In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/20 Report--

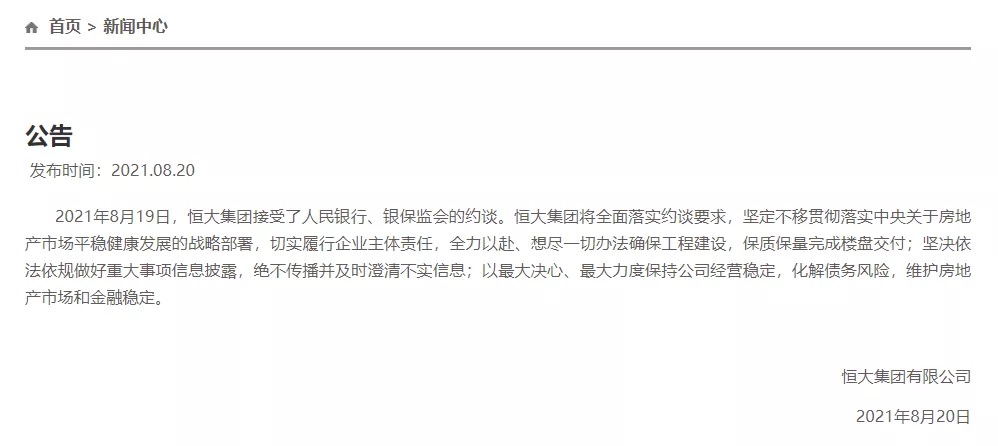

On August 19, 2021, responsible comrades of relevant departments of the people's Bank of China and the Bancassurance Regulatory Commission interviewed senior executives of Evergrande Group, according to the official website of the people's Bank of China and the Bancassurance Regulatory Bureau. The people's Bank of China and the CBIC pointed out that as the leading enterprise in the real estate industry, Evergrande Group must conscientiously implement the central strategic plan for the stable and healthy development of the real estate market, strive to maintain operational stability, and actively resolve debt risks. maintain real estate market and financial stability; do a good job in disclosing true information on major matters in accordance with the law, and do not disseminate and clarify false information in a timely manner.

