In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/08 Report--

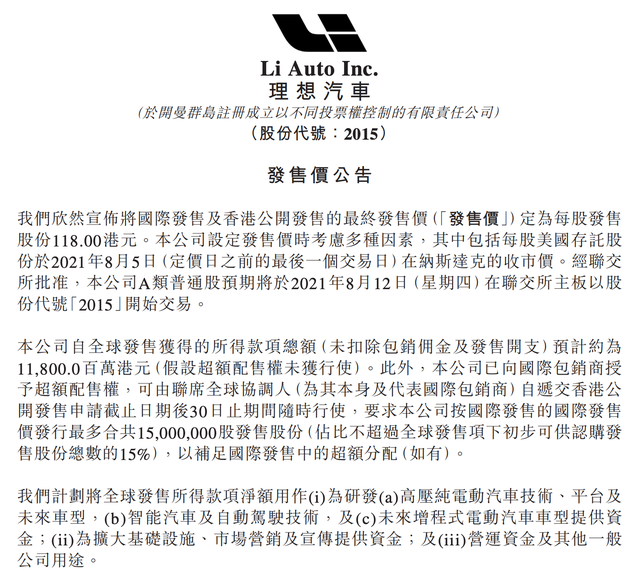

Recently, Ideal Motor announced that the final offering price of its Hong Kong IPO International Offering and Hong Kong Public Offering is HK $118 per share, which is lower than the previously expected maximum issue price of HK $150 per share. Based on its global issuance of 100 million Class A ordinary shares, the net proceeds from the Ideal Global Offering (net of underwriting fees, commissions and estimated offering expenses) are expected to be approximately HK $11.6 billion.

However, this news failed to drive up the ideal car stock price. On August 6, U.S. stocks closed at $30.05, down 3.19%, with a total market capitalization of $29.6 billion.

From the subscription situation, investors are relatively cold to the ideal car. Based on the data of several securities firms, by the end of ideal automobile subscription, the financing subscription amount of public offering part is HK $3.471 billion, the financing subscription multiple is 2.31 times, and the estimated subscription multiple is 6.78 times. Among them, the financing amount of Futu Securities is HK $1.462 billion, that of Huasheng Securities is HK $500 million, that of Phillip Securities is HK $468 million, that of Yaocai Securities is HK $250 million, that of Huatai International is HK $231 million, that of Fangde Securities is HK $180 million, and that of Funderstone, Livermore and Yingli Securities is less than 100 million.

According to the data, the ideal car is a new energy automobile company founded by Li Xiang in July 2015. The company was named "Che He Jia" earlier and renamed as Ideal Automobile in March 2019. Since then, it has obtained production qualification through acquisition of Lifan passenger car, and its self-built factory is located in Changzhou, Jiangsu Province. The Ideal ONE, which began production in November 2019, is the first model of the Ideal car and the only one currently on sale.

On July 30,2020, Ideal Automobile was officially listed on NASDAQ with stock code "LI", becoming the second listed car-making enterprise after NIO. On July 7,2021, Xiaopeng Automobile was officially listed on the main board of the Stock Exchange of Hong Kong with the stock trading code of "9868" and the issue price of HK $165/share, becoming the first new force to build cars listed on the Hong Kong Stock Exchange. In other words, the ideal car will become the second dual-listed car-making enterprise after Xiaopeng.

Car-building is recognized as a money-burning project in the market. After all, store construction, product R & D, technology R & D, marketing, etc. all need a large amount of capital investment, which is also the reason why Xiaopeng, Ideal and other car-building brands accelerate double listing. Li Xiang once said in an interview that the ideal does not mind any kind of financing, including secondary market, bank loans and debt issuance, etc.,"of course, the more money, the better."

In cash flow, the ideal car is not as good as Xiaopeng and Wei Lai. According to the prospectus, as of July 20,2021, the ideal car cash reserve was 30.36 billion yuan, compared with 47.5 billion yuan and 36.2 billion yuan for NIO and Xiaopeng respectively. That is to say, the ideal car will be subject to certain restrictions in terms of business development and research and development in the future.

In the product layout, the ideal car is also inferior to Xiaopeng and Wei Lai. At present, the ideal car has only one ideal ONE model, while NIO has ES6, ES8, EC6, ET7, while Xiaopeng has Xiaopeng P7, Xiaopeng G3i, Xiaopeng P5 and other models. By contrast, the product layout of NIO and Xiaopeng is more perfect, and the ideal product is quite single.

Of course, the ideal is different from Xiaopeng and NIO in that the ideal car is an extended range hybrid model, while Xiaopeng and NIO are pure electric vehicles. In July this year, 8589 ideal cars were delivered by the ideal ONE model alone, while Xiaopeng and NIO delivered 8040 and 7931 units respectively, up 22% and down 1.9% month-on-month respectively. 1-7 The total monthly ideal vehicle delivery volume is 38743, with 38778 Xiaopeng vehicles and 49,887 NIO vehicles delivered cumulatively. From the whole year, NIO is still ahead of ideal and Xiaopeng, but from a single model, the advantage of ideal car is much higher than NIO Xiaopeng.

According to the prospectus, the ideal car outlines ambitious goals for the future: launch a new "X" platform in 2022, build on it to develop a size luxury extended-range electric SUV, launch two high-voltage pure electric vehicles in 2023, and launch at least two new pure electric vehicles every year.

Overall, the dual listing of ideal cars may solve the capital problem, but whether they can continue to obtain market financial support also depends on the performance of ideal car products, not only ideal ONE, if ideal pure electric products can not open the market, then presumably the market expectations for ideal cars will not be very large. In a short period of time, ideal cars still need to rely on the extended program layout market. Pure electric vehicles will not be launched until 2023. At that time, the cross-border automobile enterprises currently entering the bureau have launched new cars for six consecutive years. Will ideal cars still have opportunities?

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.