In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)07/30 Report--

The price of Tesla's standard upgrade version of Model 3 has been reduced by 15000 yuan to 235900 yuan, with delivery time of 4-6 weeks, according to Tesla's Chinese official website. Tesla said that the price adjustment reflects the actual situation of cost fluctuations.

This is the first time that Tesla has reduced his price this year. On October 1, 2020, Tesla announced that the price of the standard battery life upgrade version of Model 3 was reduced from 271550 yuan to 249900 yuan. After entering 2020, Tesla raised the price of domestic models many times. On March 24th, the price of domestic Model Y increased by 8000 yuan, of which the long-lasting version rose from 339900 yuan to 347900 yuan, and the high-performance version rose from 369900 yuan to 377900 yuan. The domestic Model 3 standard battery life upgrade rose 1000 yuan to 250900 yuan on May 8.

As Tesla adopts the method of direct sales, Tesla has direct control over the price of the products, and there will be no arbitrary price increase in the service center. Compared with traditional automobile companies, the sales price of Tesla's products is close to cost sales, so their products are greatly affected by the market, such as the increase in the cost of battery raw materials and the shortage of chips.

Tesla's use of direct sales has both advantages and disadvantages. As far as consumers are concerned, the prices of Tesla's products are relatively clear and intuitive, there will be no charges at will, and consumers can also obtain products at a lower cost. However, this sales model is greatly affected by the market, and once the price is adjusted, whether it is up or down, the impact on consumers is relatively large, it is easy to break out the protection of consumer rights. Of course, from a fundamental point of view, the price adjustment of Tesla's products is reasonable, but it is still income consumers in the long run.

Zhu Xiaotong, president of Tesla in China, said in an interview that Tesla's price reduction is normal and the price will get lower and lower. Tao Lin, vice president of foreign affairs of Tesla, also said: "our starting point is to enable more people to enjoy the dividends of scientific and technological development, promote the rapid development of the industry, and accelerate the transformation of the world to sustainable energy." There are too many routines in the auto industry for so many years, and we just want to break it in the most frank and direct way. After all, the vast majority of consumers will benefit in the end.

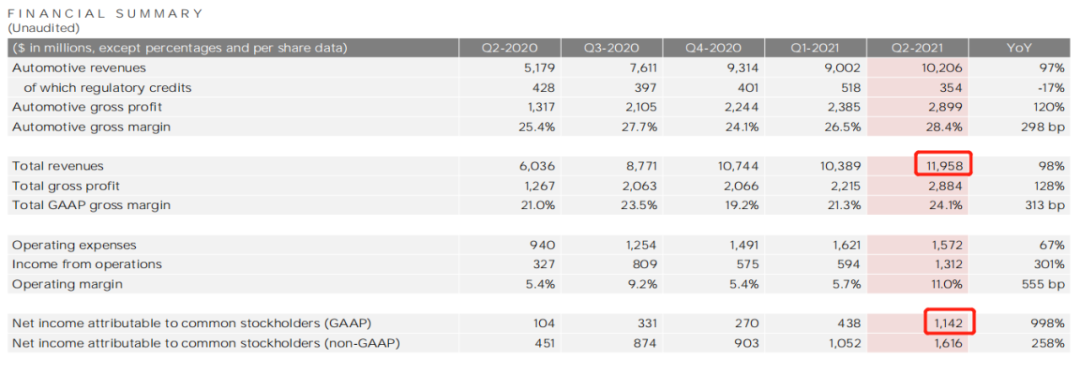

Recently, Tesla released its financial results for the second quarter of 2021, showing that Tesla's revenue in the second quarter was 11.958 billion US dollars (about 77.501 billion yuan), an increase of 98 percent over the same period last year. Realized net profit of $1.142 billion (about 7.401 billion yuan), an increase of 998% over the same period last year. The gross profit is 2.884 billion yuan and the gross profit margin is 24.1%, all of which are record-breaking.

This growth has something to do with the delivery volume of Tesla's models. According to Tesla's previous data, Tesla produced a total of 386759 vehicles worldwide in the first half of 2021, with a total delivery volume of 386050 vehicles, of which Model 3/Model Y produced 20481 vehicles and delivered 199360 vehicles in the first half of the year. Tesla did not disclose specific market sales, but according to previous data, Tesla maintained a leading position in the US and Chinese markets, with Tesla's cumulative sales in the Chinese market reaching 161743 in the first half, accounting for 41.9 per cent of the global market.

In a sense, China has become an important market for Tesla. In the long run, with the deepening of Tesla's localization, Tesla Model 3 and Model Y still have some room for price reduction, coupled with the fact that Tesla may put into production a 200000 yuan entry-level model in the future, which will have a "catfish"-like impact on the domestic new energy vehicle market, which may be in the situation of Tesla's sales growth in China, and is expected to surpass the United States to become Tesla's largest market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.