In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)03/29 Report--

The three major domestic car brands Ullai, ideal and Xiaopeng once again spread the news of listing in Hong Kong. According to the Financial Associated Press on March 29, Lulai Motor and Xiaopeng Motor have submitted their listing applications to the Hong Kong Stock Exchange, and the ideal car has not yet been "submitted."

Xilai, Xiaopeng and ideal Motors plan to list in Hong Kong this year to attract more investors and are discussing listing plans with several banks, Reuters reported on March 9, citing people familiar with the matter. The three car brands plan to sell at least 5 per cent of their shares, raising a total of $5 billion based on the market capitalisation of US stocks, according to sources.

Xilai is working with Credit Suisse and Morgan Stanley to prepare a secondary listing in Hong Kong, which is likely to sell about 5 per cent of its shares and is considering a further listing on the A-share market.

Xiaopeng is working with Bank of America and JP Morgan on the listing plan, while ideal is working with Goldman Sachs and UBS, which are expected to complete their listings as early as the third quarter of this year, raising about $1 billion-2 billion. In addition, it is reported that Xiaopeng Motor is also considering listing on the Shanghai Stock Exchange Kechuang Board. In response to the above news, NIO, Xiaopeng and ideal did not comment.

After entering 2021, NIO, Xiaopeng and ideal three companies collectively closed down. On March 26, Xilai Motor shares closed at US $36.13 per share, down 42.5% from its high of US $62.84 on February 9; Xiaopeng Motor shares closed at US $32.14 per share, down 43.0% from US $56.39 on January 25; ideal Motor shares closed at US $23.70 per share, down 35.53% from US $36.76 on January 12.

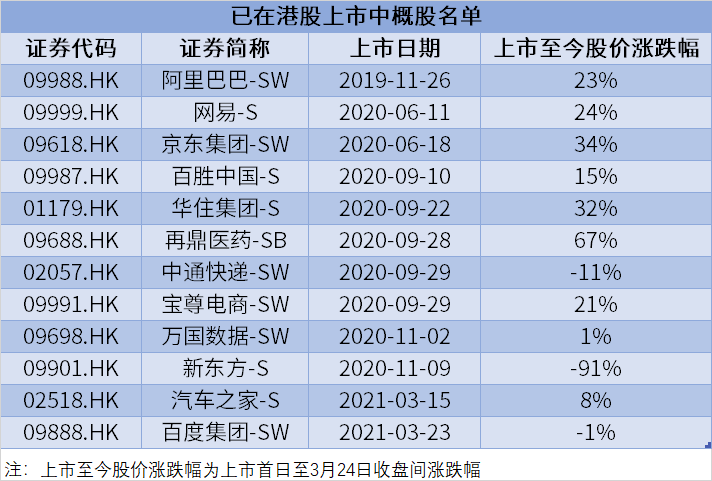

In fact, the return of Chinese-listed stocks to Hong Kong is nothing new. Baidu, Alibaba, Tencent and Auto Home have all been listed on the Hong Kong Stock Exchange since 2020, while the next Chinese stock to be listed in Hong Kong is bilibili, which will start trading on the main board of the Hong Kong Stock Exchange under the stock code "9626" on March 29th. Under the background that the listing of Chinese stocks back to Hong Kong has become a trend, it is not surprising that Ullai, Xiaopeng and the ideal plan to return to Hong Kong.

Why do Chinese stocks return to Hong Kong collectively? After the US House of Representatives passed the Foreign Company Accountability Act in May 2020, the pace of US-listed Chinese stocks returning to Hong Kong was further accelerated. Since 2020, 12 Chinese stocks have been successfully listed in Hong Kong, which has also led to an upsurge of IPO applications for Hong Kong stocks. On March 24, the US Securities Regulatory Commission began to implement the provisions passed in the Foreign Company Accountability Act to impose compulsory delisting of foreign companies that have failed to comply with US audit standards for three consecutive years.

According to the new regulations, foreign companies listed in the United States need to meet several main conditions: 1. Disclose the audit manuscripts of accounting firms to the Public Company Accounting Supervisory Board (PCAOB); 2. Prove to the US Securities Regulatory Commission that foreign governments have no actual control or shareholding of the company. Disclose the list of CPC officials on the board of directors.

Some analysts said that Chinese companies listed in the United States may not be able to comply with US accounting requirements and will face greater delisting pressure. Affected by the news, Chinese stocks fell accordingly. On the same day, Lulai fell 10.25%, ideal car 13.20%, and Xiaopeng car 15.08%.

As for the reasons for returning to Hong Kong for listing, in addition to stricter regulation of the US capital market, the greater purpose is to raise funds and need to make longer-term planning with capital. In short, for the three car manufacturers, it is not easy to return to Hong Kong for listing, and they need to pay more costs.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.