In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/14 Report--

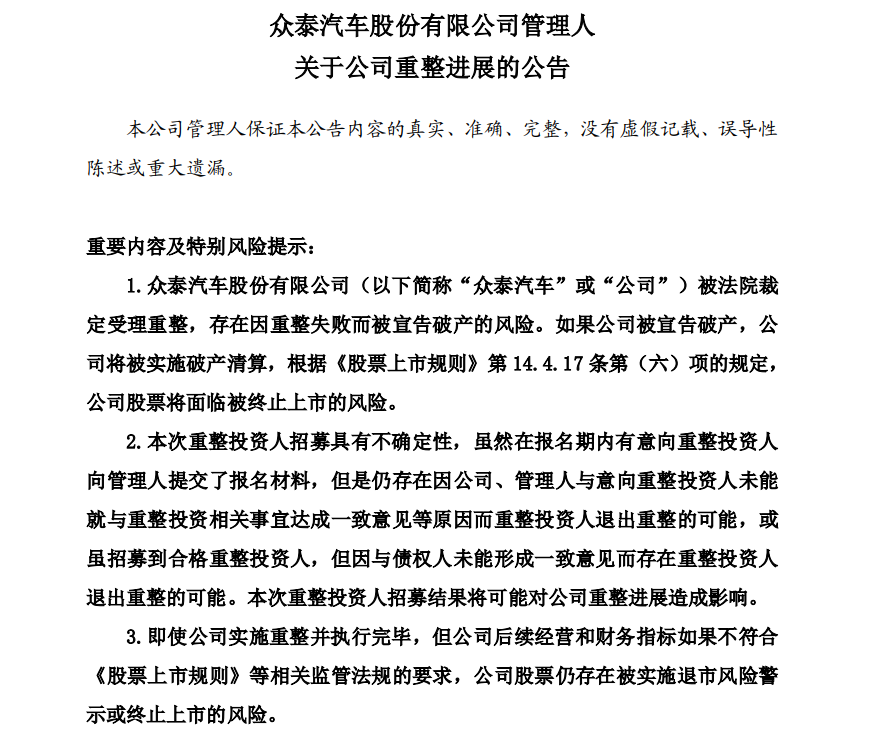

On August 13, * ST Zhongtai rose by the daily limit again, closing at 7.81 yuan per share. Two weeks harvest 6 limit board, facing the risk of delisting Zhongtai Motor in the secondary market still maintain an upward trend.

At the same time, Zhongtai Automobile also issued a "notice on the progress of the reorganization of the company" that, as of the registration period stipulated by the manager, Shanghai Tiangqi Automotive Technology Partnership (Limited Partnership) (hereinafter referred to as "Tiangqi Automobile"), Jiangsu Shenshang holding Group Co., Ltd., Hunan Zhibo Intelligent vehicle Equity Investment Partnership (Limited Partnership) (hereinafter referred to as "Zhibo Investment") three intended investors submitted application materials to the manager.

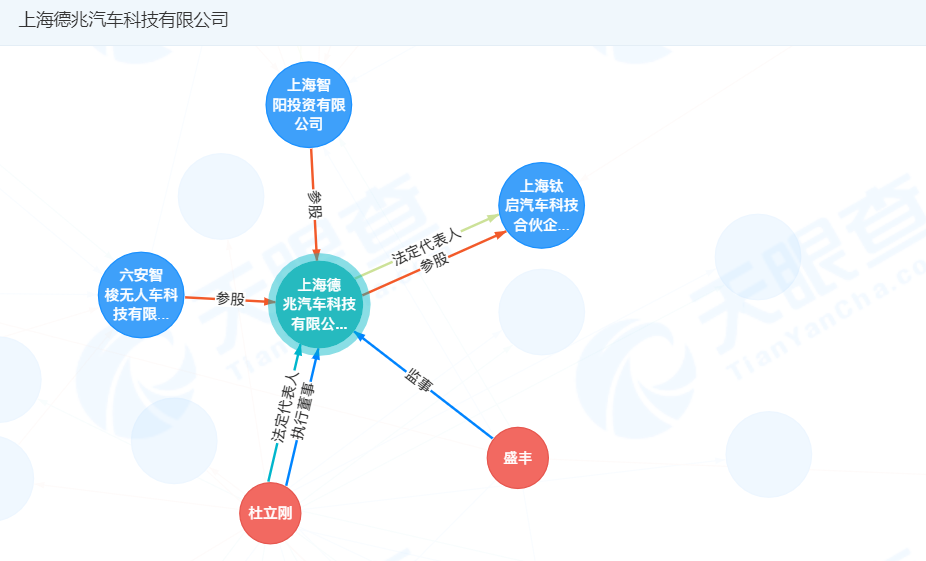

According to Tianyan investigation, Titanium Kai Automobile was founded on January 29, 2021 and is held by Shanghai Dezhao Automotive Technology Co., Ltd. (hereinafter referred to as "Dezhao Automobile") and Yancheng Junya Industrial Co., Ltd., respectively. Du Ligang, the legal representative of Dezhao Automobile, is the co-founder and CFO of Weima Automobile. In this regard, there is media speculation that Weima Motor or participate in Zhongtai restructuring, in order to obtain A-share shell resources.

