In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/06 Report--

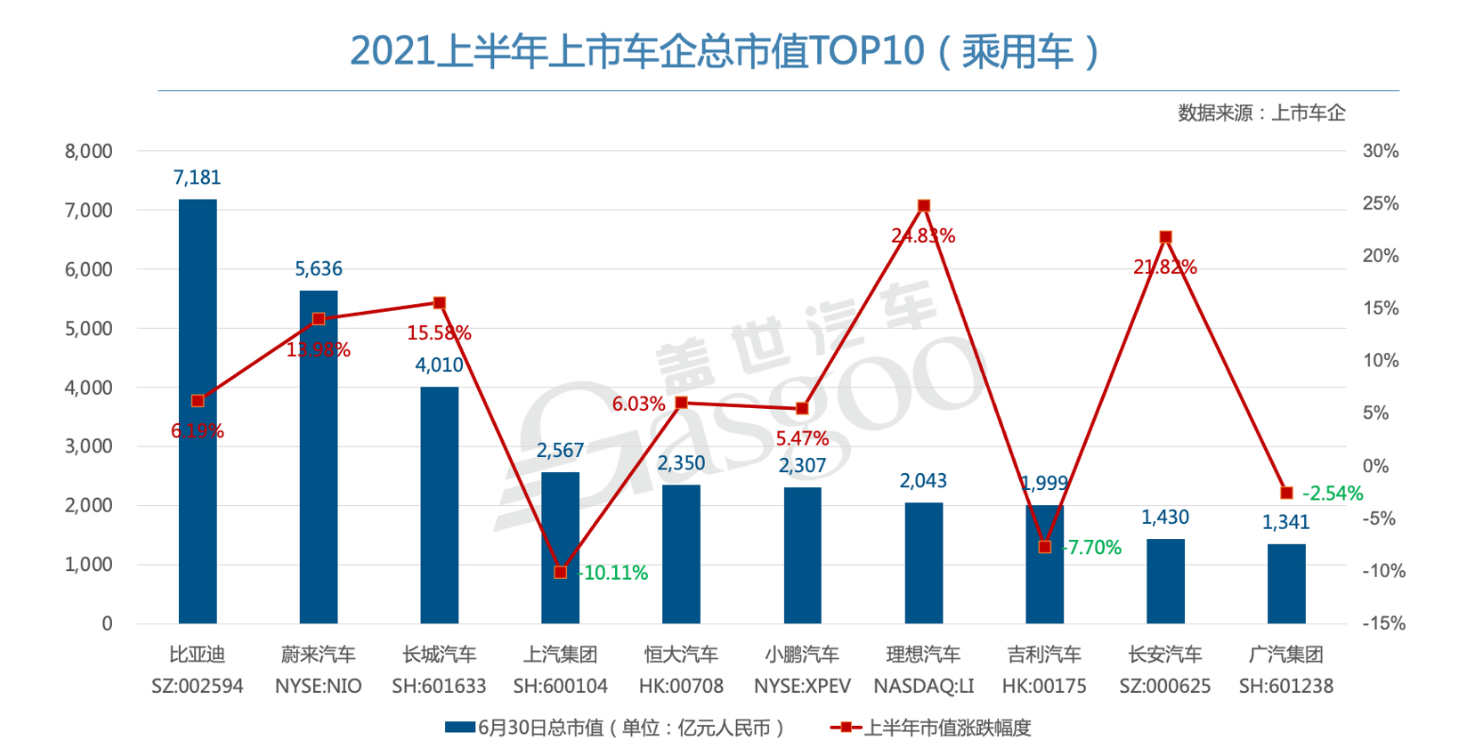

Recently, Galaxy counted the stock prices of listed passenger car companies and the total market capitalization of passenger car listed car companies in the first half of 2021. According to the chart, in the past six months, domestic automobile sectors, including BYD, Xilai Automobile, Great Wall Motor, Great Wall Automobile, Changan Automobile, and so on, have all seen great growth, of which BYD is the highest passenger car company in China by market capitalization. Xiaokang stock price rose 290.34% in half a year.

In the ranking of the total market capitalization of listed passenger car companies in the first half of 2021, seven of the top 10 car companies showed growth, while SAIC, Geely Motor and GAC GROUP all lost market capitalization.

In terms of independent brands, BYD is the car company with the highest market capitalization in China, with an increase of 6.19% in half a year, with a total market capitalization of 718.1 billion yuan. BYD is the leader of domestic new energy vehicles. With the new energy vehicles becoming the tuyere in 2020, the market value of BYD has increased significantly. However, in addition to new energy vehicles, BYD also has certain technical background in batteries, semiconductors and motors, which is the main reason why BYD has become the largest car company in China by market capitalization. It is understood that BYD is also alive in the year to launch high-end brands, the price is expected to be more than 500000 yuan.

