In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/05 Report--

Recently, Jiangling Motor has caused controversy in the market because of an "abnormal" dividend that has attracted the attention of investors.

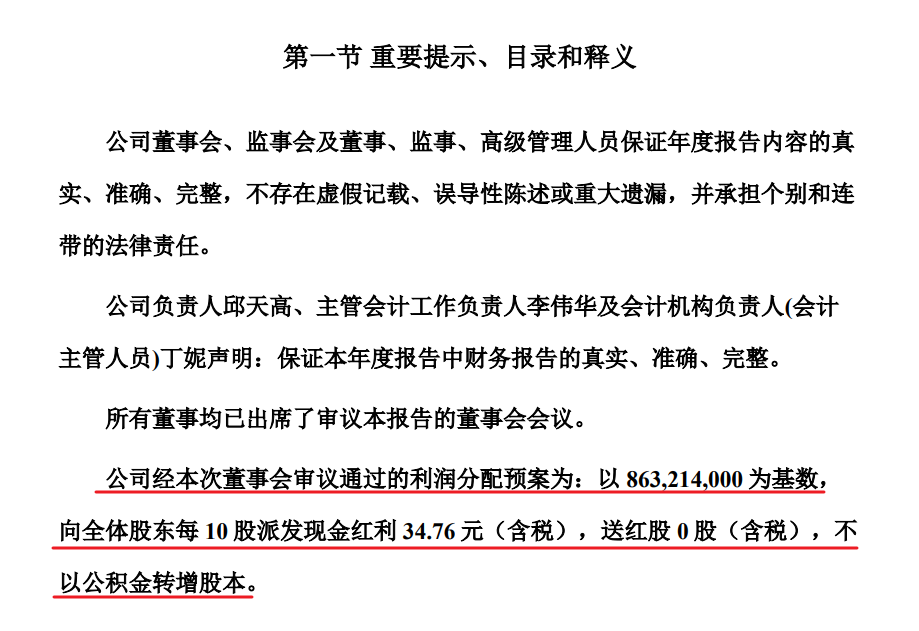

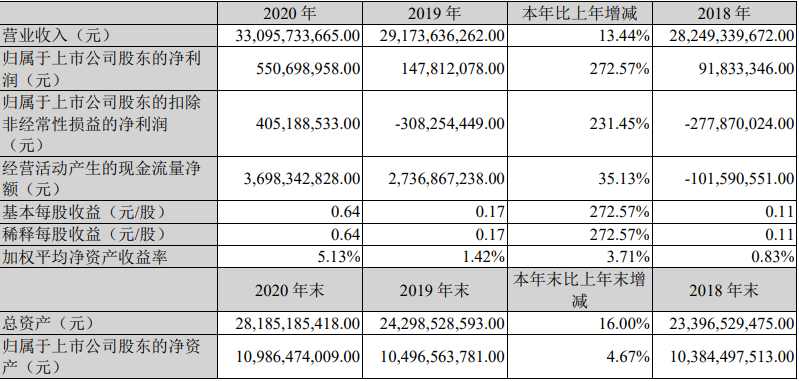

According to the financial report released by Jiangling Motor, the company's operating income in 2020 was 33.096 billion yuan, an increase of 13.44% over the same period last year, and its net profit was 551 million yuan, an increase of 272.57% over the same period last year. According to the disclosed information on the dividend shooting plan, Jiangling Motor plans to pay a cash dividend of 34.76 yuan (including tax) for every 10 shares. Based on the closing price of 25.39 yuan per share on the day of disclosure, the dividend yield is 13.69%, and the dividend ratio is as high as 544.86%.

The news quickly caused a reaction in the capital markets. It rose by the daily limit on March 29 and 30, and opened higher by 6% on March 31. Jiangling's share price rose from 23.10 yuan to 28.71 yuan in three days. It fell in the next two days, and the current share price of Jiangling Motor is 27.54 yuan.

Professionals said that this operation of Jiangling Motor, "or in advance for the next action 'division of the family', does not rule out the possibility of new changes in the composition of shareholders." However, Jiangling said that the board of supervisors believes that the company's 2020 profit distribution plan is in line with relevant laws and regulations and the articles of association, in line with the actual situation of the company, there is no harm to the interests of minority shareholders. In addition, Jiangling Motor also said that the company has abundant cash reserves, and the overall operating cash flow will remain strong for some time to come. Therefore, under the premise of ensuring the healthy and sustainable development of the company, the company's board of directors draws up the above dividend plan to repay all shareholders, including minority shareholders.

It is understood that it is only natural for listed companies to pay dividends, but the number of dividends is determined by enterprises according to the situation. As a newly listed company, it is normal for the company to pay less dividends, but if the company is in good condition, too little dividends will also cause some controversy. As far as Jiangling is concerned, since its listing in 1993, it has basically maintained a stable dividend every year, but the amount of dividend is basically no more than 1 yuan, but there are two huge dividends. In 2017, Jiangling Motors disclosed a special dividend plan for the mid-term of 2017, which "intends to pay a cash dividend of 23.17 yuan (including tax) for every 10 shares, totaling more than 2 billion yuan." this not only triggered a rise in its share price for many days in the capital market, but also received a letter of concern from the Shenzhen Stock Exchange. On another occasion, in 2020, it is proposed to pay a cash dividend of 34.76 yuan (including tax) for every 10 shares.

However, it is not the investors who benefit from such large dividends, but the top two shareholders of the company. Data show that the top 10 shareholders of Jiangling Motor hold a total of 80 per cent of the shares, of which 41 per cent are held by Nanchang Jiangling Investment Co., Ltd., and 32 per cent by Ford Motor. The two sides will receive 1.231 billion yuan and 960 million yuan respectively through the dividend, making it the biggest winner of the big dividend.

The reason why Jiangling's dividend scheme has attracted much attention is mainly because it is not in line with the actual market performance. According to the financial report, the net profit from 2016 to 2020 is 1.318 billion yuan, 691 million yuan, 92 million yuan, 147 million yuan and 551 million yuan respectively, which means Jiangling Motor is the total profit of the past five years. However, Jiangling's debt ratio has also increased in recent years, with total liabilities of 13.011 billion yuan, 13.802 billion yuan and 17.199 billion yuan respectively from 2018 to 2020, which also means that the soundness of Jiangling's 3 billion yuan dividend plan will be tested.

Some people in the industry said that a high level of dividend per share is certainly good, but we advocate that cash dividends should be consistent, stable and sustainable. If cash dividends are only "bought and sold with one shot" or eaten all at once, this is irresponsible behavior. This is also unfair to new and old investors. In addition, in the event of an one-off high proportion of dividends, the market should be vigilant on whether there is a transfer of benefits or moral hazard.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.