In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/10 Report--

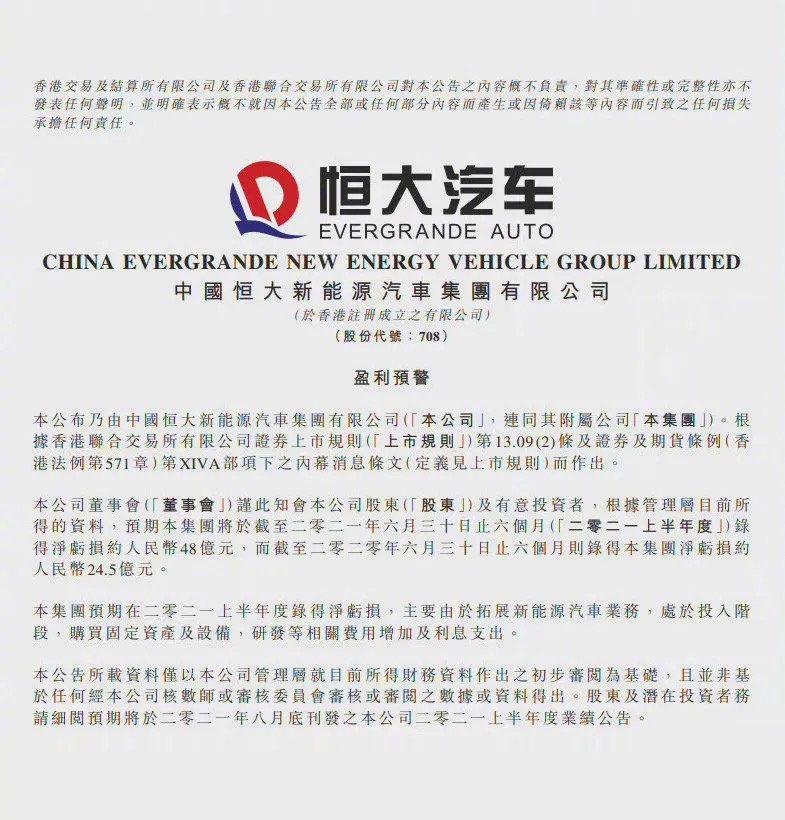

Evergrande announced on Aug. 9 that it expects a net loss of about 4.8 billion yuan in the first half, compared with a net loss of about 2.45 billion yuan in the same period in 2020. Evergrande said in its announcement that the loss in the first half of the year was mainly because the company was still in the investment stage and increased spending on fixed assets, equipment and technology research and development.

Although Evergrande is still losing money, the trend of Evergrande in the capital market is not bad. Evergrande rose more than 8 per cent on Aug. 10 and fluctuated all the way through the day. By the close of Hong Kong shares, Evergrande had risen 8.02 per cent to HK $13.2a, with a total market capitalization of HK $129 billion. Of course, although Evergrande's share price has risen sharply in a single day, it has shrunk sharply from its high in February.

This is not Evergrande's first loss. On March 25, 2021, Evergrande released its annual results, with an annual operating income of 15.487 billion yuan, an increase of 174.8% over the same period last year, and a net loss of 7.665 billion yuan, compared with 4.947 billion yuan in the same period last year.

It is worth noting that today, China Evergrande issued an announcement indicating that the company is in contact with several potential independent third-party investors to discuss the sale of some of the Company's assets. including, but not limited to, the sale of some interests in the listed subsidiaries of the Company, China Evergrande New Energy Automobile Group Co., Ltd. And Evergrande property Group Co., Ltd.

Evergrande also issued an announcement saying that as of the date of the announcement, no specific plan or formal agreement had been determined or concluded. If these plans or final agreements are implemented, the company will make a further announcement to notify the market.

Evergrande has struggled to raise money because of concerns about its financial health, according to Reuters analysis. Standard & Poor's, the international rating agency, downgraded Evergrande to CCC from B-on Aug. 5, two weeks after S & P again downgraded China Evergrande and its subsidiaries, downgrading China Evergrande, Evergrande and Space Holdings from Bplus to Bmur. the outlook is negative. In response, a spokesman for Evergrande Group said in July that the company deeply regretted and did not understand the downgrade. The spokesman also said that overseas short sellers frequently create public opinion through internal and external cooperation and maliciously short Evergrande stocks, causing great panic in the capital market against Evergrande.

According to the plan announced earlier by Evergrande, Evergrande's first model will be in mass production in 2021 and 1 million will be produced and sold by 2025. However, the recent financial crisis of Evergrande Group has also added more uncertainty to Evergrande's future.

Last week, several financial media reported that cases related to Evergrande had been transferred to the Guangzhou Intermediate people's Court, perhaps marking a critical point in Evergrande's debt problem.

