In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/26 Report--

According to the HKEx today, ideal Motor was heard through the HKEx, with Goldman Sachs and CICC as co-sponsors and UBS as financial advisors. Ideal car will seek to apply for dual major listing as issuers with different voting structures.

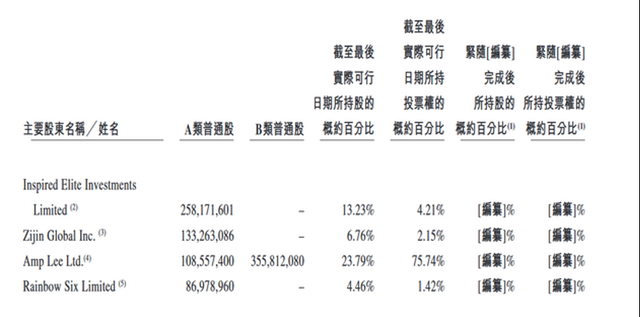

According to the prospectus, Li Xiang holds 23.79% of the shares, with voting rights up to 75.74%, Meituan 13.23%, voting rights 4.21%, Wang Xing holds 6.76%, voting rights 2.15%, Fan Zheng holds 4.46%, voting rights 1.42%. According to the prospectus, the income of ideal Automobile in the first quarter of 2021 was 3.575 billion yuan, and the total revenue increased from 284 million yuan in 2019 to 9.566 billion yuan in 2020; the cost of sales in the first quarter of 2021 was 2.958 billion yuan, and the total cost of sales increased from 285 million yuan in 2019 to 7.834 billion yuan in 2020. From 2019 to 2020, the total income of ideal cars is about 284 million yuan and 9.457 billion yuan respectively, and the net losses attributed to ordinary shareholders are 3.282 billion yuan and 792 million yuan respectively. The total income in the first three months of 2021 was 3.575 billion yuan, while the net loss attributable to ordinary shareholders was 360 million yuan.

