In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-15 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/22 Report--

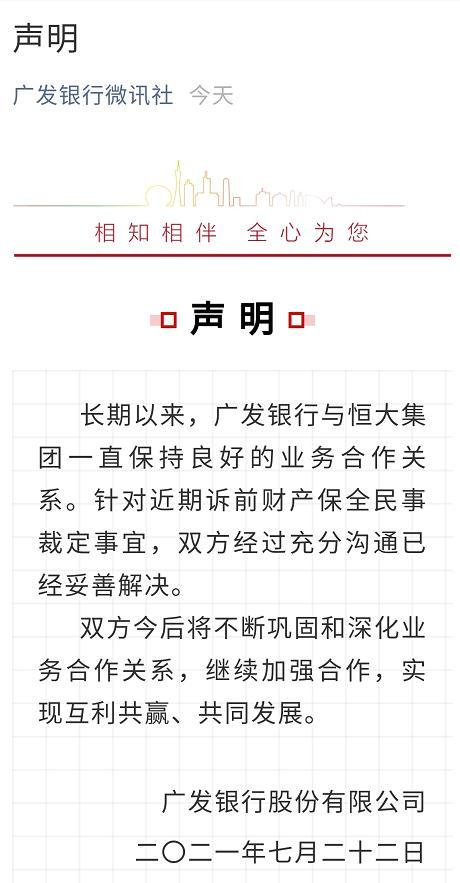

On July 22, Guangfa Bank and Evergrande Group issued a statement saying: Guangfa Bank and Evergrande Group have maintained a good business relationship for a long time. With regard to the recent civil ruling on property preservation before litigation, the two sides have been properly resolved through full communication. In the future, the two sides will continue to consolidate and deepen business cooperation and continue to strengthen cooperation to achieve mutual benefit and common development.

Or affected by this news and Faraday's future official listing on NASDAQ, Evergrande accounted for 20% of the shares, Evergrande shares all rose sharply in the morning trading on the 22nd. As of press time, China Evergrande reported HK $8, up 10.5%, Evergrande Properties HK $7.18, up 7.49%, Evergrande Motor HK $15.68, up 18.94%, and Hengten.com HK $4.27, up 8.1%.

