In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/04 Report--

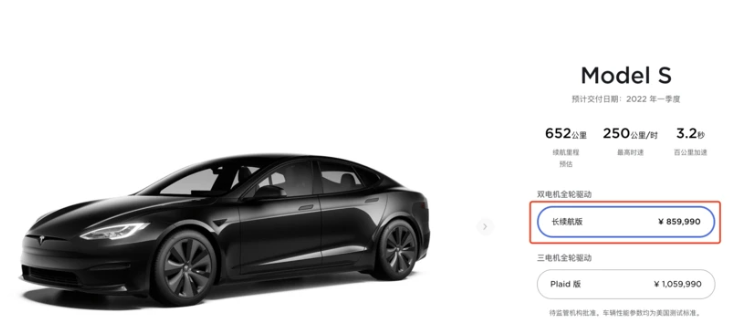

Today, I learned from Tesla's official website that the prices of 2021 Model S long-lasting versions and 2021 Model X long-lasting versions have been raised, and both models have increased by 30, 000 yuan. After adjustment, the long-lasting version of Model S will be sold at $859990 and the long-lasting version of Model X will be sold at $909990. The price of the high-end Plaid version remains the same, still 1.05999 million yuan. For this price adjustment, Tesla did not disclose the specific reasons.

Although Tesla has raised the price of models many times in recent months, the reasons for the price increase have not been disclosed to the public, but according to the current situation in the global automobile market, the price increase by Tesla is likely to be related to the global shortage of chips. the gap in automotive semiconductor chips has not been met for a long time, resulting in higher production costs for cars. Earlier, Tesla CEO Musk also said on the earnings call that the shortage of semiconductors is a "huge problem" and the company will solve the shortage of chips by looking for new suppliers.

The price adjustment is not just for China. The price of Tesla Model S / X long-lasting model in the United States has also been raised again, with the prices of both models rising by $5000. After the adjustment, the long-lasting version of Model S will sell for $89990 and the long-lasting version of Model X will cost $99990. In addition, this price adjustment in the domestic market is the second price increase of Tesla Model S long-lasting version. It is understood that the official price of Tesla Model S long-range flight version is 799990 yuan, and the vehicle has not yet been officially delivered. On July 16, Tesla raised the price of 2021 Model S long-life upgrade version and 2021 Model X long-life upgrade version, both by 30, 000 yuan. After the adjustment, the 2021 Model S long-life upgrade version sells for 829990 yuan, and the 2021 Model X long-life upgrade version sells for 879990 yuan.

It is worth noting that on July 30, Tesla's Chinese official website showed that the price of Tesla's standard upgrade version of Model 3 was reduced by 15000 yuan to 235900 yuan, with a delivery time of 4-6 weeks. Tesla said that the price adjustment reflects the actual situation of cost fluctuations. It also said that as long as consumers have not mentioned the car, they can pick up the car at the new price. At the same time, after the price reduction, the standard continued version of Model 3 has no change in both comfort configuration and performance configuration.

Why can Tesla adjust the price freely? As we all know, Tesla uses the way of direct sales, Tesla has direct control over the price of products, there will not be middlemen to earn the price difference. Compared with traditional car companies, the sales price of Tesla's products is close to cost sales, so it is more easily affected by the market, such as battery raw material costs, chip supply and so on may directly lead to price adjustment. Of course, Tesla's use of direct sales also has its advantages and disadvantages. As far as consumers are concerned, the prices of Tesla's products are relatively clear and intuitive, there will be no charges at will, and consumers can also obtain products at a lower cost. However, this sales model is greatly affected by the market, and once the price is adjusted, whether it is up or down, the impact on consumers is relatively large, it is easy to break out the protection of consumer rights.

According to Tesla's financial results for the second quarter of 2021 released in July, Tesla realized revenue of $11.958 billion (about 77.501 billion yuan) in the second quarter, up 98 per cent from a year earlier. Realized net profit of $1.142 billion (about 7.401 billion yuan), an increase of 998% over the same period last year. The gross profit is 2.884 billion yuan and the gross profit margin is 24.1%, all of which are record-breaking. This growth has something to do with the delivery volume of Tesla's models. According to Tesla's delivery data in the second quarter of 2021, Tesla produced a total of 206421 electric vehicles and delivered a total of 201250 electric vehicles in the second quarter of 2021, both of which set a new quarterly high for the company. Combined with Tesla's first quarter sales, Tesla produced a total of 386759 vehicles worldwide and delivered 386050 vehicles in the first half of 2021, of which Model 3/Model Y produced 20481 vehicles and delivered 199360 vehicles in the first half of the year.

Tesla officially launched the Model Y standard continuation version on its official website on July 8. the new car costs 291840 yuan before the subsidy and 276000 yuan after the subsidy. Delivery is expected to begin in August and bookings will be accepted from now on. In a sense, China has become an important market for Tesla. With the delivery of Model Y models under 300000 yuan, including the possible introduction of 200000 yuan entry-level models by Tesla in the future, it will promote sales growth in the Chinese market, and has a tendency to overtake the United States to become the first market.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.