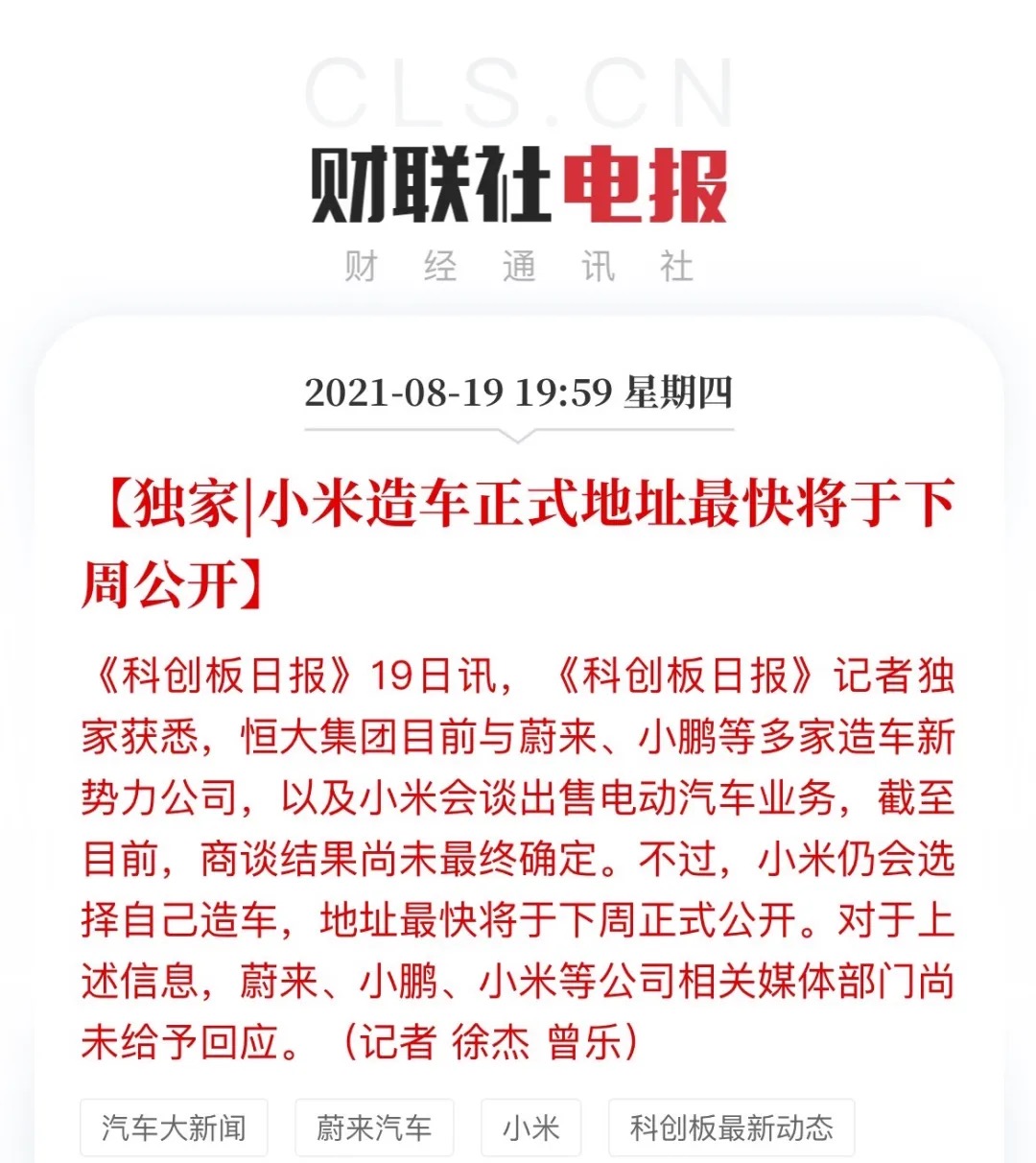

At the same time, according to the latest news from the market, Evergrande Group is negotiating with a number of new car-building companies such as Xilai and Xiaopeng, as well as Xiaomi, to sell shares in the electric vehicle division.

In the early morning of August 20, Evergrande Group issued two public announcements in response. In response to the interview between the central bank and the Bancassurance Regulatory Bureau, Evergrande Group issued a notice saying that Evergrande Group had accepted the interview from the people's Bank of China and the Bancassurance Regulatory Commission. Evergrande Group will fully implement the interview requirements, unswervingly implement the central government's strategic plan for the stable and healthy development of the real estate market, earnestly fulfill the main responsibility of the enterprise, and do everything possible to ensure the construction of the project. complete the delivery of the real estate in quality and quantity; resolutely disclose information on major issues in accordance with the rules and regulations, never disseminate and clarify false information in a timely manner With the greatest determination and maximum efforts to maintain the company's operational stability, resolve debt risks, and maintain the real estate market and financial stability.