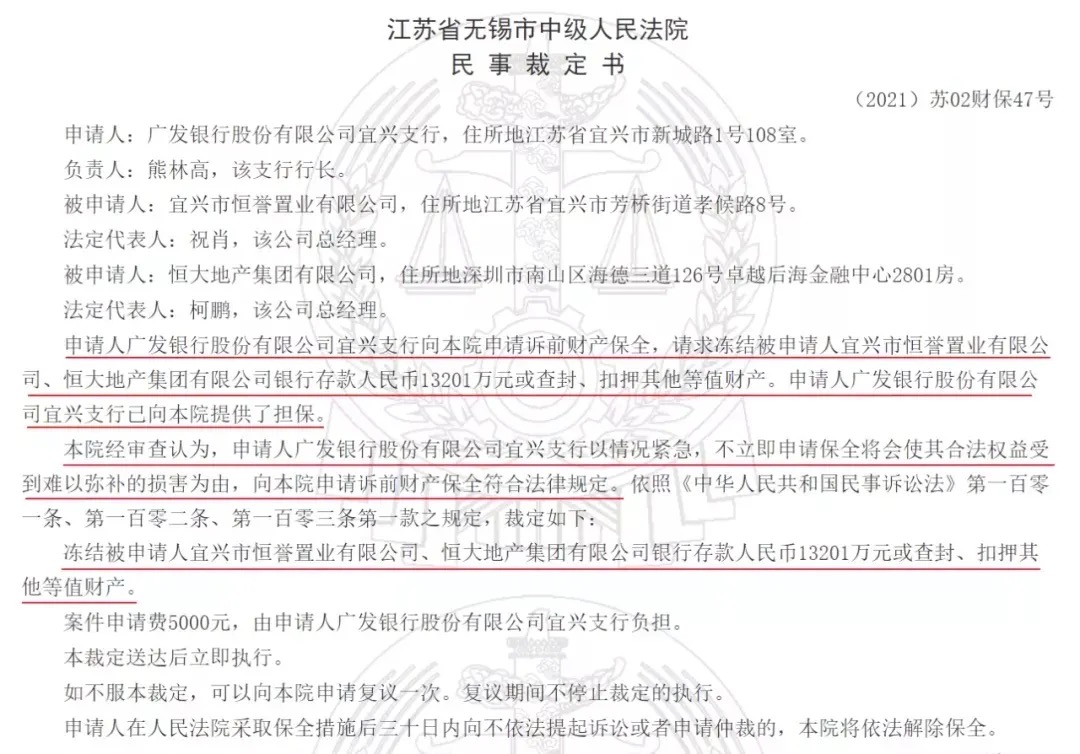

On July 19 this year, a civil order was published on the Internet, in which the applicant Guangfa Bank Yixing Branch applied for property preservation before the lawsuit to the Intermediate people's Court of Wuxi City, Jiangsu Province, requesting to freeze the bank deposits of 132.01 million yuan or seize or seize other equivalent property of the respondent Yixing City Hengyu Real Estate Co., Ltd. As for the reasons for the application, the reason given by the Yixing branch of Guangfa Bank is that the situation is urgent and that failure to apply for preservation immediately will cause irreparable damage to its legitimate rights and interests. Although soon after, the incident ended in a settlement between Evergrande and Guangfa. But Guangfa's move has also raised concerns about Evergrande's financial situation, which has largely focused on its huge debt since last year.

At the results conference in March 2021, Xu Jiayin put forward a downgrade plan for the next three years: on December 31, 2021, China Evergrande's cash-to-debt ratio will reach more than 1, and on December 31, 2022, the asset-liability ratio will be reduced to less than 70%. Fully meet the regulatory requirements to achieve the "three red lines" all turn green.

According to the regulations of the regulatory "three red lines", if the three indicators are not up to standard, they will be classified as "red file", and the scale of interest-bearing liabilities shall not be increased; if two items do not reach the standard, they shall be classified as "orange files", and the annual growth rate of interest-bearing liabilities shall not exceed 5%; if one item fails to meet the standard, it belongs to the "yellow file", and the annual growth rate of interest-bearing liabilities shall not exceed 10%. All three indicators are up to the standard and classified as "green", and the annual growth rate of interest-bearing liabilities shall not exceed 15%.

Everbright Securities pointed out that according to the 2020 annual report of China Evergrande Group, its asset-liability ratio, net debt ratio and cash-to-debt ratio after excluding accounts received in advance all exceed the requirements of the "three red lines", and external financing channels are limited. As a result, the repayment of its debt depends more on sales rebates, while most of Evergrande's projects for sale and for sale are located in third-and fourth-tier cities, so it is relatively difficult to defund.

