In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)05/29 Report--

The share price of Haima Motors rose by the limit at one point on May 28, and then continued to fluctuate downward after being suppressed by the market. It closed at 5.66 yuan per share on the same day, with a total market capitalization of 9.309 billion yuan, which has never been seen by Haima Motor in the past four years.

The main reason for the big rise in the opening of seahorse cars is to "take off the stars and take off the hat." On May 25, Haima Motors announced that trading in the company's shares was suspended for one day from the opening of the market on May 26 and resumed trading on May 27. The company's stock trading has revoked other risk warnings since the opening of the market on May 27, the abbreviation of the securities has been changed from "ST seahorse" to "seahorse car", and the daily rise and fall limit of stock trading price has changed from 5% to 10%. This means that the seahorse car that has been "ST" for nearly two years has finally successfully taken off its hat.

2017 is the turning point of Haima car from prosperity to decline. After a loss of 994 million yuan in 2017, Haima Motor continued to lose 1.637 billion yuan in 2018. Although it achieved a net profit of 85 million yuan in 2019, it recovered through the sale of idle real estate, company equity and government subsidies. After deducting Fei, its net profit loss reached 731 million yuan.

On April 24, 2019, Haima Motor was given a "delisting risk warning" treatment, and the stock was changed from "Haima Automobile" to "* ST Haimai" because of negative net profit for two consecutive years. The seahorse car, which was "wearing a hat", opened the way to self-rescue.

In order to save the seahorse and reverse its declining performance, Jingzhu returned as chairman of the company again. Data show that Jingzhu, who is also a veteran of the automobile industry, joined Haima Motor in 1988. Jingzhu began to serve as chairman and party committee secretary of Haima Automobile Group at the end of 2004. Jingzhu resigned as chairman of the board in July 2013 for personal reasons. After being re-elected as chairman, Jingzhu said he was "determined to return to the front line, recreate seahorses and lead employees to start a business for the fourth time."

After Jingzhu returned to the seahorse car, the first thing is to invigorate the cash flow by selling the family property. It is understood that by selling 401 properties and some real estate properties and divesting the car R & D business in 2019, Haima Automobile will turn a loss into a profit in 2019. In 2020, Haima Motors sold another 145 properties so that in June of the same year, the securities were changed from "* ST seahorse" to "ST seahorse" for short.

