In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/17 Report--

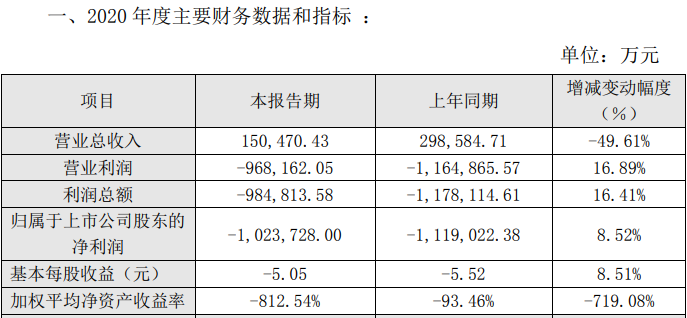

Recently, Zhongtai Automobile disclosed that its 2020 financial officer KuaiBao showed that during the reporting period, total revenue is expected to reach 1.505 billion yuan, down 49.61% from the same period last year; the estimated net loss is 10.237 billion yuan, an increase of 8.52% over the same period last year.

In the face of huge losses, Zhongtai Automobile said that due to the shortage of funds in 2020, the automobile production bases under the company were basically in a state of suspension or semi-suspension of production, and the company's main products, vehicles, basically had no sales revenue. At the same time, the company's main business vehicle business is in a state of stop-production and semi-stop production, resulting in a huge loss on the company's overall performance in 2020.

However, Zhongtai's loss has been reduced compared with a loss of 11.19 billion yuan in 2019. Of course, Zhongtai Motors said at that time that it could not guarantee the authenticity and accuracy of the financial data.

Looking back at the development of Zhongtai Automobile in 2020, it is not too much to use the word "miserable". In September 2020, Zhongtai Automobile was applied to the court for pre-restructuring by creditors because it was unable to pay off its due debts. during the year, companies including Zhongtai New Energy Automobile Co., Ltd., Hunan Jiangnan Automobile Manufacturing Co., Ltd., Hangzhou Jieneng Power Co., Ltd., Hangzhou Yiwei Automobile Industry Co., Ltd., Zhejiang Zhongtai Automobile sales Co., Ltd., Zhejiang Zhongtai Automobile Manufacturing Co., Ltd., etc., were restructured / liquidated. Even Tieniu Group, the controlling shareholder of Zhongtai Motor, was declared bankrupt by the court. In addition, as the production base is in a state of suspension and semi-suspension of production, Zhongtai Motor has no national six cars to sell, its Junma, Hanteng and Hanlong brands continue to thunderstorm, and dealers and employees have joined the team of asking for wages.

From an independent car company with annual sales of more than 300000 vehicles to negative net assets, Zhongtai Automobile's development process is only a microcosm of the survival of the fittest in China's auto market.

Some people in the industry said that there are three main reasons why Zhongtai Automobile has come to the current stage: first, it has poor management and blindly invests and expands production without considering the actual situation; second, it has no core technology, no product competitiveness, and product quality continues to be thunderous; third, the subsidies for new energy vehicles have declined, and Zhongtai New Energy has not complied with the development of the times.

