In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/07 Report--

Tesla lost at the start of trading on March 5, falling more than 13% at one point in intraday trading, then quickly rebounded. As of the day's close, Tesla fell 3.78% to $597.95 per share, with a total market capitalization of $573.9 billion. It is worth mentioning that this is the first time that Tesla has fallen below the $600 mark since December 3, 2020. After the news came out, it was quickly uploaded to Weibo for hot search.

According to statistics, Tesla's share price has fallen by 15.26% since the beginning of the year. Tesla slipped in 19 of the 28 trading days from January 26 to March 5, with a cumulative total of more than $275 billion (1.7864 trillion yuan) evaporated, equivalent to the market capitalization of two BYD (currently 561.8 billion yuan). However, even so, Tesla's market capitalization still ranks first in the world, surpassing traditional automakers such as Toyota, Volkswagen and Daimler.

Some netizens said that Tesla still has room to fall, the current market value is not in line with the size of its market, and the share price was only a few dozen dollars last year. Some netizens also said that Tesla's share price rose last year, which is only a technical downgrade, and there is still room to rise in the later stage. Data show that Tesla's share price rose 743.44% in 2020, making it the world's largest car company by market capitalization.

With regard to the collapse of Tesla's stock price, the US CNBC summed up the following four reasons:

The first is the Federal Reserve. Federal Reserve Chairman Colin Powell said that with the resumption of the US economy after the COVID-19 epidemic, the United States is facing the pressure of rising prices and inflation. Financial markets feared that the Fed would raise interest rates to curb inflation, while bond yields began to climb.

The second is market competition. Tesla is a global leader in electric vehicles and self-driving, but some strong competitors have emerged and Tesla's long-term investors have begun to cash out.

In addition, there is a shortage of spare parts. After entering 2020, the news that the shortage of chips has caused car companies to stop production or reduce production continues to spread. Tesla, as a new energy car company, has not been spared. Prior to this, Tesla issued an early warning that the shortage of chips may affect the company's production target in the first half of 2021.

Finally, there is expenditure. Tesla is currently starting a large-scale expansion around the world, which undoubtedly requires a lot of financial support. In addition, Tesla also recalled many times because of vehicle quality problems, which will also affect Tesla's expenditure.

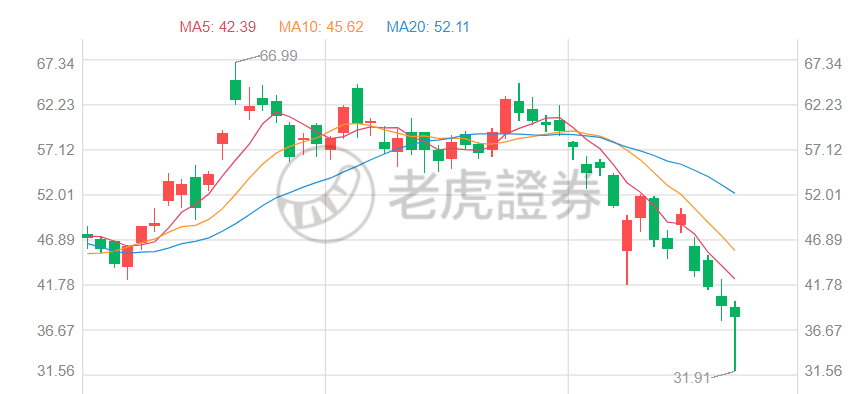

It is worth mentioning that, in addition to Tesla, the three major domestic car brands, ideal, Xiaopeng in the U. S. stock market is also difficult. Xilai fell 40% to $38.11 from $62.84 on Feb. 9, wiping out $40 billion (200 billion yuan) in market value.

The shares of ideal and Xiaopeng also halved, falling more than 36% to $22.46 from $36.76 on January 12, wiping out $11.5 billion (about 75 billion yuan) in market value.

Xiaopeng fell to $28.03 from $56.39 on Jan. 25, wiping out nearly $22 billion (140 billion yuan) in market value. So far, the three car brands have lost more than 480 billion yuan from the high point of market capitalization.

Of course, in addition to the US stock market, the domestic A-share market is also falling, including BYD, Great Wall Automobile, Ningde era and other auto stocks, as well as new energy stocks have fallen in turn. Take BYD as an example, it fell 26.59% to 196.37 yuan from 267.5 yuan on Feb. 2, and its market value lost nearly 200 billion yuan.

So will the new energy vehicle industry still have a chance? New energy vehicles are mentioned in the latest government work report, including "doing a solid job in carbon peak and carbon neutralization, formulating an action plan for carbon emission peak by 2030", "increasing the construction of charging column facilities, speeding up the construction of power battery recycling system" and so on.

Some securities companies said that the supply side of the global new energy vehicle industry continues to change qualitatively, showing the dual characteristics of "electric acceleration + intelligent opening" as a whole, the trillion-level market is opened, traditional car companies are actively transforming, and new car-building forces and high-tech Internet enterprises are speeding up their entry to promote the prosperity and development of the industry.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.