In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)04/29 Report--

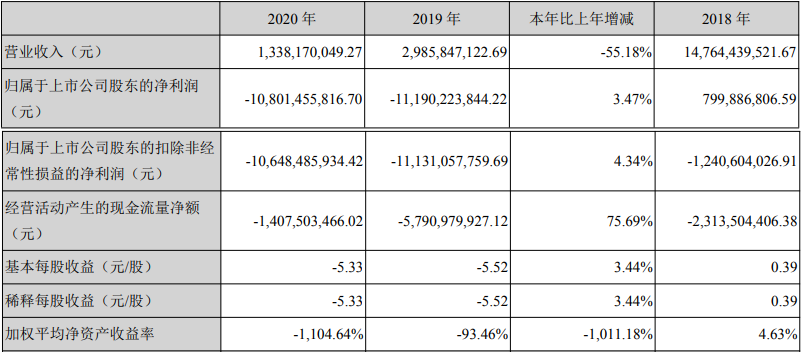

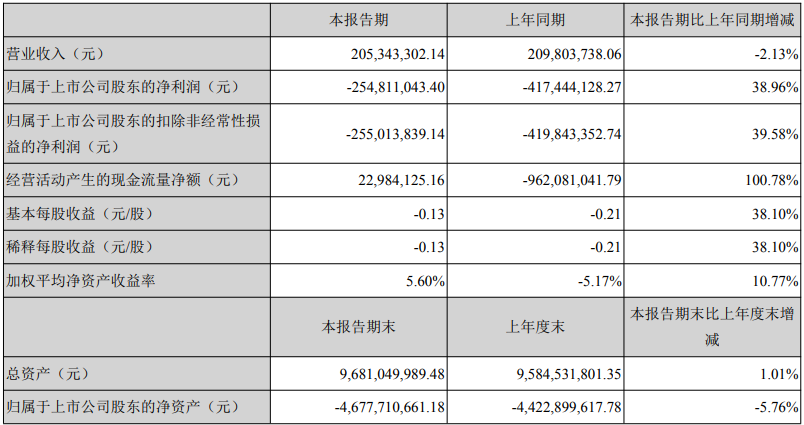

On April 29th, Zhongtai Motor disclosed its 2020 financial results, showing that during the reporting period, total revenue reached 1.338 billion yuan, down 55.18% from the same period last year, while the net loss was 10.801 billion yuan, up 3.47% from the same period last year. At the same time, Zhongtai Motor also released financial data for the first quarter of 2021, with operating income of 205 million yuan during the reporting period, down 2.13% from the same period last year, and a net loss of 254 million yuan, up 38.96% from the same period last year. According to the financial report, by the end of March 2021, the net assets of Zhongtai Motor belonging to shareholders of listed companies were-4.678 billion yuan.

Zhongtai Automobile said that the subordinate automobile production bases are basically in a state of suspension, the production and sales of the main products are not large, and the total sales revenue is low. At the same time, because the vehicle business is in a state of suspension, the company has made a large provision for impairment of assets and provision for bad debts, resulting in a large operating performance loss in 2020.

According to the financial report, Zhongtai Automobile produced a total of 1371 cars and sold a total of 1674 vehicles in 2020. At the same time, the company designed a production capacity of 685000 vehicles in 2020, and the capacity utilization rate was 0 during the reporting period because the company's vehicle business was in a state of suspension and semi-suspension of production.

Although Zhongtai Motor has lost a lot of net profit, the performance of the capital market so far this year has been very "weird". Since January 11, Zhongtai Motor has gained 35 trading boards in 47 trading days. Today, Zhongtai Automobile shares rose by the daily limit again, closing at 4.33 yuan per share, with a total market capitalization of 8.78 billion yuan.

As an independent car brand that once sold more than 300000 cars a year and has six major production bases, Zhongtai Automobile has also been highly sought after, relying on a tape measure to produce products similar to mainstream car brands. Some netizens even bluntly said, "whether you can drive a luxury car in this life, it depends on Zhongtai." although there is a lot of ridicule in the words, this is also a kind of "affirmation" of Zhongtai Automobile.

With the changes in the automobile market, the disadvantages of Zhongtai Motor have gradually emerged. Compared with the same period last year, Zhongtai Automobile almost reached the end of the market in 2020. Zhongtai Automobile was applied for restructuring by creditors. A number of subsidiaries, including Zhongtai New Energy Automobile Co., Ltd., Hunan Jiangnan Automobile Manufacturing Co., Ltd., Hangzhou Jieneng Power Co., Ltd., were restructured / liquidated, and Zhongtai Automobile shareholder Tieniu Group was also applied for reorganization by the court. In addition, Zhongtai Automobile's Zhongtai, Hanteng, Hanlong and Junma brands are almost at a standstill.

Some people in the industry said that there are three main reasons why Zhongtai Automobile has come to the current stage: first, it has poor management and blindly invests and expands production without considering the actual situation; second, it has no core technology, no product competitiveness, and product quality continues to be thunderous; third, the subsidies for new energy vehicles have declined, and Zhongtai New Energy has not complied with the development of the times.

Although Zhongtai Automobile is very hot in the capital market, and its stock market capitalization has repeatedly reached record highs, Zhongtai Automobile's whole vehicle business is at a standstill, losing more than 20 billion yuan in two years, and Zhongtai Automobile has only "chicken feathers in one place". Although Zhongtai Automobile is in a state of restructuring, the current auto market has excess capacity, survival of the fittest and intensified stock competition. Even if Zhongtai Automobile is reorganized smoothly, the development potential in the later stage will not be very great, and the chance of turnaround is very slim. However, some industry insiders believe that if Zhongtai Automobile can, like Lifan Motor, invigorate production capacity through transformation, there may still be a glimmer of chance.

According to the financial report, the operating income of Lifan Automobile in 2020 was 3.637 billion yuan, down 51.18 percent from the same period last year, and the net profit was 58 million yuan, an increase of 101.24 percent over the same period last year. In the first quarter of 2021, operating income was 840 million yuan, an increase of 48.89 percent over the same period last year, and net profit was 16 million yuan, an increase of 108.04 percent over the same period last year. Lifan Automobile has realized the transformation through the introduction of electric exchange models of Geely Technology Group. At present, it has turned losses into profits. "ST Lifan" has been changed to "Lifan shares" and then changed to "Lifan Technology". The current total market capitalization is 25.9 billion yuan.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.