In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/20 Report--

Yesterday, a civil ruling was exposed online, and the share price of "Evergrande" plummeted collectively. Evergrande shares tumbled 16.22% to close at HK $8.21 on the day. Evergrande fell 19.1 per cent to HK $16.1 per share. Evergrande property and Evergrande Network fell 13.38% and 11.76% respectively.

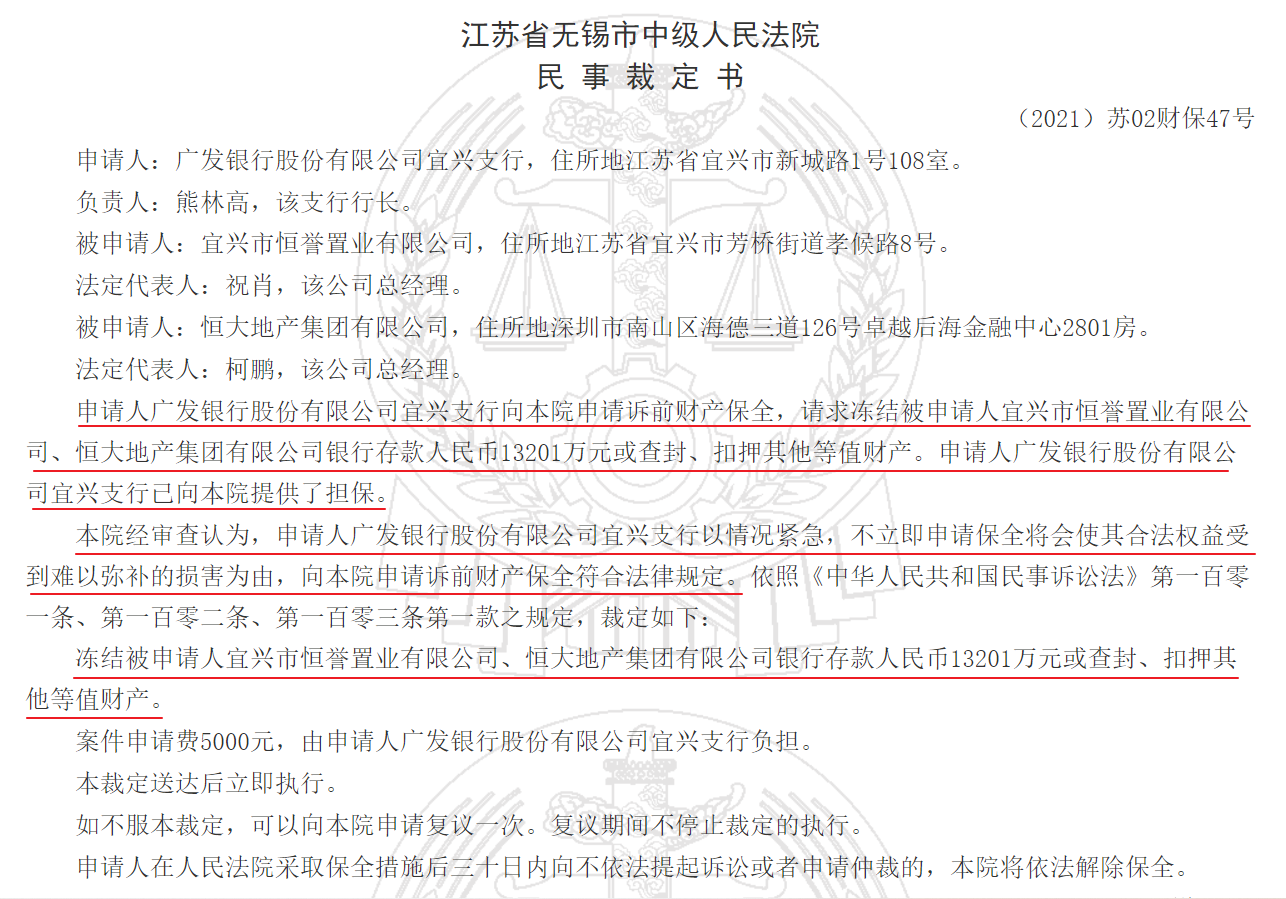

On July 19, a "Civil order of Guangfa Bank Co., Ltd. Yixing Branch and Yixing Hengyu Real Estate Co., Ltd., Evergrande Real Estate Group Co., Ltd." circulated on the Internet. The contents of the documents show that the applicant Guangfa Bank Yixing Branch applied for property preservation before the lawsuit to the Intermediate people's Court of Wuxi City, Jiangsu Province, requesting to freeze the bank deposits of 132.01 million yuan of the respondent Yixing City Hengyu Real Estate Co., Ltd., Evergrande Real Estate Group Co., Ltd., or seal up or seize other equivalent property.

In this regard, Evergrande Group issued a notice: "our Jiangsu Province company's project company Yixing Hengyu Real Estate Co., Ltd. and Guangfa Bank Yixing Branch Project loan 132 million maturity date is March 27th, 2022." For Yixing branch abuse of pre-litigation preservation, we will sue in accordance with the law. "

However, Evergrande's response also failed to turn the secondary market around quickly. On July 20, China Evergrande plunged 8.77% again, and Evergrande Motor plunged 11.18%.