At present, China Evergrande, which is listed in the red file, is now "stepping on all three lines." According to the analysis of some industry experts, Evergrande Group has long expected to strengthen the supervision of the real estate market and improve the real estate financial policy, and its response is to borrow the name of Evergrande Automobile to finance the development of real estate.

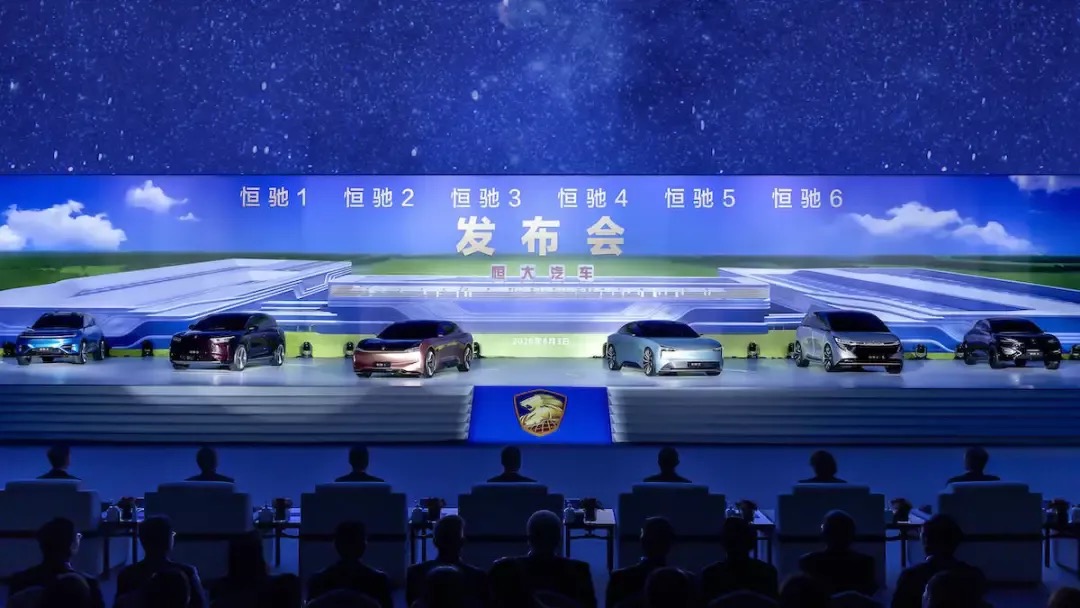

It is understood that in July 2020, Evergrande Department of listed company "Evergrande Health" announced that it changed its name to "Evergrande Automobile". In August 2020, Evergrande released six models: Hengchi 1, Hengchi 2, Hengchi 3, Hengchi 4, Hengchi 5 and Hengchi 6. In November 2020, Evergrande officially released the Hengchi logo, which means "protect the blue sky, win the Red Sea, the Lion of the East, and be proud of the world." In February 2021, Xu Jiayin, chairman of the board of Evergrande, supervised the winter test of Hengchi, and in the same month Evergrande released three models: Hengchi 7, Hengchi 8 and Hengchi 9. In March 2021, Evergrande released the H-SMARTOS Hengchi intelligent network connection system. Under this series of operations, Evergrande, whose share price was only 6 Hong Kong dollars per share at that time, suddenly soared, rising more than 10 times in less than a year, and even surpassed BYD to become the highest car company in China.

At a time when Evergrande's market capitalization is at a record high, the industry questions Evergrande's high valuation as a real estate cross-border carmaker that has not even launched a mass-production car, why can it get such a high valuation in the capital market? At the Shanghai auto show, nine Evergrande models were unveiled together. When they thought Evergrande's share price would hit a new high, it opened a path of decline. With April 19 as the dividing line, Evergrande's share price has plummeted 80% by the end of the day, during which Evergrande also took the initiative to issue some good news in an attempt to stimulate the stock price, including the publication of patent information and the holding of a summer calibration test ceremony for Hengchi cars, but the stock price continued to fall.

At present, Evergrande has released nine models, covering all levels A to D, as well as passenger vehicles such as cars, sedan cars, SUV, MPV, crossover cars, etc., but Evergrande has no reference information on the specific parameters of its products except for the appearance of the models. However, according to Xu Jiayin's previous plan, Evergrande plans to develop into the world's largest and most powerful new energy vehicle group in three to five years. At the semi-annual results meeting of Evergrande Automobile Group in 2020, Liu Yongzhao, president of Evergrande Automobile Group, said that Hengchi products plan to be trial-produced in the first half of 2021, strive for mass production in the second half of 2021, and plan to achieve production and sales of 1 million vehicles by 2025. Some industry insiders believe that, "the automobile industry is a scale victory, but among the existing large companies, none of them can achieve a breakthrough in the scale of one million vehicles in a short time."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.