In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/03 Report--

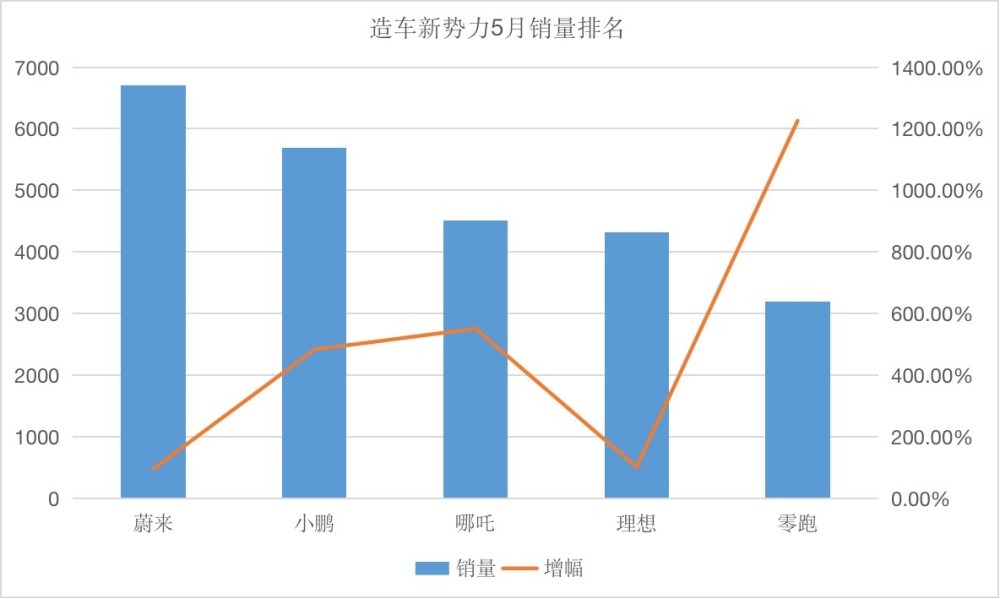

Just turned to June, domestic NIO, ideal, Xiaopeng several new power car manufacturers immediately can not wait to release their respective sales data last month. The top seller is still NIO, with 6711 cars delivered in May, an increase of 95 percent over the same period last year. Second, Xiaopeng delivered 5686 vehicles in May, an increase of 483 percent over the same period last year. Surprisingly, Naha car sold 4508 vehicles in May, up 551 percent from the same period last year, surpassing ideal car sales for the first time.

Based on the overall sales situation, sales of new energy vehicle companies continued to grow after the first quarter fell at the beginning of this year. From the end of last year to the beginning of this year, the new energy automobile industry became the most concerned industry for capital. in the second week of November, the daily trading volume of Lulai Motor in the United States reached 27.4 billion US dollars, exceeding the combined turnover of Amazon and Apple. Wei has made great progress all the way, turning to January 12 this year. The stock price of Lulai Motor is $62.70, corresponding to a market capitalization of $98.38 billion, which once soared in intraday trading. With a market capitalization of more than 100 billion US dollars, it has become the highest market capitalization car company in China.

In November last year, Toyota had a market capitalization of $195.23 billion, Audi $82.22 billion and BYD $72.4 billion. The carnival story lasted until February, when sales of New Power car companies began to be flat because of seasonal factors, and investors slowly began to come to their senses. By the close of the market yesterday, Xilai had a market capitalization of $67.441 billion and its share price had fallen to $41.16. Compared with its peak, it has dropped by 1/3. Such a gap and financial constraints have led several auto companies listed in the United States to announce plans to find new financing channels, and sales are the most important endorsement in the whole story.

Lulai remains the leading brand in sales among the new forces of car-building, with sales figures released yesterday showing that it delivered 6711 cars in May, up 95 per cent from a year earlier. But month-on-month slightly decreased, specific model composition, ES8 delivered 1412, ES6 delivered 3017, EC6 delivered 2282, April Wei delivered 7102 vehicles, delivery fell for two months in a row.

Wei Lai explained earlier that sales were directly affected by the shortage of chips and supply, and in March, Jianghuai Wei stopped production at the Hefei plant for five days. It is planned to accelerate delivery in the following June to ensure that the quarterly delivery target of 21000 to 22000 vehicles can be successfully met.

