In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/27 Report--

Jia Yueting, founder of Faraday Future, posted on Weibo on March 27: "FF has received another US $100m in loans before going public. The new financing will help FF start production preparations at the Hanford plant ahead of time, enter the countdown to FF 91 delivery, and accelerate the landing of FF's business in China."

On March 26th, Faraday Future announced that it had raised nearly $100m in debt financing, which was led by a credit group managed by Ares Management Corporation and was also attended by existing lenders such as Birch Lake. Faraday Future said that the new financing will comprehensively accelerate the implementation of FF's complete product strategy, officially start the preparatory work for the production of FF Hanford plant, advance the countdown to FF 91 delivery, and accelerate the landing of FF's business in China.

This is the first time that Faraday Future has received debt financing since signing a merger agreement with PSAC. On the evening of January 28, Faraday Future announced on its website that it had reached a final agreement with the special purpose acquisition company (SPAC) on the business merger, valuing the company at about $3.4 billion (22 billion yuan) after the transaction was completed, and planned to list on the Nasdaq Stock Exchange in the second quarter under the symbol "FFIE." It is understood that FF 91 is expected to complete delivery 12 months after the deal with SPAC, and the domestic price is expected to be more than 2 million yuan.

What is SPAC? SPAC's full name is Special Purpose Acquisition Company, which literally translates to "special purpose acquisition company". SPAC is a way of backdoor listing. Different from shell listing, SPAC as a listing platform (shell company), SPAC has only cash, no actual business and no assets. This company will invest in mergers and acquisitions of pre-listed target enterprises, and the target enterprises will quickly achieve the purpose of listing financing through mergers and acquisitions with listed SPAC.

Its purpose is to acquire a high-quality enterprise (target company) and make it quickly become a listed company on the main board of the United States. As a listing platform (shell company), SPAC has only cash, but no actual business. The target company can be listed on the stock market by merging with SPAC and obtain the funds of SPAC at the same time.

Like traditional IPO, SPAC needs to write a prospectus and require investment banks to underwrite it. Securities issued by SPAC are usually denominated in "unit". Each unit usually sets a price of $10, and an unit consists of one common share and a warrant. Before the merger and acquisition is completed, the money raised by SPAC will be deposited in a trust fund to isolate the risk.

After IPO, SPAC will have up to 2 years to find the M & A target. After a series of due diligence and financial audits on the target company, the shareholders of SPAC will vote on the project. If more than half of them approve, SPAC will promote the merger with the target company and trade on the market with the new stock symbol. If a suitable target is not found to complete the merger within two years, SPAC will be liquidated and $10 will be refunded to investors.

Compared with the traditional IPO,SPAC, it has the advantages of fast time, low cost, high success rate and simple process, which has great advantages for both investors and target companies. Goldman Sachs calculates that more than half of the companies listed in the United States last year reported the completion of the listing of SPAC, and more than half of the total amount raised was raised by SPAC. It can be said that at present, SPAC has become a shortcut to listing.

According to the previous release of FF, Geely and FF have signed a cooperation framework agreement to cooperate in the areas of technical support and engineering services, and to explore the possibility of a joint venture between Geely and Foxconn to provide contract manufacturing services. At the same time, Geely Holdings Group also participated in a small amount of investment in the listing of Faraday Future SPAC.

According to data, FF is being founded in 2016 and officially launched its first mass-production electric car, the FF 91, in Las Vegas in January of the following year, after which the company announced the completion of a $1 billion round of financing, with Leeco founder Jia Yueting as the global CEO and chief product officer. Subsequently, due to the outbreak of Jia Yueting's personal debt crisis, FF fell into financial problems, and the car-building project continued to shut down.

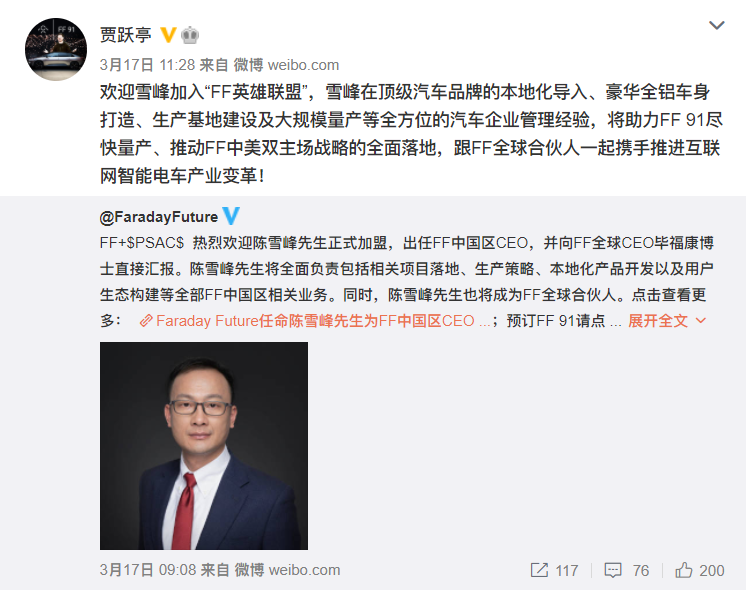

On March 17th, the former Chery Jaguar Land Rover executive officially joined FF as CEO of FF China and reported directly to Dr. Bi Fukang, CEO of FF Global. In this regard, Jia Yueting welcomed Chen Xuefeng to join the "FF League of Legends", saying that he would help FF 91 mass production as soon as possible, promote the comprehensive landing of FF's Sino-US home strategy, and join hands with FF global partners to promote the reform of the Internet smart tram industry.

As the problem of funding for mass production has gradually alleviated and the delivery of FF 91 will be accelerated, Jia Yueting shared the moment on Weibo. However, netizens were more concerned about when Jia Yueting would return home than the delivery of FF 91, and asked under Weibo one after another.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.