In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/01 Report--

As of the close of Hong Kong shares on June 1, Evergrande shares rose 9.57% to close at HK $38.35/share, with a total market value of HK $374.6 billion. Up to now, Evergrande ranks fourth in market value in China, overtaken by BYD, NIO Automobile and Great Wall Motor.

It is worth mentioning that just yesterday, Evergrande Hengchi Intelligent Technology (Shanghai) Co., Ltd. was established with registered capital of RMB 100 million and legal representative Liu Yongzhuo. Its business scope includes technology development, technology transfer, technical consultation and technical service in the fields of intelligent technology, automobile technology, network technology and computer technology. According to the equity penetration chart, the company is indirectly 100% owned by Evergrande New Energy Automobile Investment Holding Group Co., Ltd. However, whether the establishment of the new company is the reason for Evergrande's share price surge is not conclusive.

This is the first time Evergrande has experienced substantial growth in recent months. Since April 19, Evergrande's share price began to decline all the way, from HK $68.1/share on April 19 to HK $38.35/share on June 1, a decrease of 44.41%.

At the Shanghai Auto Show held on April 19, Evergrande put 9 Hengchi models on the booth in one breath, which is the first time Evergrande has displayed the real car in close proximity to the public since it announced the car building. Evergrande's booth was crowded on the media day, which was enough to show Evergrande's attention in the market. However, most of Evergrande's products were only for visiting and could not be photographed at close range. For this reason, many netizens questioned that Evergrande exhibited concept cars instead of production cars. Perhaps due to some of these reasons, coupled with not much action in recent months, Evergrande's share price began to misfire and continued to fall.

It is understood that Evergrande Automobile was renamed from Evergrande Health. The share price of Evergrande Automobile, which successfully renamed, once overtook BYD and became the automobile enterprise with the highest market value in China. If the closing price of new energy vehicles is HK $4.6 from June 25,2018 to the closing price on April 19 this year, Evergrande Health's share price will rise by 1400.8% in two years.

The reason why Evergrande's share price once rose was that, on the one hand, the state vigorously promoted the implementation of policies related to new energy vehicles, and on the other hand, it originated from its own excellent "marketing skills" and super "circle of friends". On August 3,2020, Evergrande Automobile released six models: Hengchi 1, Hengchi 2, Hengchi 3, Hengchi 4, Hengchi 5 and Hengchi 6. On February 10,2021, Evergrande released Hengchi 7, Hengchi 8 and Hengchi 9 models.

Such rapid product launch is unique at home and abroad. From the perspective of the industry, whether it is a traditional automobile enterprise or a new force to build vehicles, it will generally launch models by stages and then deliver them in batches. For example, Evergrande will launch six/three models at one time, which violates the basic law of vehicle building in the industry. In addition, in general, the product is designed first, and then the equipment is purchased according to the process, and the factory is built to realize mass production, while Evergrande Automobile "goes the opposite way", and the operation of building the factory before producing the vehicle is difficult to understand.

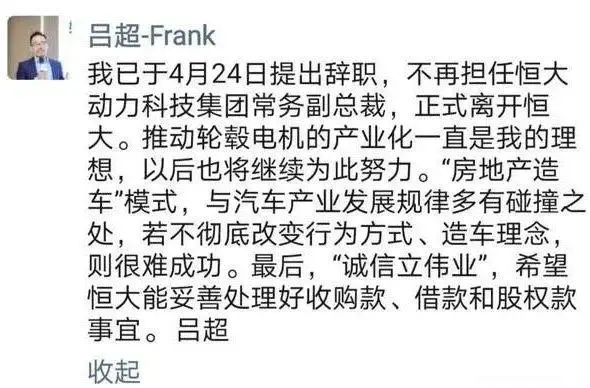

In April last year, Lv Chao, executive vice president of Evergrande Power Technology Group, announced his resignation. He issued a document in the circle of friends saying that there were many collisions between the mode of "real estate car-building" and the development law of automobile industry. If he did not change his behavior mode and car-building concept, it would be difficult to succeed. According to the current situation of Evergrande Automobile, Lv Chao's words are still full of profound meaning.

According to Xu Jiayin's plan, the annual output of new energy vehicles will reach 1 million vehicles, and it will become the largest and strongest new energy vehicle group in the world in 3 to 5 years. Xu Jiayin's investment budget in Evergrande's new energy vehicles is RMB 45 billion yuan in three years, including RMB 20 billion yuan in 2019, RMB 15 billion yuan in 2020 and RMB 10 billion yuan in 2021. He also arranges ten production bases in China, Sweden and other countries to develop 15 new models simultaneously. At this year's Shanghai Auto Show, Evergrande announced that Hengchi Automobile will fully start trial production in the fourth quarter of this year and deliver it on a large scale next year. Will Evergrande's "car-building dream" come true or suffocate? Perhaps he could only use time to prove it!

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.