In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/02 Report--

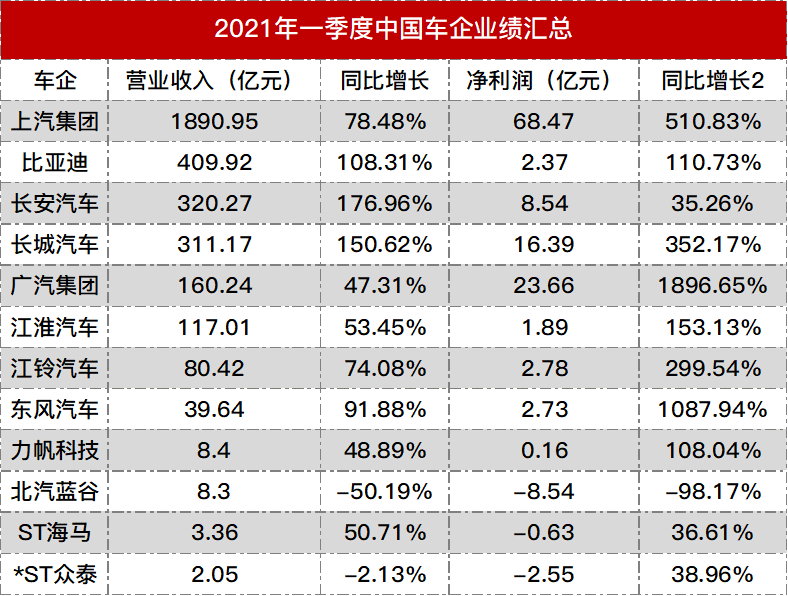

According to the summary statistics of the performance of a number of listed car companies in the first quarter of 2021, revenue and profit has become a trend compared with the same period last year, of which SAIC made a net profit of 6.847 billion yuan. Listed car companies are able to hand over gratifying transcripts, not only from a low base due to the impact of last year's epidemic, but also because of the recovery of the auto industry. According to data from the Federation of passengers, a total of 5.092 million narrow passenger cars were sold in China from January to March, an increase of 68.8% over the same period last year.

According to the statistical results of the first quarter of 2021, the revenue and profits of auto companies generally increased in the first quarter, while SAIC, BYD and Changan Automobile ranked in the top three in a row.

SAIC is the largest automobile enterprise in China, and its revenue and profit are in the forefront of the industry. In the first quarter of this year, SAIC's revenue was 184.41 billion yuan, up 82.13% from the same period last year, and its net profit was 6.847 billion yuan, up 510.83% from the same period last year.

SAIC said the increase in revenue and profit in the first quarter was mainly due to an increase in sales. According to the data, SAIC sold 1.1424 million vehicles in the first quarter, an increase of 68.24 percent over the same period last year, which is basically in line with the market, including less than 249100 SAIC-Volkswagen, 335800 SAIC-GM and 308600 SAIC-GM Wuling.

BYD's revenue and profit also increased, with operating income of 40.992 billion yuan in the first quarter, up 108.31% from the same period last year, and net profit of 237 million yuan, up 110.73% from the same period last year. It should be noted that BYD's revenue comes not only from cars, but also from mobile phone parts and assembly, secondary charging and photovoltaic, as well as high government subsidies. In other words, although all kinds of BYD data show growth, but the book is very ugly, revenue and net profit of 40.992 billion yuan is only 237 million yuan.

By contrast, the performance of Changan Automobile is more eye-catching. According to the data, the operating income of Changan Automobile in the first quarter was 32.027 billion yuan, an increase of 176.96% over the same period last year; net profit was 854 million yuan, up 35.26% over the same period last year; and 720 million yuan was deducted from non-net profit, an increase of 140.2% over the same period last year. In other words, the auto business alone can make a profit, and this is the first time Changan Automobile has deducted non-net profit to become a regular employee since the first quarter of 2019.

In addition, due to a low base last year, including Great Wall Motor, Jianghuai Automobile, Dongfeng Motor, and Lifan Technology, which completed the restructuring and renamed, all turned from losses to profits. For example, Great Wall Motor lost 650 million yuan in the first quarter of last year and made a net profit of 1.64 billion yuan in the current quarter.

Of course, there are individual companies that have not yet made a profit in the first quarter of this year, such as Zhongtai Automobile, BAIC Langu and Haima Motor.

Since entering 2020, Zhongtai vehicle business has basically stagnated under the influence of the epidemic. In the first quarter of this year, Zhongtai Motor's operating income was 205 million yuan, down 2.13% from the same period last year, while the net loss was 255 million yuan, up 38.96% from the same period last year. Although the vehicle business of Zhongtai Automobile has stagnated, the performance of the capital market is very "weird". Since January 11, Zhongtai Automobile has gained 36 trading boards in 48 trading days, an increase of 279.17%. Up to now, Zhongtai Automobile shares closed at 4.55 yuan per share, with a total market capitalization of 9.226 billion yuan.

The operating income of Haima Motor in the first quarter was 336 million yuan, an increase of 50.71% over the same period last year, and a net loss of 63 million yuan, an increase of 36.61% over the same period last year. In recent years, the sales of Haima car in the market has declined sharply, and there have been a series of huge financial losses. In 2019, Haima Motors sold a large number of idle properties, as well as its related properties and equity interests in R & D companies. Data show that in 2020, the net loss of Haima Motor was 1.335 billion yuan, and the operating income fell from 4.832 billion yuan to 1.448 billion yuan.

Compared with Haima and Zhongtai, the "worst" listed car companies are BAIC Langu. BAIC Langu's operating income in the first quarter was 830 million yuan, down 50.19% from the same period last year; the net loss was 854 million yuan, compared with a net loss of 431 million yuan in the same period last year. Judging from the data, BAIC Langu is the only car company on the list that has seen a double decline in revenue and profit.

The current market performance of BAIC New Energy is saddening. With its high performance-to-price ratio and rich products, BAIC New Energy ranked first in domestic pure electric vehicle sales for seven consecutive years from 2013 to 2019, and changed its name to "BAIC Blue Valley" to complete its backdoor listing in 2018. However, sales of BAIC New Energy declined sharply in 2020, with a net loss of 6.482 billion yuan in 2020, with a total sales of only 25900 vehicles, down 82.79% from the same period last year. In the first quarter of this year, the net loss was 854 million yuan, and the total sales volume was only 3149 vehicles, down 65.01% from the same period last year. More importantly, even though the base was low because of the epidemic last year, BAIC Blue Valley showed no sign of warming up and increased its losses.

Judging from the list, the vast majority of car companies in the first quarter of this year have achieved good results and good profit performance. Of course, the performance of some car companies is still disappointing, including BYD, which has the largest market capitalization in China, and BAIC New Energy, which has been the top seller of new energy vehicles for seven years in a row. Based on the analysis of the market situation in 2020, all the major automobile companies will achieve good results in the first half of this year, but there are also many hidden worries in the domestic automobile industry, such as chip crisis, high dealer inventory early warning index and so on. These are not small challenges for the operation of automobile companies.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.