Xiaopeng followed closely, delivering 5686 units in May, a year-on-year increase of 483%, an increase of 10.5% month-on-month to deliver 3797 units of the dome P7 and 1889 units of the Xiaopeng G3, the highest monthly delivery record since July 2020. Contrary to the high-end style of Xilai, Xiaopeng P7 makes the entry price of Xiaopeng P7 around 200000 by putting into the application of lithium iron phosphate battery, thus gaining more free potential consumers.

This month, the one who unexpectedly came out from behind is Nahu Automobile. Last month, the Cyber Security Group invested and became its major shareholder. The words "serving the people" embedded on the hall wall of the Group began to be used in automotive products. The new power said that it would "do good business in the name of the people", which means that it starts from the middle and low end market as a cut-off point, and Nahu Automobile launches its compact SUV model, Nahu U Pro, at the Shanghai Auto Show. The official price of the model, which includes four subsidized versions, ranges from 9.98 yuan to 159800 yuan, with the highest battery life for 610km. Zhang Yong, co-founder and CEO of Naha Automobile, once said, "Naga U Pro aims to reach monthly sales of 3000 vehicles this year and may increase next year." In less than a month, the cumulative order has exceeded 5000. In May 2021, Nashi sold 4508 cars, an increase of 551% over the same period last year. The cumulative sales from January to May were 15966. Judging from the sales performance of Nezha, price is the decisive factor in sales, which is of great significance for Naga to surpass the ideal car for the first time.

The ideal car is a little depressed because of the launch of the new model. On May 25th, ideal suddenly released a new ideal ONE with richer features, while the price of the new model was 338000, which was only 10, 000 yuan more expensive than the old model, but the old car owners knew nothing about this information before, which triggered a conflict of trust between the old car owners and the ideal car. Some owners thought that they had become the leek of the ideal car to clean up the old model, so they sent a lawyer's letter to the ideal car. It is required that older models can also achieve hardware upgrades, while some car owners say that if the ideal car is willing to admit mistakes, it will still support the ideal car. Ideal ONE delivered 4323 vehicles in May, up 101.3% from a year earlier and down 21.95% from 5539 in April. Ideally, be confident about next quarter's delivery. Ideal plans to sell more than 10,000 cars a month by the end of this year, increasing the number of retail stores from the current 83 to 200.

![1622727688915143.png L5[_C%FX]O4WPYO$KM{ASVO.png](https://www.autochat.com.cn/uploadfile/ueditor/image/20210603/1622727688915143.png)