In addition to BYD, among the independent brands, Great Wall Motor and Changan Motor also performed well. The share price of Great Wall Motor rose 15.58% in half a year, with a total market capitalization of 401 billion yuan, while Changan Automobile rose 21.82% in half a year, with a total market capitalization of 143 billion yuan. The share price of Great Wall Motor exploded in July 2020, when it released three major technology platforms, "Lemon, Tank and Coffee", as well as the addition of popular products such as Great Wall Gun, Harvard Dog and Tank 300, which led to the rise of the company's share price. As for Changan Automobile, it may be related to its record sales, coupled with the launch of high-end brands in Ningde era and Huawei in the future, which also brings more expectations for its future development.

Compared with the above car companies, Evergrande, Geely and GAC GROUP are not optimistic. As a cross-border carmaker, Evergrande's share price has been rising since July 2020, even surpassing BYD to become the most valuable car company in China, but its share price has been falling since the Shanghai auto show, offsetting gains over the past year and closing at 27.4 Hong Kong dollars per share as of July 6. As for Geely, although it is the first brother of its own brand, the performance of the capital market in the past six months is not optimistic, with a market capitalization of 199.87 billion yuan, a decline of 7.7%.

Let's take a look at the new power of car building. at present, front-line car brands such as NIO, Xiaopeng and ideal have all been listed in the United States. In the past 2020, the market capitalization of these three car brands has increased significantly, even surpassing many traditional car companies. Judging from the trend in the first half of 2021, they have basically continued the growth in 2020. Among them, NIO's total market capitalization is 563.556 billion yuan, which is the second car company in China. Xiaopeng and ideal's total market capitalization in the first half of the year are 230.7 billion yuan and 204.349 billion yuan, respectively, ranking sixth and seventh on the list, although ideal cars are ranked at the bottom of the list. however, its growth rate is the highest, with a market capitalization increase of 24.38% in the first half of the year, the largest increase among the top 10 car enterprises. According to previous reports, NIO, Xiaopeng and ideal will also return to Hong Kong for listing, of which Xiaopeng will officially trade on the Hong Kong Stock Exchange on July 7 at a price of 165 Hong Kong dollars per share.

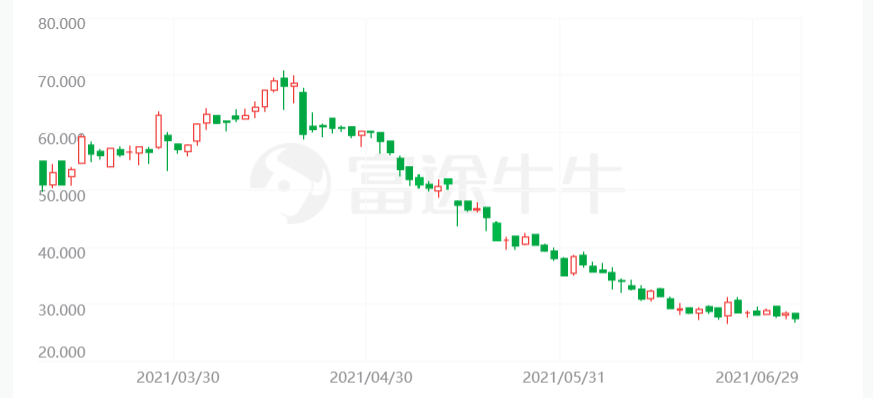

In the list of stock prices of listed passenger cars in the first half of 2021, Xiaokang shares became a dark horse with an increase of 290.34%. Since its cooperation with Huawei, Xiaokang shares have attracted the attention of the capital market. Since the beginning of April, Xiaokang shares have risen more than 180%, from 8 yuan last October to a new high of 83.83 yuan on June 22 this year, surpassing the share prices of many traditional car companies, such as Great Wall Motor and Geely Motor. However, Xiaokang shares have shown a slow downward trend for six consecutive trading days, and by the close of trading on July 6, its offer was 61.54 yuan, which was significantly lower than the peak price of 83.83 yuan.

In addition to the well-off shares, BAIC Langu has also become the focus of the A-share market because of its cooperation with Huawei. On April 17, the first mass production model "Alpha S HI version" developed by Huawei and BAIC Jihu was officially released. Since April this year, BAIC Langu's share price has continued to climb, from 8.51 yuan per share to 19.20 yuan per share on May 20, a cumulative increase of nearly 130%. However, with well-off shares, BAIC Blue Valley has also begun to shrink for nearly a month, closing at 12.79 yuan per share as of July 6. For these two car companies, cooperation with Huawei has brought about a rise in the capital market, but Huawei's auto concept is not omnipotent, and how to improve the company's brand strength and product strength is the top priority.

Under the background that new energy has become a tuyere, a number of traditional car companies begin to increase the transformation of new energy vehicles, launch related new energy vehicle products, or launch high-end new energy vehicle brands. It can be seen that in the first half of the year, many listed car companies TOP10 were linked to new energy, and most of them also caused the stock price to rise because of new energy. However, the rise of stock prices should also follow the market. If a brand lacks technical support and brand guidance, its soaring stock price will eventually become a bubble.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.