In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-23 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/23 Report--

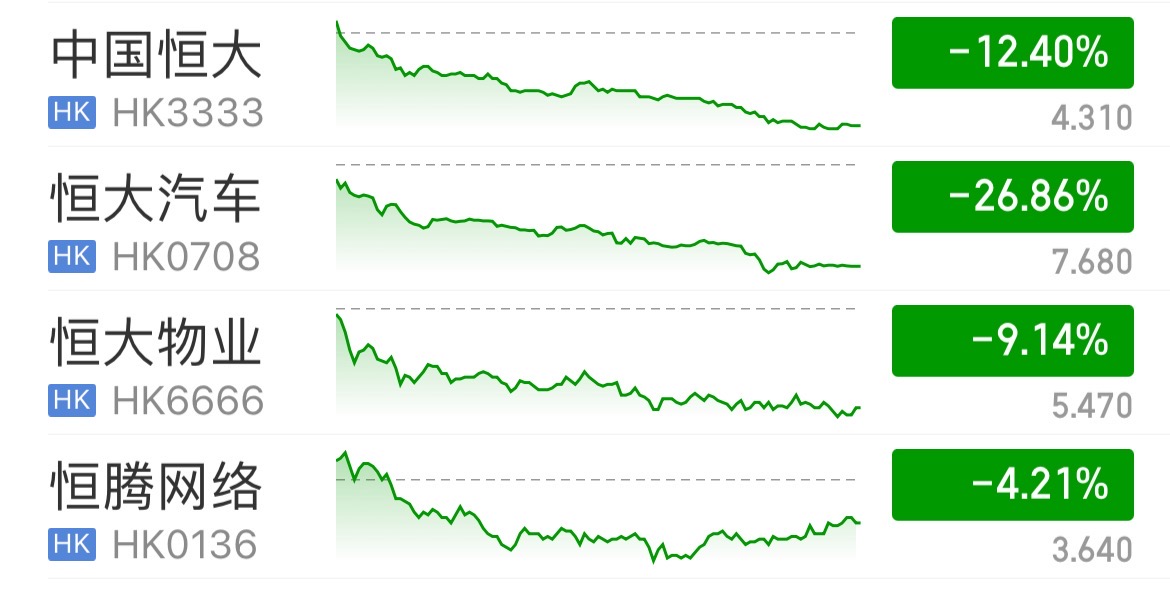

AH shares today all appeared to stop falling rebound, while Evergrande went down one way. By the close of Hong Kong shares, China Evergrande fell 12.40%; Evergrande Automobile fell 26.86%; Evergrande Property fell 9.14%;

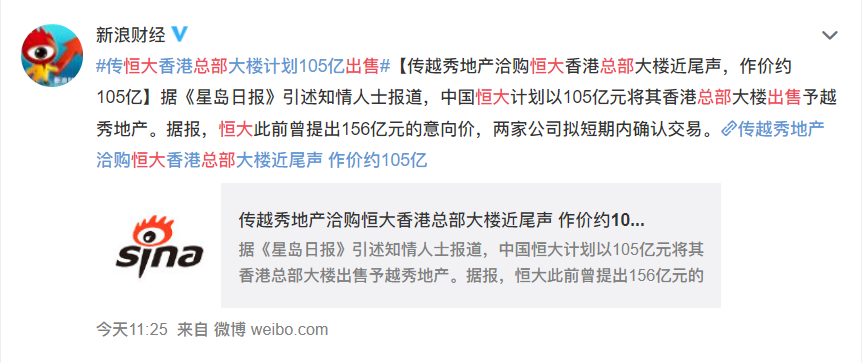

Evergrande's share price plummeted collectively, or related to market news. Yuexiu Property, a state-owned holding company, plans to spend about HK $10.5 billion (8.75 billion yuan) to buy Evergrande's Hong Kong headquarters, China Evergrande Center, according to Hong Kong's Sing Tao Daily, citing people familiar with the matter. The two sides reached an agreement on the matter last Friday. Relevant reports pointed out that the negotiation process between Yuexiu Real Estate and Evergrande Group is progressing smoothly. At present, the purchase negotiation is nearing the end, and both parties will formally sign a contract in a short time. China Evergrande plans to sell its Hong Kong headquarters building to Yuexiu Real Estate for 10.5 billion yuan, after Evergrande offered an intention price of 15.6 billion yuan, Economic Observer reported.