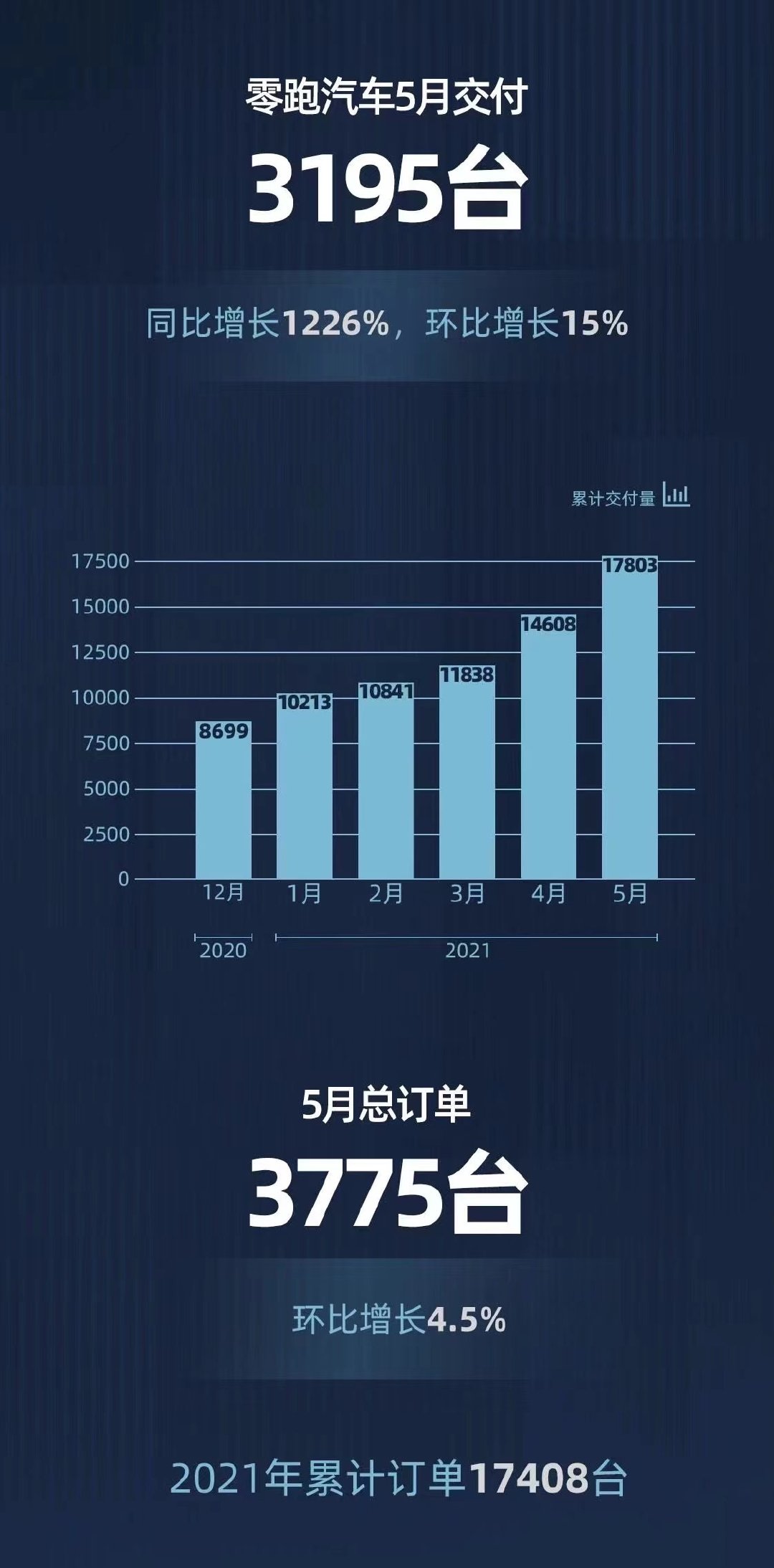

In addition, zero-running cars also reported a 12.26% year-on-year increase in May delivery to 3195 vehicles, with a cumulative delivery of 17803 vehicles from January to May. From the relevant data, we can see that the sales gap of the new forces of car building is narrowing, and the competition for ranking among enterprises is becoming more and more fierce.

Domestic new power sales data look at the same period last year, Tesla sales see month-on-month comparison. Before becoming the focus of daily news, Tesla was not worried about sales. After all, the total delivery volume of NIO, ideal and Xiaopeng in the first quarter of this year was less than 30% of that of Tesla. But now Tesla is full of bewilderment about the situation that he has repeatedly become the protagonist of the news, attributing the problem to the training of car owners and the targeted coverage of Tesla brand by the media. "for some functions, consumer education should be strengthened, such as working with driving schools or transportation departments," Tao Lin, Tesla's global vice president in charge of Tesla's Greater China affairs, said in an interview with Xinhua on May 10.

In response to some media reports, Tesla's legal Department launched an independent Weibo account on May 31. At present, this account has not yet started to publish content. I believe this is Tesla's gesture that he is beginning to plan to fight back. After all, it is impossible to open an account without posting anything, and some netizens have pointed out that people on his follow-up list have apologized one after another. At present, Tesla has not yet announced its May sales. Tesla's wholesale sales in China in April were 25845, down nearly 10,000 from 35478 in March. Tesla became the focus. Starting with the Shanghai auto show on April 19th, an activist car owner was carried out from the pavilion. This photo triggered a storm of public opinion, and May sales will fully reflect the impact of the incident on Tesla's brand.

Tesla's first-quarter 2021 results show that with more than double the number sold, Tesla's sales increased by only 74%, and Tesla's money on every car sold is declining. Tesla is a leader in the field of electric vehicles. Tesla's share price has fallen 11.59% so far this year. If Tesla's market value drops, or is returning to rationality, how much impact will this have on domestic brands?

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.