As we all know, Weimar is a member of the new force of car building. As a member of the new car-building force, Weima Automobile obtained the production qualification through the acquisition of Huanghai Automobile as early as 2017, so participating in Zhongtai Automobile restructuring to obtain production qualification is not what Weima Automobile needs most. Some people in the industry think that Zhongtai Automobile's A-share shell resources are more attractive.

In fact, Weimar has planned to list in Science and Technology Innovation Board, but its road to listing has encountered many ups and downs. In January 2021, the CSRC Shanghai Bureau website published the summary report of CITIC Construction Investment on Weima Automobile listing guidance, which was completed at the end of January 2021. The report points out that after this tutoring, Weimar has completed the preparation of applying to the China Securities Regulatory Commission for an initial public offering and listing, and plans to land on the Kechuang board.

In April 2021, Sina Technology, citing insiders, reported that Weimar had suspended its application at Science and Technology Innovation Board IPO. According to reports, Science and Technology Innovation Board was questioned about the lack of science and technology, the proportion of R & D investment in revenue is not high, coupled with continuous huge losses, as well as many problems in the review of listed materials, resulting in its listing in Science and Technology Innovation Board encountered many ups and downs. In response to the above reports, Weima Motor responded that at present, preparations for listing are being carried out in an orderly manner. For details, please refer to the announcement of the Shanghai Stock Exchange. However, seven months have passed since 2021, but there has been no new progress in Weimar's landing board.

Some market analysts believe that it is almost impossible for Weimar to go public in Science and Technology Innovation Board. It is understood that Science and Technology Innovation Board opened the board in June 2019 and listed the first batch of companies in July. As a registration plate independent of the existing main board market, Science and Technology Innovation Board has always been famous for its low threshold, convenient financing, low cost of information disclosure, short audit period, controllable listing time and other advantages, which has also become the first choice for financing and listing of technology companies. However, due to changes in the market environment, the implementation of the new securities law and a large number of financial fraud cases similar to Leeco, the audit of IPO is being tightened comprehensively. Analysts at Guotai Junan Securities said that Science and Technology Innovation Board not only has high requirements for scientific and technological level and innovation ability, but also considers the landing of business models and the development prospects of enterprises.

Weima Automobile, as a member of the new car-building forces, was firmly in the first echelon in the early days, and Weima EX5 was also in the forefront of new energy vehicle sales. However, after entering 2021, Weimar rarely released data to the public. Weimar has obviously left the first echelon, while the second echelon of Nezha and zero cars are also desperately catching up, and Weima has begun to "lag behind." Relevant data show that Weima sold 15600 vehicles in the first half of 2021, while Wei Xiaoli sold 41900, 30700, 30200 and 21100 cars respectively in the same period.

Weimar needs more capital to expand the market, and listing financing is the best and most direct way. If Zhongtai's listing qualification can be obtained, Weima will be able to continue to promote a series of plans to land, including the launch of a car strategy in the second half of 2021 and the launch of a new intelligent vehicle platform for the next generation. Pick up Zhongtai, Weima can get funds from the secondary market, and Zhongtai may also be reborn in another way, refer to Geely-Lifan.

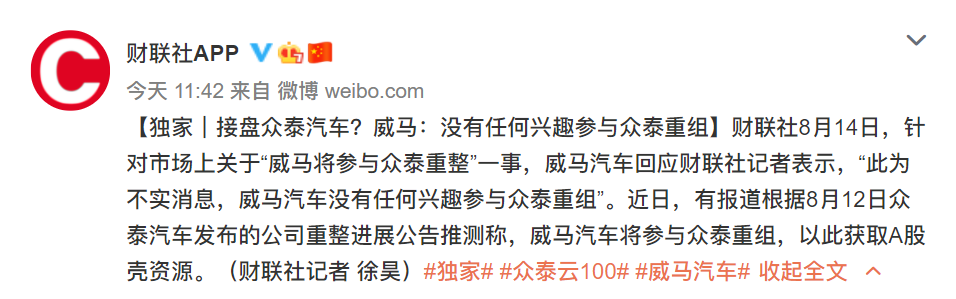

However, in response to the market on the "Weima will participate in Zhongtai restructuring" matter, Weima Motor is a clear response, "this is false news, Weima Automobile does not have any interest in participating in Zhongtai restructuring."

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.