In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/17 Report--

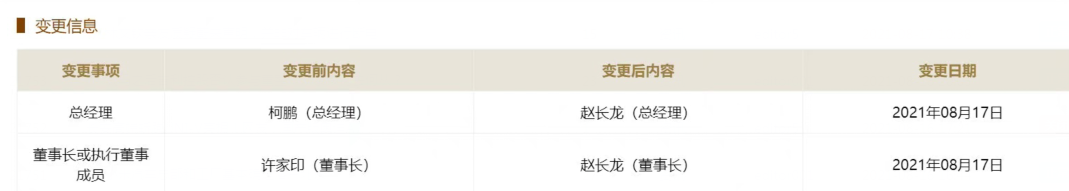

Today, according to the National Enterprise Credit Information publicity system (Guangdong), Xu Jiayin will no longer serve as chairman of Evergrande Real Estate, Ke Peng will step down as general manager, and the new chairman and general manager will be Zhao Changlong. Or affected by this news, Hong Kong stock "Evergrande" shares fell sharply in the secondary market. As of press release, Evergrande property fell by more than 8%, Evergrande Motor fell by more than 5.11%, and China Evergrande fell by more than 4.34%. For this change, people close to Evergrande said that the change is a normal change after the termination of backdoor housing A to A shares, and does not involve changes in specific management structure and equity. At present, the identity of Xu Jiayin as the chairman of the board of directors of China Evergrande Group and the actual controller of Evergrande Real Estate Group has not changed.

At the results conference in March 2021, Xu Jiayin put forward a downgrade plan for the next three years: on December 31, 2021, China Evergrande's cash-to-debt ratio will reach more than 1, and on December 31, 2022, the asset-liability ratio will be reduced to less than 70%. Fully meet the regulatory requirements to achieve the "three red lines" all turn green. According to the regulations of the regulatory "three red lines", if the three indicators are not up to standard, they will be classified as "red file", and the scale of interest-bearing liabilities shall not be increased; if two items do not reach the standard, they shall be classified as "orange files", and the annual growth rate of interest-bearing liabilities shall not exceed 5%; if one item fails to meet the standard, it belongs to the "yellow file", and the annual growth rate of interest-bearing liabilities shall not exceed 10%. All three indicators are up to the standard and classified as "green", and the annual growth rate of interest-bearing liabilities shall not exceed 15%. According to the analysis of some industry experts, Evergrande Group has long expected to strengthen the supervision of the real estate market and improve the real estate financial policy, and its response is to borrow the name of Evergrande Automobile to finance the development of real estate.

It is worth noting that Evergrande has accelerated the disposal of its assets since June this year. On June 20, China Evergrande transferred 739 million shares of Hengteng Network for a total of HK $4.433 billion; on June 21, it transferred 29.9% shares of Jiakai City for a total price of about 2.762 billion yuan. On August 1st, China Evergrande sold its stake in Hengteng Network again for a total price of HK $3.25 billion, reducing its shareholding to 26.55%. On August 2, Evergrande withdrew from Shenzhen High-tech Investment shareholders and transferred 7.08% of its shares to Vanke subsidiaries. On August 5, according to a number of financial media reports, cases related to Evergrande were transferred to the Guangzhou Intermediate people's Court for trial.