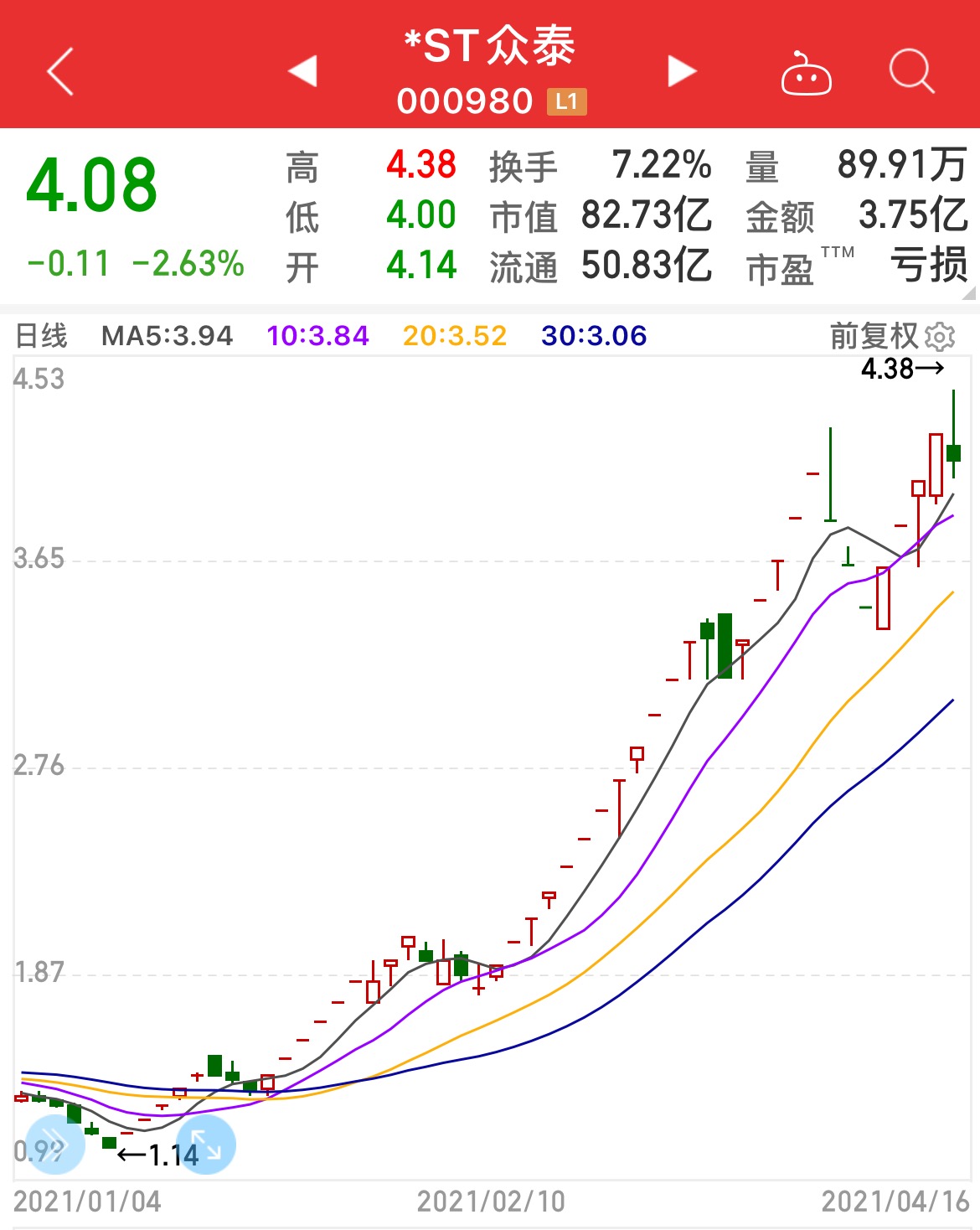

It is worth mentioning that although Zhongtai Motors lost a lot of net profit, its share price could not stop rising. It rose from 1.14 yuan per share on January 11 to 4.08 yuan per share on April 16, an increase of 240%. For this reason, Zhongtai Motor has suspended its license many times for verification, but still can not stop the limit. Industry speculation, the reason why Zhongtai Automobile shares continue to rise by the limit, and restructuring has a lot to do with, as to who is Zhongtai Automobile White Horse Guardian, it is still unknown. On April 6, Zhongtai Automobile issued an announcement denying that it had discussed cooperation with Tesla, Xiaomi, NIO and Baoneng. After that, from April 7 to 9, the share price of Zhongtai Motor fell by the limit for three consecutive days, thinking that when Zhongtai Motor stopped rising, Zhongtai Motor harvested the limit board for four consecutive days.

On April 15, the Shenzhen Stock Exchange issued a letter of concern about Zhongtai Automobile Co., Ltd., which indicated that Zhongtai Automobile's net assets in 2020 had been negative, requiring it to verify and disclose additional delisting risks; in addition, the Shenzhen Stock Exchange also required Zhongtai Automobile to give hints on the risk of stock price deviating from fundamentals and to assess the impact of abnormal stock price fluctuations on pre-restructuring.

Although Zhongtai's share price continued to hit record highs, industry insiders said it was "very cautious". Although Zhongtai Automobile is currently in a state of restructuring, it has lost more than 20 billion yuan in two years, and the restructuring of Zhongtai Automobile is still a long way off. At present, there is already excess capacity in the automobile market, survival of the fittest, and increased competition in stock. Even if Zhongtai Automobile is reorganized smoothly, the development potential in the later stage will not be very great, and the chance to turn around is very slim.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.