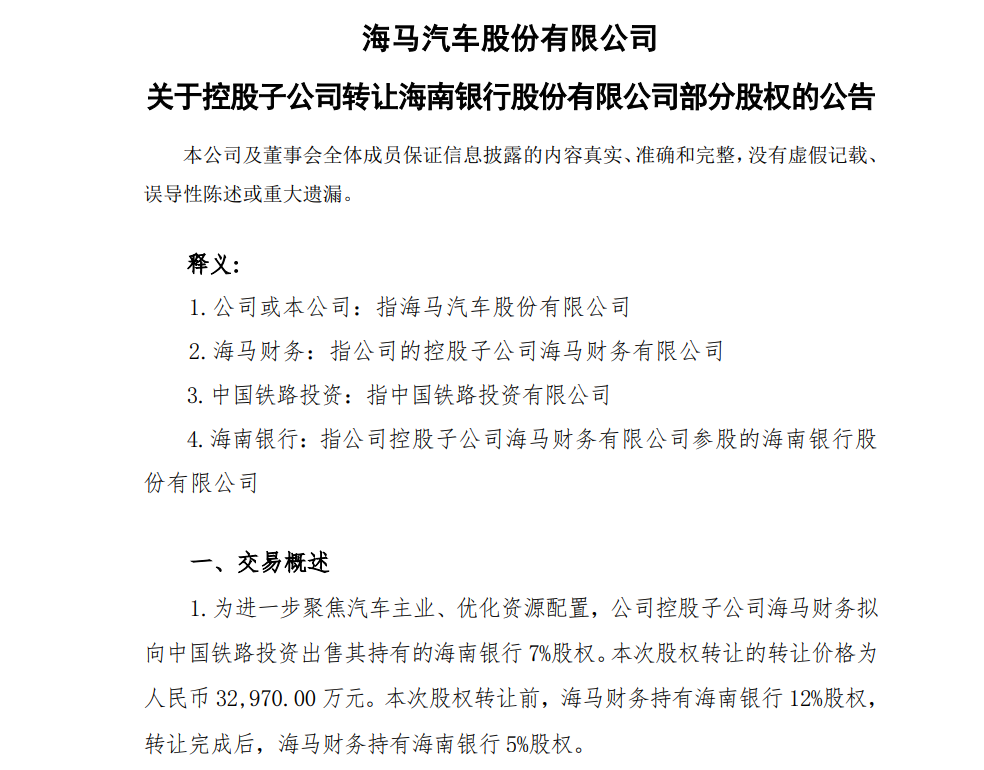

In order to completely "take off its hat", Haima did not stop selling its property. ST Haima announced that its controlling subsidiary, Haima Finance, plans to sell its 7 per cent stake in Hainan Bank to China Railway Investment at a transfer price of 329.7 million yuan. It is understood that before the transfer, Haima Finance held a 12% stake in Hainan Bank, and after the transfer, Haima Finance held a 5% stake in Hainan Bank.

Although Haima Motor has "taken off its star and hat", its main business is still worrying. At present, Haima Motors has four models on sale, namely, Haima 8s, Haima 6P, Haima 7X and Haima @ 3. According to the data, the cumulative sales of seahorse cars from January to April in 2021 were 10468, an increase of 1.639 million over the same period last year. It is worth mentioning that the sales figures disclosed by Haima Motors include the cumulative sales of Xiaopeng G3 G3, which is a substitute for Xiaopeng cars, with a total sales of 7518 vehicles from January to April.

Through the generation of seahorse cars, seahorse cars can get additional benefits, but in the mode of contract manufacturing, the efficiency, cost and quality of production can not be directly controlled by Xiaopeng Automobile. On March 19, 2020, Xiaopeng officially announced the acquisition of Guangdong Fudi Automobile Co., Ltd., whose shareholder was changed to Zhaoqing Xiaopeng New Energy Investment Co., Ltd. In other words, Xiaopeng Motor acquired the production qualification through the acquisition of Fudi Motor, and no longer had to rely on Haima Motor to wait for delivery. It is understood that the mid-term revamped Xiaopeng G3 will be officially launched in the second half of the year, after which the new car will be produced by Xiaopeng itself. In other words, Haima Motor will lose this part of the revenue in the future.

Perhaps it has lost its competitiveness in products, and the new energy industry has become a hot topic now, and Haima Motor has turned its attention to the hydrogen energy track. In the past year and a half, new energy sectors, including hydrogen energy, have been extremely hot. Since January last year, Haima Motors has announced the development of hydrogen fuel cell vehicles and cooperation with scientific research institutions to build integrated stations for water hydrogen production and high-pressure hydrogenation. Seahorse car aimed at the new track, "take off the star and take off the hat" after the seahorse car seems to coruscate new vitality.

Industry insiders said that whether Haima can turn around still maintains a wait-and-see attitude, without well-known models, without key technical support, and without clear development goals. It remains to be seen whether Haima can turn around in the auto industry with overcapacity.

On the current A-share market, only * ST Zhongtai is still wearing a hat. On March 2, in view of the fact that the delisting risk warning involved in the completion of the company's restructuring plan has been eliminated, the SSE agreed to withdraw the delisting risk warning and implement other risk warnings, and the securities abbreviation was changed to "ST Lifan". On April 22nd, the Shanghai Stock Exchange agreed to withdraw the application for other risk warnings of stocks, and the company's securities were changed from "ST Lifan" to "Lifan shares", and then changed from "Lifan shares" to "Lifan Technology".

In fact, the stock market listing and delisting is also a normal phenomenon. Earlier, FAW Xiali announced that the company plans to change its name from "Tianjin FAW Xiali Automobile Co., Ltd." to "China Railway Materials Co., Ltd.". The short title of the securities will also be changed from "* ST Xiali" to "China Iron objects". The business scope has been changed from "manufacture and after-sales service of cars, automobile engines, auto parts and internal combustion engine parts" to "railway transport infrastructure equipment sales, rail processing, high-speed rail equipment, accessories manufacturing and sales, etc." For the automobile market, the reshuffle of the automobile industry has been accelerated in the market environment of stock competition, China's independent weak brands are being accelerated to be eliminated, and the hopeless brands will eventually withdraw from the market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.