideal car

In response to the continuous decline in the share prices of the new forces of car building, Cui Dongshu, secretary general of the Federation of passengers, said, "New energy vehicles are a hot concept, which is popular in the capital market, driving up the stock price by a big margin." As the epidemic stabilizes and the global economy recovers, some hot money will be diverted to other cyclical industries. It's not just new energy, but the share prices of the entire auto industry are fluctuating. "

So will the share prices of the new forces of car-building continue to rise? Some analysts believe that the new energy vehicle is the inevitable trend of the future automobile market development, the global new energy vehicle, especially China's new energy vehicle development prospect is huge, the head car brand still has a lot of room for development in the future. Under the guidance of the double points policy, the new forces of car building still have more market space. Some analysts believe that although the current head car brands have made some achievements, the actual development situation can not match the high market valuation, and there are still some challenges in the future development prospects.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.