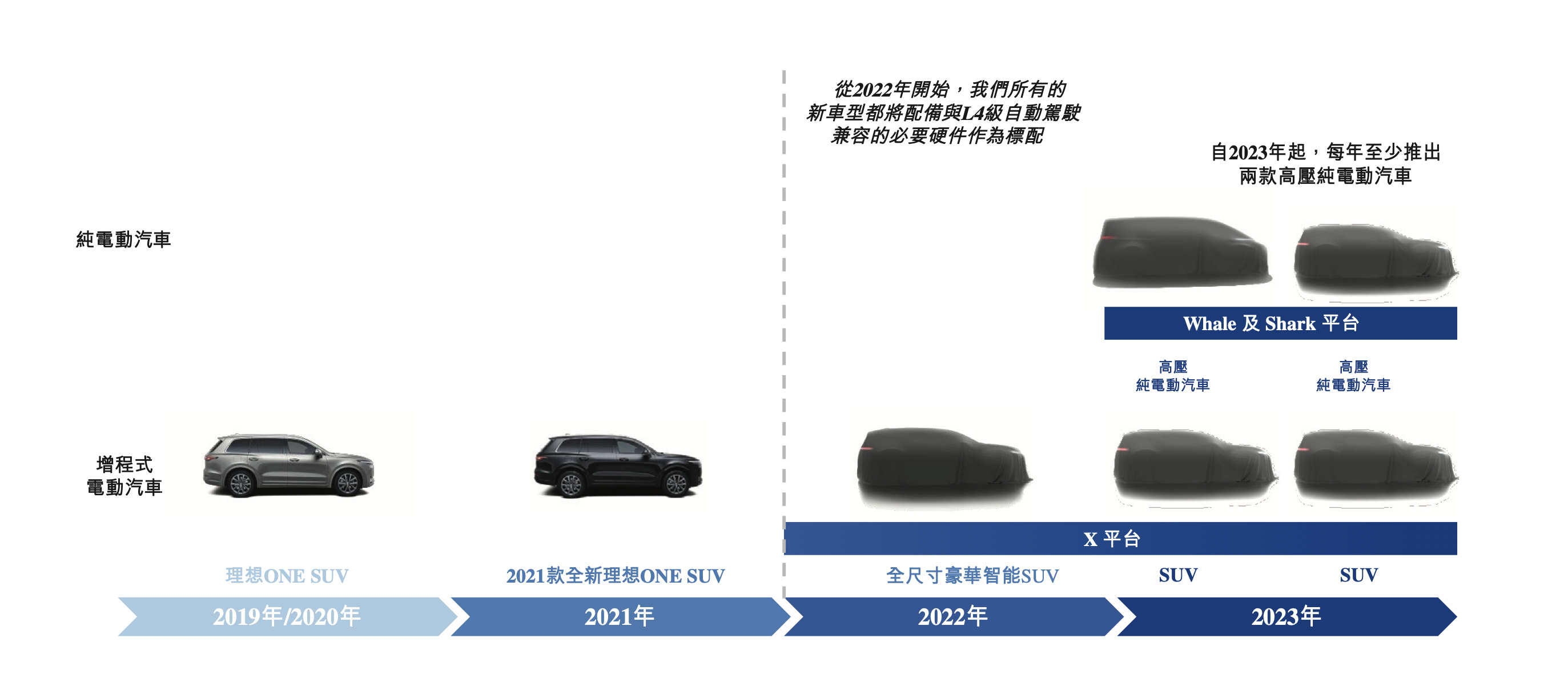

In addition, the prospectus also reveals the new car plans of ideal Automobile, which plans to launch the first product on the X platform, the full-size luxury add-on electric SUV, in 2022, and two other SUV models on the X platform in 2023. It is worth noting that at present, only a single model of the ideal car is on sale, and it is difficult to support it on its own. With the decline in the popularity of the new model, the ideal also urgently needs to launch a new model. Ideal promised in its prospectus that "from 2022, all our new models will be equipped with the necessary hardware compatible with the future L4 self-driving developed by ourselves." It is understood that the predecessor of the ideal car is car and Home, a car brand that Li wants to set up on July 1, 2015. The first model, ideal ONE, was launched in 2018, and the car and home registration changed its name to ideal car in June 2019, which unifies the naming of the company and the brand. According to the relevant data, according to the delivery data in June 2021, the ideal car delivered 7713 ideal ONE in June, an increase of 320.6% over the same period last year and 78.4% month-on-month growth, setting a new record for monthly delivery. A total of 17575 ideal cars were delivered in the second quarter, an increase of 166.1% over the same period last year and 39.7% month-on-month, setting a new record for quarterly delivery. The cumulative delivery volume from January to June is 30154. As of June 30, 2021, ideal car has delivered more than 63000 ideal ONE.

It is worth noting that only Xiaopeng Motor is listed on the Hong Kong Stock Exchange of the three Musketeers, the new power of car building in China. Relevant information shows: on July 7, Xiaopeng Motor officially listed and traded on the main board of the Stock Exchange of Hong Kong, with the stock trading symbol "9868" and the issuing price of 165HK dollars per share. From the market point of view, Xiaopeng Motor Hong Kong shares opened up 1.82%, then fluctuated all the way down to HK $159.3 per share, closing at HK $165.00 as of July 7, with a total market capitalization of HK $279.1 billion, surpassing traditional car companies such as Geely Motor and Great Wall Motor.

Earlier, Reuters quoted people familiar with the matter as saying that Xilai and ideal Motors also plan to list in Hong Kong this year in order to attract more investors and are discussing listing plans with several banks. The three car brands plan to sell at least 5 per cent of their shares, raising a total of $5 billion based on the market capitalisation of US stocks, according to sources. For the new forces of car building, capital is an important support for its follow-up product development and technological attack, and it is necessary to establish links with domestic capital markets and funds. Ideal car CEO Li Xiang has responded to the rumors of a "secondary listing" in the market: for automobile companies, the more money, the better. Ideal cars do not mind acquiring capital reserves in any way, including financing from the secondary market, bank loans and bond issuance. The money-burning road of new car manufacturers has not yet stopped, and returning to Hong Kong for listing may ease their financial pressure. For now, the ideal car is also picking up the pace.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.