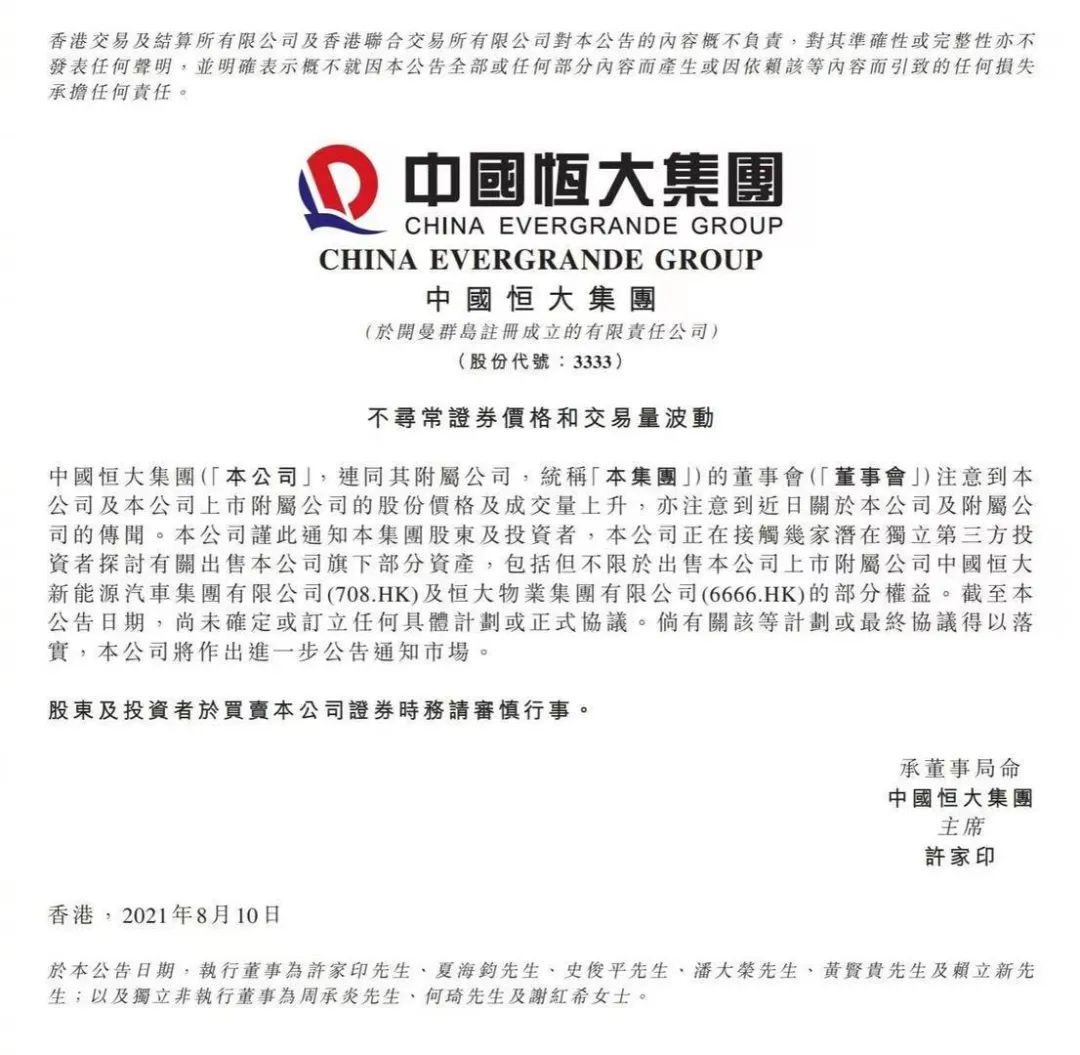

From 2018 to 2020, Evergrande's annual losses were 1.428 billion yuan, 4.426 billion yuan and 7.74 billion yuan respectively. On August 9, Evergrande issued a profit warning announcement for the first half of 2021, and is expected to record a net loss of 4.8 billion yuan in the first half of this year. An hour later, Evergrande issued another announcement and is in contact with a third party to discuss the sale of some assets such as Evergrande Motor and Evergrande property. So the question is, is it Evergrande's own liquidity problem, or is Evergrande's car still a long way off? Evergrande's announcement does not make this point.

According to Reuters analysis, Evergrande has been struggling to raise funds because of concerns about its financial health. Standard & Poor's, the international rating agency, downgraded Evergrande to CCC from B-on Aug. 5, two weeks after S & P again downgraded China Evergrande and its subsidiaries, downgrading China Evergrande, Evergrande and Space Holdings from Bplus to Bmur. the outlook is negative. In response, a spokesman for Evergrande Group said in July that the company deeply regretted and did not understand the downgrade. The spokesman also said that overseas short sellers frequently create public opinion through internal and external cooperation and maliciously short Evergrande stocks, causing great panic in the capital market against Evergrande.

At present, Evergrande has released nine models, covering all levels A to D, as well as passenger models such as cars, sedan cars, SUV, MPV, crossover cars, etc., but Evergrande has no reference information on the specific parameters of its products except for the appearance of the models. However, according to Xu Jiayin's previous plan, Evergrande plans to develop into the world's largest and most powerful new energy vehicle group in three to five years. At the semi-annual results meeting of Evergrande Automobile Group in 2020, Liu Yongzhao, president of Evergrande Automobile Group, said that Hengchi products plan to be trial-produced in the first half of 2021, strive for mass production in the second half of 2021, and plan to achieve production and sales of 1 million vehicles by 2025.

Xia Haijun, vice chairman of China Evergrande, has sold 3 million Evergrande shares at an average price of HK $14.18 each, reducing his position from 0.15 per cent to 0.12 per cent, according to HKEx filings. Today, Evergrande's closing price was 12.62 yuan, down 5.11%. 10 production bases, 9 models, 1 million cars produced and sold in 2025, 5 million cars produced and sold in 2035, this Evergrande car dream, today in 2021, I don't know whether there will be a major turning point at the moment when Xu Jiayin leaves office. Let's wait and see.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.