In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/07 Report--

On July 7, Xiaopeng Motor officially listed on the main board of the Stock Exchange of Hong Kong under the ticker "9868" and issued at a price of HK $165.It became the first new car-building force to be listed on the Hong Kong Stock Exchange. From a market point of view, Xiaopeng Motor Hong Kong shares opened up 1.82 per cent, then fluctuated all the way down to HK $159.3 per share, up 0 per cent as of today's close. The total market capitalization is 279.1 billion Hong Kong dollars, surpassing traditional car companies such as Geely Motor and Great Wall Motor.

According to the data, Xiaopeng Automobile, founded in 2014, is the Internet electric vehicle brand of Guangzhou Orange Line Intelligent Automotive Technology Co., Ltd. According to the Hong Kong stock exchange prospectus, Xiaopeng co-founder, chairman and CEO he Xiaopeng and his affiliated companies are Xiaopeng's controlling shareholders, with 21.75%; Taobao China holds 11.9%; IDG Capital holds 4.8%; Xiaopeng Co-founder and President Xia Heng and his affiliated companies hold 3.8%, Wuyuan Capital holds 3.2%, and GGV Capital holds 2.8%.

At present, Xiaopeng Motor has a total of Xiaopeng P7 and Xiaopeng G3 models on sale, of which Xiaopeng G3 is produced by Haima Automobile OEM and began delivery in December 2018, while Xiaopeng P7 is produced by self-built Zhaoqing factory and began delivery in May 2020. Data show that the annual cumulative delivery volume of Xiaopeng cars from 2018 to 2020 is 29, 12728 and 27141 respectively, and the cumulative delivery volume in the first half of this year is 30738, which has exceeded that of last year.

Delivery volume is the most direct performance of product strength, although Xiaopeng car delivery volume reached a new high, but most of the sales are contributed by Xiaopeng P7, Xiaopeng G3 market performance is gradually flagging, indicating that its product competitiveness has begun to decline. To this end, Xiaopeng plans to launch a mid-term revamped Xiaopeng G3 in July, which follows some of the design techniques of Xiaopeng P7 and renamed it "Xiaopeng G3i". In terms of new products, the Xiaopeng P5 released by Xiaopeng at the early stage of the Shanghai Auto Show is scheduled to be launched this year, and another model named Xiaopeng N5 is also declared and completed by the Ministry of Industry and Information Technology, or focuses on the travel market.

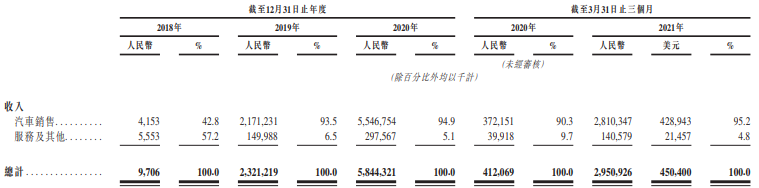

Although Xiaopeng car sales hit a record high, it is still in a state of loss in business. According to the prospectus, Xiaopeng's net losses in the first half of 2018-2020 were 1.399 billion yuan, 3.692 billion yuan and 2.732 billion yuan, with a cumulative loss of 7.823 billion yuan over three years. In the first quarter of 2021, Xiaopeng Motor achieved an operating income of 2.951 billion yuan and a net loss of 787 million yuan. Of course, Xiaopeng auto self-built factory, product research and development, technology development all need financial support, it is not realistic to achieve a balance in a short period of time.

Industry analysts believe that with the model of "dual major listing" in Hong Kong stocks, Xiaopeng Motor's real purpose is to break through the RMB market and expand its capital tentacles to compete for "ammunition" from China's capital market, so as to better grasp the market opportunity. at the same time, it can also narrow the market distance with A-share investors, activate stock transactions, making the promotion of enterprise growth space more potential. As for the possibility of whether Xiaopeng will be listed in A-shares, Gu Hongdi, co-founder of Xiaopeng, said: "from the perspective of dual listing, it is not very appropriate now, but we will certainly pay close attention to it." When the time is ripe in the future, I think the return (A shares) will certainly be considered. "

For the new forces of car building, capital is an important support for its follow-up product development and technological attack, and it is necessary to establish links with domestic capital markets and funds. Industry analysts believe that Xiaopeng Motor's real purpose is to break through the RMB market and expand its capital tentacles to compete for "ammunition" from China's capital market, so as to better grasp the market opportunities, and at the same time, it can also narrow the market distance with A-share investors. active stock transactions, so that the promotion of enterprise growth space has more potential. As for the possibility of whether Xiaopeng will be listed in A-shares, Gu Hongdi, co-founder of Xiaopeng, said: "from the perspective of dual listing, it is not very appropriate now, but we will certainly pay close attention to it." When the time is ripe in the future, I think the return (A shares) will certainly be considered. "

Xiaopeng CEO he Xiaopeng said that after the Hong Kong stock IPO, Xiaopeng Motor will enter a new stage of development. At present, Xiaopeng Motor is the first car-building new power company listed in Hong Kong stock market, leading in speed and ideal, or has a certain positive effect on its follow-up capital chain, but it does not mean that Xiaopeng Motor can rest easy. For car-building enterprises still in the market, there are all players with stories who can survive the first round of knockout, but the era of storytelling and PPT car building has passed. While raising money desperately, if you fail to maintain core competitiveness in the product, then the real pain may only just begin.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.