According to public information, Evergrande Hong Kong Headquarters Building is located in Wan Chai, close to Admiralty and Wan Chai MTR Station, Hong Kong Police Headquarters and Hong Kong Convention and Exhibition Centre. The building was formerly Vantone Building in the United States. Liu Luanxiong, founder of Chinese Real Estate, spent a total of HK $460 million to buy the building. Evergrande Group purchased it from Chinese Real Estate for HK $12.5 billion in 2015, setting the highest record for the largest commercial building transaction in Hong Kong at that time. It was also the only private enterprise in mainland China with an independent office building in Hong Kong.

It should be noted that, according to the announcement at that time, the transaction was to pay the purchase price in installments, with a down payment of 10%, and the rest to be repaid in six years, with an annual payment of 10%. Based on this calculation, Evergrande will pay the last payment of the price in 2021.

This building still has extraordinary significance for Evergrande Group. After all, this building is located in the political, commercial, tourism and transportation core area of Hong Kong, which greatly enhances the status and image of the group company in Hong Kong and internationally, and has strong brand influence. In addition, since 2015, the value of this building has obviously increased a lot, and the appreciation space in the future is even more incalculable. If Evergrande chooses to abandon this building at this time and sell it at a price lower than the previous acquisition price, it means that Evergrande has indeed encountered development problems. Of course, whether Evergrande Group will sell the Hong Kong headquarters building, or whether there is any negotiation on relevant aspects, Yuexiu Real Estate responded that "relevant information has not been received at the level of real estate listed companies", while Evergrande Group has not made a public response to relevant reports.

In recent times, Evergrande Group's life is really not very good. On June 20 of this year, China Evergrande transferred 739 million shares of Hengteng Network, with a total amount of HK $4.433 billion; on June 21, it transferred 29.9% shares of Jiakai City, with a total price of about RMB 2.762 billion yuan; on August 1, China Evergrande sold the equity of Hengteng Network again, with a total price of HK $3.25 billion, reducing the shareholding ratio to 26.55%; On August 2, Evergrande withdrew from Shenzhen High-tech Investment Shareholders and transferred 7.08% equity to Vanke subsidiaries; On August 10, China Evergrande issued an announcement stating that the Company was contacting several potential independent third-party investors to discuss the sale of some assets of the Company, including but not limited to the sale of some equity interests in China Evergrande New Energy Automobile Group Co., Ltd. and Evergrande Property Group Co., Ltd., listed subsidiaries of the Company. Since then, it has been reported recently that Evergrande Group plans to sell its Hong Kong headquarters. As for whether Evergrande has taken such actions or who will accept the Hong Kong headquarters building, the final answer can only be known after Evergrande announces official information.

According to Hong Kong Stock Exchange documents, Xia Haijun, vice chairman and president of Evergrande, sold 10 million shares of Evergrande Property at a price of HK $7.30 per share, reducing his shareholding ratio from 1.61% to 1.51%. Xia Haijun also sold 3 million shares of Evergrande Automobile at a price of HK $14.18/share, so that the shareholding ratio could be reduced from 0.15% to 0.12%. The topic of "Evergrande President Cash Over HK $100 Million" rushed to hot search! In addition, Shi Junping and Huang Xiangui, two executive directors of Evergrande, sold Evergrande shares successively, cashing in HK $225.3 billion and HK $7.42 billion respectively.

Evergrande is at debt risk, but the company's executives are eager to cash out, which also makes the market worried about Evergrande's future development. There is a view that if there is no substantial progress in Evergrande's debt, Evergrande shares will not change their downward trend.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.