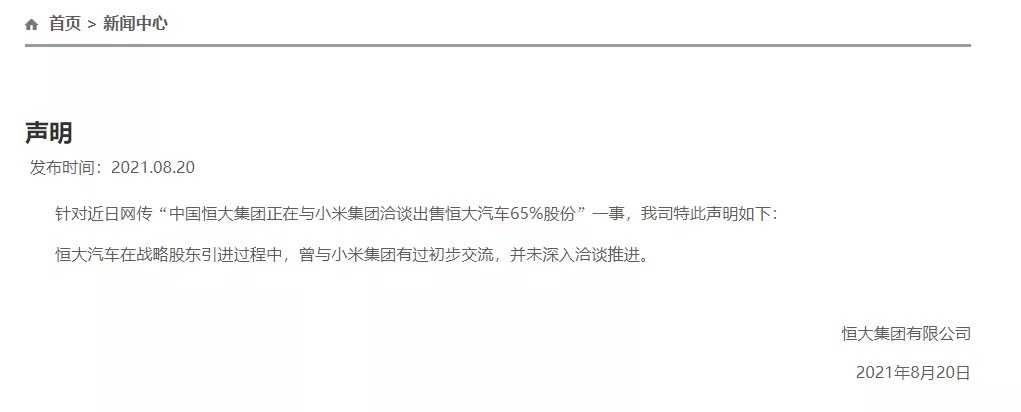

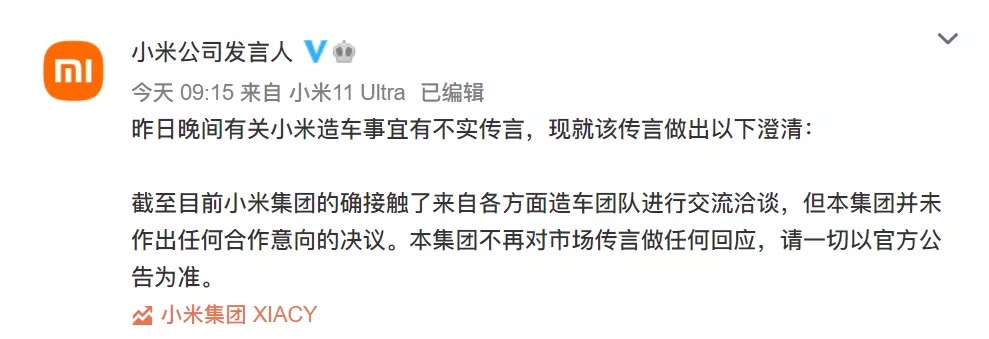

In response to the news that "Evergrande Group is in talks with Xiaomi Group to sell 65% of Evergrande's shares", Evergrande Group issued a notice saying that Evergrande had preliminary exchanges with Xiaomi Group in the process of introducing strategic shareholders, but did not discuss and promote it in depth. In response to the report, Xiaomi officially clarified: up to now, Xiaomi Group has indeed contacted the car manufacturing teams from all sides for exchanges and negotiations, but the Group has not made any decision on the intention of cooperation. The Group will no longer make any response to market rumors, please follow the official announcement.

On August 10, China Evergrande announced that it was in contact with several potential independent third-party investors to discuss the sale of some of its assets, including, but not limited to, the sale of some interests in the company's listed subsidiaries, China Evergrande New Energy Automobile Group Co., Ltd. And Evergrande property Group Co., Ltd. However, so far, apart from the rumored negotiations with Xiaomi Group, there has been no more progress.

The scale of debt remains high, and Evergrande has entered an eventful autumn. On July 26th, Standard & Poor's, an international credit rating agency, downgraded Evergrande and its subsidiaries, which are listed in Hong Kong, from B + to BMur. on August 6th, S & P downgraded Evergrande and its subsidiaries Evergrande Real Estate and Space Holdings from "B -" to "CCC" with a negative outlook.

On August 17, the chairman of Evergrande Real Estate Group changed from Xu Jiayin to Zhao Changlong, and the legal person and general manager changed from Ke Peng to Zhao Changlong. However, according to the latest announcement of the Shanghai Stock Exchange, this personnel change does not involve changes in the company's management structure and equity. Xu Jiayin is still the actual controller of Evergrande Real Estate.

As far as the market is concerned, the better feedback from Evergrande Group to the market is that as of June 29 this year, Evergrande's interest-bearing liabilities totaled more than 570 billion yuan, down more than 300 billion yuan from the peak of more than 870 billion yuan last year. At the annual results report meeting at the end of March this year, Evergrande Group announced a debt reduction target for the next three years: interest-bearing liabilities fell to less than 590 billion yuan on June 30, 2022 to less than 450 billion yuan, and to less than 350 billion yuan on June 30, 2023. In response to the "three red lines", Evergrande plans to reduce the net debt ratio to less than 100% on June 30, 2021, to more than 1 on December 31, 2021, and to reduce the asset-liability ratio to less than 70% on December 31, 2022, fully meeting regulatory requirements.

Some institutional analysts believe that it is the first time that the central bank and the Bancassurance Regulatory Commission have interviewed real estate companies that theoretically do not fall within their jurisdiction. The official attitude at least shows that Evergrande has a close interest relationship with the financial system. Evergrande cannot easily default on its own debts. On the other hand, Evergrande has indicated that it will release semi-annual results at the end of the month, at least that the financial data may not be so bad, and Evergrande is not afraid of detailed operating and debt data in the first half of the year to cause market panic.

Although Evergrande Group has been interviewed by the Central Bank and the Banking and Insurance Regulatory Commission, there is no negative impact on today's secondary market. By the close of trading in Hong Kong, Evergrande Motor was up 5.0%, Evergrande property was up 0.17%, and China Evergrande was down 1.6%.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.