In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)06/22 Report--

It is learned from the Beijing property right Exchange that the capital increase project of Changan Mazda Automobile Co., Ltd. has been officially disclosed. According to the project announcement, after the completion of the capital increase project of Changan Mazda Automobile Co., Ltd., the shares held by the new investors shall not exceed 5% (inclusive), and the total shareholding proportion of the original shareholders shall not be less than 95% (inclusive); the proposed new registered capital is 5.8404 million US dollars, and all the funds raised in excess of the new registered capital shall be included in the capital reserve and shall be shared by both new and old shareholders according to the proportion of their shareholdings. The purpose of raising funds is to "improve business quality, improve and optimize industrial layout, and enhance the competitiveness of enterprises."

In response to the capital increase project, a relevant person from Mazda China said to the media, "in order to achieve better development of Changan Mazda in China, we and our partners decided to launch this capital increase. The purpose of this capital increase is to enable Changan Mazda to cope with the drastic changes in the market and maintain stronger competitiveness."

According to the data, Changan Mazda Automobile Co., Ltd., formerly known as Changan Ford Mazda Motor Co., Ltd., Nanjing Company, was established on April 19, 2005, jointly funded by Chongqing Changan Automobile Co., Ltd. and Mazda Automobile Co., Ltd., each holding 50%.

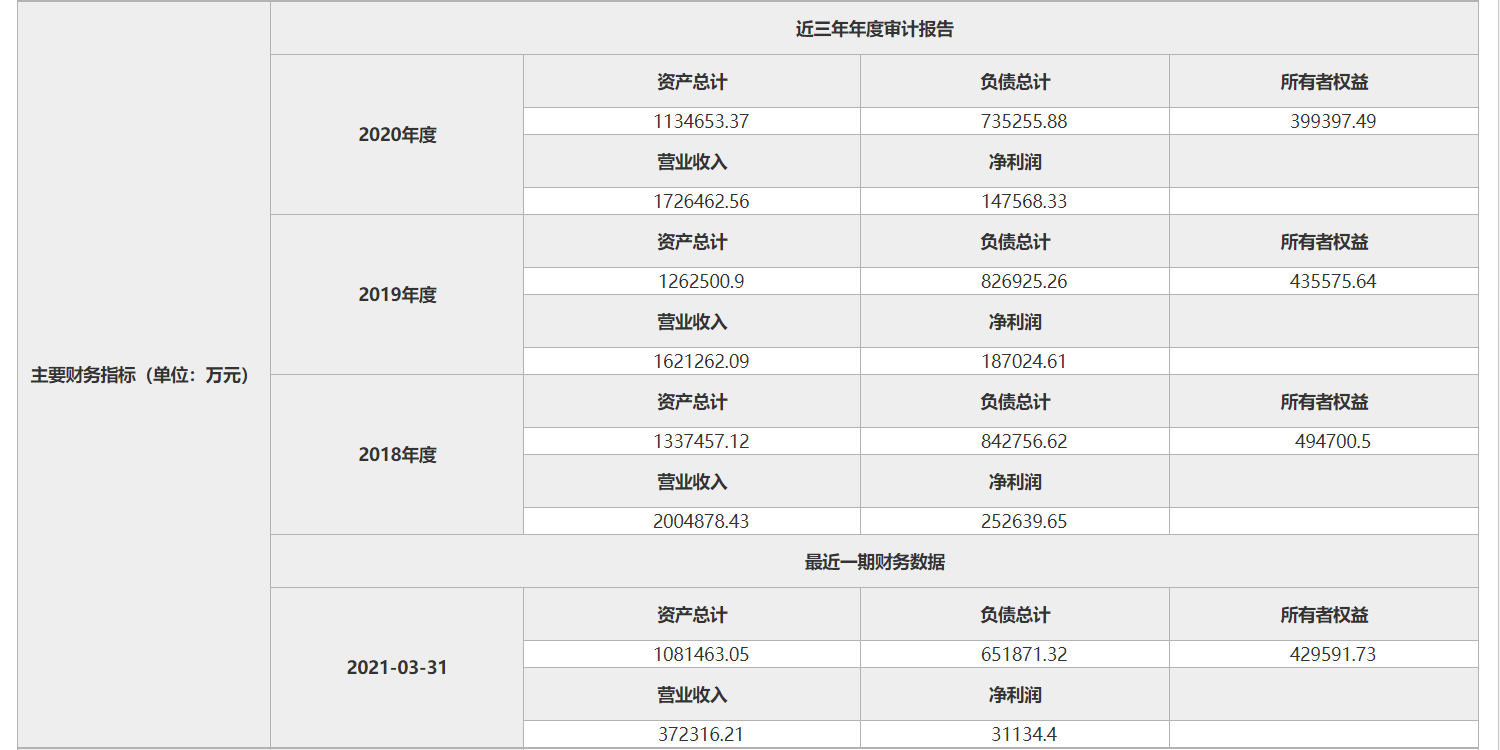

It is understood that Changan Mazda currently has four models, namely, Mazda 3 Uncella, CX-8, CX-5 and CX-30, on sale. According to the project, the net profit of Changan Mazda was 2.526 billion yuan in 2018, 25.96% to 1.87 billion yuan in 2019 and 21.12% to 1.476 billion yuan in 2020. The net profit of Changan Mazda in the first quarter of this year was 311 million yuan. In terms of sales, Changan Mazda sold 163400 vehicles in 2018, down 11.8% from the same period last year; 136300 vehicles in 2019, down 16.8% from the same period last year; and 136700 vehicles in 2020, up 0.24% from the same period last year. It can be seen that, as an overseas car company that entered the Chinese market earlier, the product camp of Changan Mazda is not perfect, the net profit has declined for two consecutive years, and the performance of sales volume is mediocre.

Although the performance of Changan Mazda is not very optimistic, it still has a great advantage over FAW Mazda. According to Mazda China data, the cumulative sales of Mazda in China in 2020 were 215000 vehicles, of which Changan Mazda sold 137000 vehicles and FAW Mazda sold only 78000 vehicles, down 14.78 per cent from the same period last year. The cumulative sales of Mazda from January to May in 2021 are 8.0, of which 27000 are from FAW Mazda and 53000 from Changan Mazda.

In this context, the rumors that FAW Mazda will be incorporated into Changan Mazda began to flow out. According to media reports, FAW Group, Mazda and Changan Automobile are in negotiations, and the three parties plan to merge the business related to the Mazda brand being carried out by FAW Mazda Automobile sales Co., Ltd. into Changan Mazda Automobile Co., Ltd., FAW Mazda Division will be dissolved in June. However, the news was quickly denied, and so far there has been no news about the dissolution of FAW Mazda and its integration into Changan Mazda.

It is understood that although Changan Mazda and FAW Mazda are joint ventures, the two companies are also different. Changan Mazda is 50% owned by Chongqing Changan Automobile Co., Ltd. and Mazda Co., Ltd., and has the right to sell and produce. FAW Mazda is jointly funded by FAW Group, FAW cars and Mazda, of which FAW Group accounts for 4%, FAW cars 56% and Japan Mazda 40%. FAW Mazda is a sales company without vehicle production business, and its models need to be licensed by Mazda cars, but the production task will be undertaken by FAW cars, which is why the Atez and CX-4 models are affixed with the tail mark of FAW Mazda.

Industry insiders said that the capital increase reflects that Mazda should focus on supporting the development of Changan Mazda in China in the future. After all, from the point of view of the mode of operation and ownership structure, the development of Changan Mazda will help Mazda to reap more profits in China.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.