In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/13 Report--

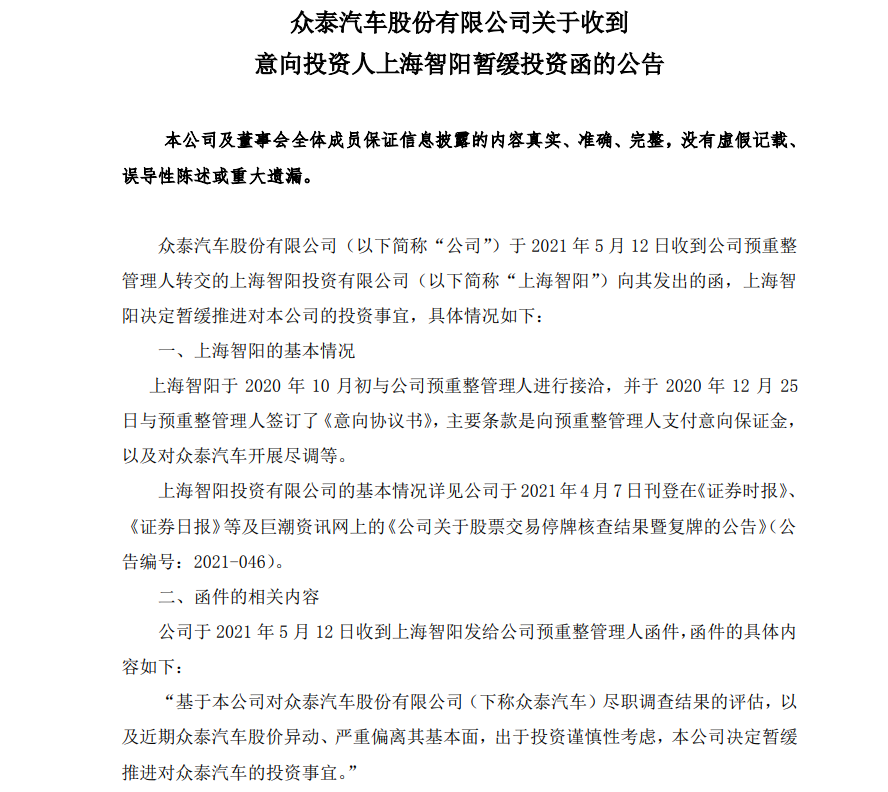

On May 12, * ST Zhongtai announced that the company received a letter from Shanghai Zhiyang Investment Co., Ltd. (hereinafter referred to as "Shanghai Zhiyang") transferred by the company's pre-restructuring manager on May 12, 2021, its Shanghai Zhiyang decided to suspend its investment in the company because of recent changes in the share price of Zhongtai Motors, which seriously deviated from its fundamentals, and decided to suspend investment because of investment prudence. Today, Zhongtai Motor opened by the daily limit, down 4.99% to close at 5.52 yuan, with a total market capitalization of 11.19 billion yuan.

According to the Zhongtai Automobile announcement, as early as October 2020, Shanghai Zhiyang contacted the pre-restructuring manager of Zhongtai Automobile, and signed an "intention Agreement" with the pre-restructuring manager on December 25, 2020. the main terms are to pay the deposit of intention to the pre-reorganization manager, as well as to carry out the full adjustment of Zhongtai Motor. After entering 2021, Zhongtai Motor has become a demon stock. Since January 4 (the first trading day of 2021), Zhongtai Motor has gained 44 limit boards since April 12, rising from 1.36 yuan per share to 5.81 yuan per share, an increase of 308.89%. In other words, the share price of Zhongtai Motor has tripled in just three months. For this reason, Zhongtai Automobile has also issued a notice of abnormal fluctuations in stock trading many times and suspended trading twice.

In fact, the current market performance of Zhongtai Automobile can not match with the secondary market. According to the financial report, Zhongtai Motor sold a total of 1674 vehicles in 2020, with a net loss of 10.801 billion yuan for the whole year, an increase of 3.47 percent over the same period last year. The net loss in the first quarter of 2021 was 254 million yuan, an increase of 38.96 percent over the same period last year. By the end of March 2021, the net assets of Zhongtai Motor belonging to shareholders of listed companies were-4.678 billion yuan.

Zhongtai Automobile said that the subordinate automobile production bases are basically in a state of suspension, the production and sales of the main products are not large, and the total sales revenue is low. At the same time, because the vehicle business is in a state of suspension, the company has made a large provision for impairment of assets and provision for bad debts, resulting in a large operating performance loss in 2020. In addition, a number of internal management of Zhongtai Automobile Company have left, including Vice President Liu Huijun, Chairman Jin Zheyong, Vice President Ma Deren, and most of the company's key technical personnel have also left.

The reason why Zhongtai Automobile performs well in the secondary market is mainly because it is in the restructuring stage, while the White Horse Guards of Zhongtai Motors have long refused to "show up", and there is some room for imagination in the market. However, even if Zhongtai Automobile performs well in the secondary market, the company's performance loss, production stagnation, delisting risk and controlling shareholder bankruptcy have become ways for investors to promote investment. even due to the mismatch between market performance and the secondary market, investors suspend investment out of caution. Zhongtai Motors said that abnormal stock price fluctuations may have a certain impact on the company's pre-restructuring and subsequent restructuring. In the future, if investors participate in the restructuring of the company, they will mainly evaluate the value of the company from the fundamentals of the company, and make a judgment on whether to invest or not, and it is very unlikely that the stock price deviating from the fundamentals of the company will be used as the reference price to invest. On the other hand, the abnormal fluctuation of the company's stock price may cause the expected differentiation of the reorganization, increase the difficulty of the follow-up reorganization, and may even lead to the reorganization unable to continue.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.