Some people in the industry believe that although the loan is only 130 million yuan, which seems negligible to Evergrande Group, when Evergrande started in Guangzhou 20 years ago, Guangfa Bank was an important financial supporter of Evergrande. Now Guangfa Bank is the first to request to freeze the relevant assets of Evergrande Group, which means that Guangfa Bank may have some important information.

GDB's move is likely to reignite concerns about Evergrande's financial situation, and the collapse in share prices partly reflects the lack of confidence in Evergrande. Earlier, Evergrande announced that it had reduced its interest-bearing debt to about 570 billion yuan, achieving the goal of "at least one red line turning green" proposed by Xu Jiayin, chairman of Evergrande board in early June.

According to the results conference in March 2021, Xu Jiayin put forward a downgrade plan for the next three years: on December 31, 2021, China Evergrande's cash-to-debt ratio will reach more than 1, and on December 31, 2022, the asset-liability ratio will be reduced to less than 70%. Fully meet the regulatory requirements, and achieve the "three red lines" all turn green.

Everbright Securities pointed out that according to the 2020 annual report of China Evergrande Group, its asset-liability ratio, net debt ratio and cash-to-short-debt ratio after excluding accounts received in advance all exceed the requirements of the "three red lines", and external financing channels are limited. As a result, the repayment of its debt depends more on sales rebates, while most of Evergrande's projects for sale and for sale are located in third-and fourth-tier cities, so it is relatively difficult to defund.

As far as the automobile market is concerned, Evergrande Group and Guangfa Bank "quarrel" has relatively little impact on Evergrande, but the capital market has also fallen sharply. Evergrande closed down 11.18% at HK $14.3 per share, with a total market capitalization of HK $139.7 billion. Evergrande shares fell more than 30 per cent in two days, losing HK $50 billion from Friday's total market capitalization of HK $194.4 billion.

Previously, driven by the concept of new energy vehicles in 2020, Evergrande, as a member of the new power of car-making, started a sharp rise in share prices with Ulai, Xiaopeng, ideal and so on. Evergrande, whose share price was only 6 Hong Kong dollars per share at that time, suddenly soared, rising more than 10 times in less than a year, and even surpassed BYD to become the highest car company in China.

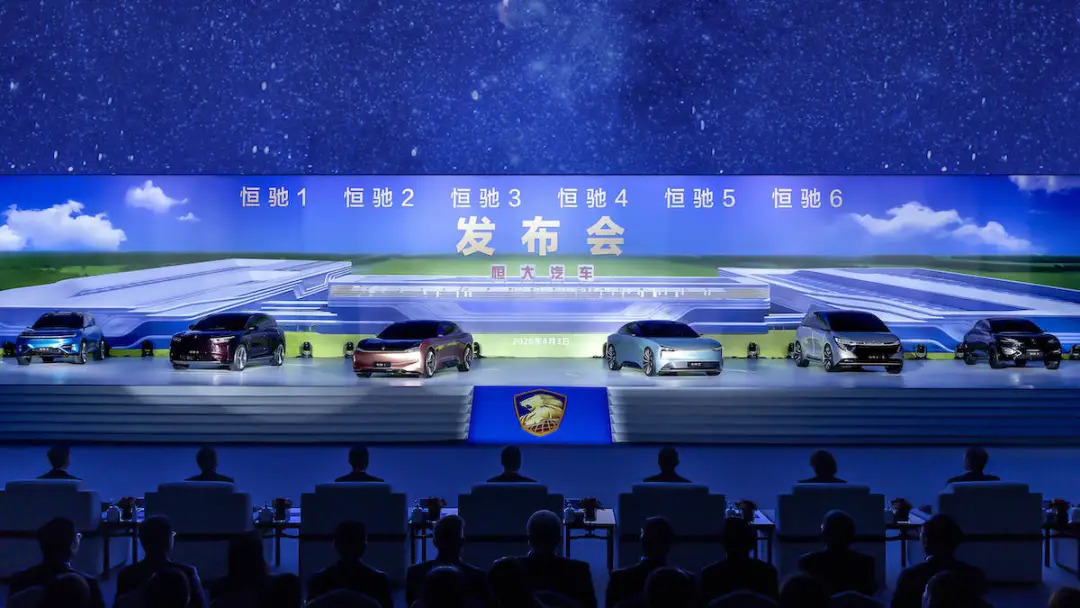

Evergrande's share price peaked at HK $70.85 per share before the Shanghai auto show, during which Evergrande unveiled nine models, which continued to rise with the launch of Hengchi's winter test and the launch of H-SMARTOS 's intelligent network connection system. However, since Evergrande unveiled at the Shanghai auto show, Evergrande's share price has been falling all the way. Taking April 19 as the dividing line, Evergrande's share price has plummeted 80% by the end of the day. Evergrande also took the initiative to release some good news in an attempt to stimulate the stock price, including the release of patent information and the summer calibration test ceremony of Evergrande, but the stock price continued to fall.

At the semi-annual results meeting of Evergrande Automobile Group in 2020, Liu Yongzhao, president of Evergrande Automobile Group, said that Hengchi products plan to be trial-produced in the first half of 2021 and strive for mass production in the second half of 2021. In other words, Evergrande will officially achieve mass production in 2021, but half a year later, coupled with Evergrande Group debt squeeze, how much patience do the capital markets still have?

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.