In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/18 Report--

Leeco, founded by Jia Yueting, has recently pulled 15 trading limits and its share price has nearly doubled. Although Jia Yueting is no longer the legal representative of Leeco, some outsiders believe that this is thanks to the future of Jia Yueting and the car company Faraday he founded.

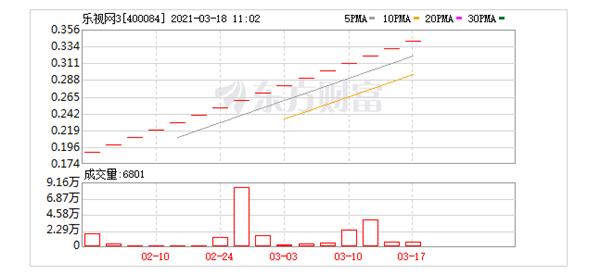

On March 17, Leeco 3, which delisted from the gem to the old third board, rose by the limit again! The latest share price is 0.34 yuan per share, with a total market capitalization of 1.356 billion yuan, nearly double the closing price of 0.18 yuan on the last trading day before delisting. Although, this has lost more than 99% of Leeco's market value of 165.6 billion yuan at its peak.

However, "LeTV pulled 15 trading limits" on Weibo, and as of press time, the topic has garnered 21.816 million views and 1349 discussions.

As we all know, Leeco delisted because of its operational problems, and finally delisted to the old third board on July 20, 2020. Since then, the stock price has been depressed, all the way down.

Although Leeco has announced its delisting, the company's main product, Letv Video, is still in operation. Lerong Zhixin still employs about 240,250 people, while Leeco now has about 200 people, a total of about 450 people.

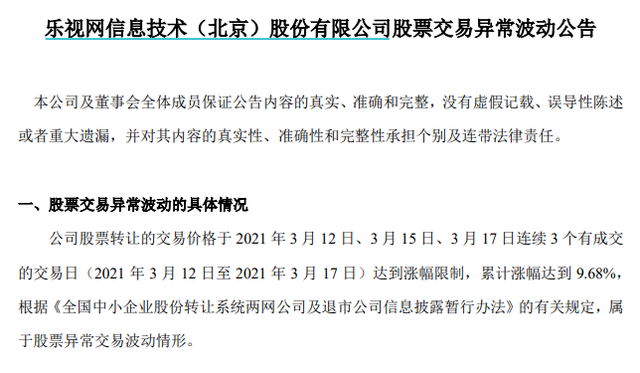

For the recent stock volatility events, on the evening of March 17, Leeco once again issued a stock trading abnormal volatility announcement. Leeco said it did not know that the company had information that should be disclosed but not disclosed, which had a greater impact on the trading price of the company's shares.

Leeco claimed that the abnormal volatility of the transaction is caused by the independent trading of both parties on the trading platform, which is a market behavior.

Prior to this, Leeco has issued three announcements of abnormal volatility in stock trading in succession.

Although officials did not give a reason why the company's share price rose by more than a dozen times. However, some outsiders believe that this has something to do with the recent good news of Faraday Future (FF), the electric car company that Jia Yueting has invested in.

In order to thoroughly solve Jia Yueting's personal debt problem in China, Mr. Jia Yueting, founder and CPUO of FF, has previously filed for personal bankruptcy reorganization in the United States and established a creditor trust controlled and managed by the creditor committee and the trust trustee. Upon completion of the plan, Mr. Jia Yueting will transfer all his equity in Smart King Limited (Faraday Future Global Holdings) to the creditor trust fund to better protect the interests of creditors and repay the remaining debt.

Among them, Jia Yueting made it clear to Leeco shareholders that he had set aside no more than 10% of the proportion through the creditor trust for the contingent compensation of Leeco shareholders, which could be implemented after the completion of the relevant legal procedures, and arranged a special team to coordinate the compensation of Leeco shareholders. In this regard, with the frequent occurrence of the advantages of FF, it has also promoted the share price of Leeco.

The FF91 electric car has completed its second-quarter winter test in the United States and is ready for sale in the first half of 2022, Faraday Future officials said on March 16. This means that Jia Yueting's long-awaited FF 91 finally ushered in mass production. The next day, Faraday announced in the future that Chen Xuefeng had officially joined as CEO of FF China, and reported directly to Dr.Carsten Breitfeld, CEO of FF Global.

Earlier, the US electric car company Faraday Future (Faraday Future) announced on its website that it had reached a final agreement with the special purpose acquisition company (SPAC) on a business merger, valuing the company at about $3.4 billion (22 billion yuan) after the deal was completed, and would be listed on the Nasdaq Stock Exchange under the symbol "FFIE". It also said it would set up a joint venture with Geely Holdings and a first-tier city in China to support FF's production in China and FF's China headquarters.

To sum up, all reflect the better progress of Faraday's future development at present, and successfully achieve financing to promote the mass production of its first model, FF 91, which naturally further promotes the possibility of Faraday's future.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.