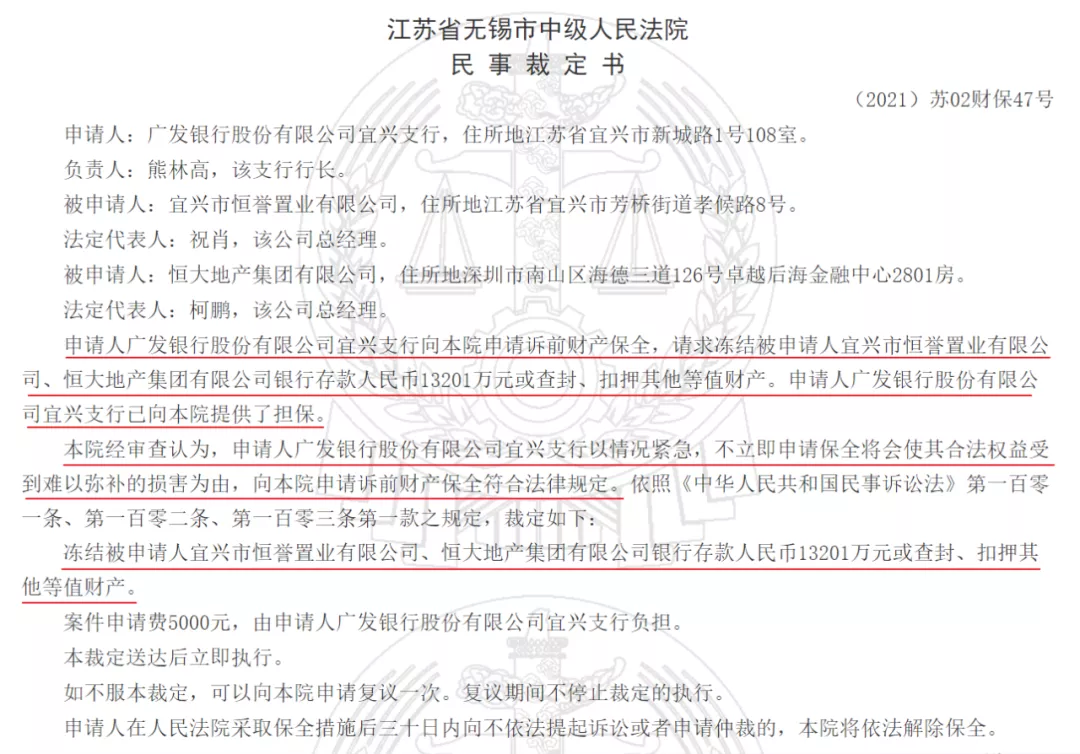

According to media reports, a civil order was published on the Internet on July 19, in which the applicant Guangfa Bank Yixing Branch applied for property preservation before the lawsuit to the Intermediate people's Court of Wuxi City, Jiangsu Province, requesting to freeze 132.01 million yuan in bank deposits of Yixing City Hengyu Real Estate Co., Ltd., Evergrande Real Estate Group Co., Ltd., or seal up or detain other equivalent property. As for the reasons for the application, the reason given by the Yixing branch of Guangfa Bank is that the situation is urgent and that failure to apply for preservation immediately will cause irreparable damage to its legitimate rights and interests. Then Evergrande responded: "the 132 million maturity date of the project loan of Yixing Hengyu Real Estate Co., Ltd., a project company of our Jiangsu company, and the Yixing branch of Guangfa Bank is March 27th, 2022. For Yixing branch abuse of pre-litigation preservation, we will sue in accordance with the law. " Affected by the news, by the end of July 19, China Evergrande fell more than 16%, Evergrande Motor plunged nearly 20%, Hengteng Network fell nearly 12%, Evergrande property fell 13.38%. As a result, the total market capitalization of China Evergrande fell to HK $108.8 billion. On July 20th, China Evergrande plunged 8.77% again.

Guangzhou Development Bank's move is likely to reignite concerns about Evergrande's financial situation, which has focused on its huge debt since last year. At the results conference in March 2021, Xu Jiayin put forward a downgrade plan for the next three years: on December 31, 2021, China Evergrande's cash-to-debt ratio will reach more than 1, and on December 31, 2022, the asset-liability ratio will be reduced to less than 70%. Fully meet the regulatory requirements to achieve the "three red lines" all turn green.

According to the regulations of the regulatory "three red lines", if the three indicators are not up to standard, they will be classified as "red file", and the scale of interest-bearing liabilities shall not be increased; if two items do not reach the standard, they shall be classified as "orange files", and the annual growth rate of interest-bearing liabilities shall not exceed 5%; if one item fails to meet the standard, it belongs to the "yellow file", and the annual growth rate of interest-bearing liabilities shall not exceed 10%. All three indicators are up to the standard and classified as "green", and the annual growth rate of interest-bearing liabilities shall not exceed 15%.

Everbright Securities pointed out that according to the 2020 annual report of China Evergrande Group, its asset-liability ratio, net debt ratio and cash-to-short-debt ratio after excluding accounts received in advance all exceed the requirements of the "three red lines", and external financing channels are limited. As a result, the repayment of its debt depends more on sales rebates, while most of Evergrande's projects for sale and for sale are located in third-and fourth-tier cities, so it is relatively difficult to defund.

The settlement between Evergrande Group and Guangfa Bank still has a great impact on Evergrande. In addition, Faraday's future listing on NASDAQ also makes Evergrande's capital market rise sharply. On July 22nd, Evergrande soared by 30%.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.