In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/26 Report--

On the evening of August 25, China Evergrande announced that it expected its first-half net profit to be 90-10.5 billion yuan, down 29% from a year earlier. China Evergrande pointed out in its announcement that the decline in profits in the first half of the year was mainly due to the decline in real estate sales prices and rising expenses in the first half of the year. From the contents of the announcement, we can see that in the first half of this year, its real estate development business lost about 4 billion yuan. China Evergrande New Energy Automobile Group Co., Ltd. lost about 4.8 billion yuan. In addition, the announcement also pointed out that some of the shares held by Hengteng Network Group Co., Ltd. will be sold and the remaining shares will be held, with a profit estimated at market price of about 18.5 billion yuan. Affected by a series of news, Evergrande generally opened low. Evergrande Motor (00708.HK) opened at 6.14 and closed at HK $5.18, down 18.68%, an all-time low, down 91.5% from its all-time high of HK $72.45 in February, with a total market capitalization of 50.603 billion. Ironically, Evergrande Health shares skyrocketed since its name was changed to Evergrande a year ago, and today Evergrande's price is lower than it was then, returning to its starting point so quickly, or something Evergrande did not think of a year ago.

Today, according to China Business report, state-owned assets, represented by Guangzhou City Investment and Yuexiu, have begun to take over some Evergrande projects, such as Evergrande's Stadium and matching apartments in Panyu, Guangzhou, which have been sold to Guangzhou City Investment. Evergrande is planning to relocate some of its functional departments and employees from Shenzhen to Guangzhou, and relevant preparatory work has been started, and the list of people involved in the relocation has been reported to the group from various departments on the 25th. In response to the news, Evergrande Group responded that the online news that some of Evergrande's functions and employees would move back to Guangzhou from Shenzhen was not true.

China Evergrande's residential project in Yuen long in the New Territories will be sold to the market in a dark market in the near future, with an intended price of about HK $8 billion, less than the HK $8.9 billion Evergrande spent when it acquired the project, Sing Tao Daily said, citing people familiar with the matter. In addition, on August 23, there were media reports that Evergrande was preparing to sell its Hong Kong headquarters, which was picked up by Yuexiu Real Estate. It is understood that the office building was bought by Evergrande in 2015 for HK $12.5 billion, has just paid the price of the transaction in 2021, and now sells for only HK $10.5 billion. On August 17, Shengjing Bank, a listed Hong Kong stock company, issued a notice revealing that two affiliated enterprises of Shenyang SASAC intend to transfer about 167 million domestic shares held by Evergrande Group (Nanchang) Co., Ltd. at a transfer price of 6 yuan per share. Evergrande will cash out more than 1 billion yuan this time. According to the announcement, Northeast Pharmaceutical Group affiliated to Shenyang SASAC and Shenyang Shengjing Financial Investment Group will be transferred to about 138 million domestic shares and about 28.8333 million domestic shares held by Evergrande Nanchang at a price of 6 yuan per share, accounting for 1.57% and 0.33% of the total issued shares of Shengjing Bank, respectively. It is not difficult to see that in the case of weak core real estate development business, Evergrande is forced to sell off its assets to recover funds, even at a loss to solve the looming debt problem.

In addition, Evergrande Group's cash flow also seems to have problems, bills overdue phenomenon continues to occur, a number of listed companies issued announcements "roll call". On August 24, Yonggao shares announced that recently, due to the cash flow difficulties of Evergrande Group and its member enterprises, commercial acceptance bills were overdue, and as of the date of announcement, the company has reached an asset purchase solution with Evergrande Group and its member enterprises for 167 million yuan in notes receivable, and the company and Evergrande Group and its member enterprises still have accounts receivable balance of 478 million yuan. Of this total, the amount of commercial acceptance bills receivable is 451 million yuan, and the amount of overdue commercial acceptance bills is 195 million yuan. A week ago, Evergrande Group was interviewed by the people's Bank of China and the Bank of China Insurance Regulatory Commission. Evergrande Group issued a notice saying that Evergrande Group had accepted the interview from the people's Bank of China and the Bank of China Insurance Regulatory Commission. Evergrande Group will fully implement the interview requirements, unswervingly implement the central government's strategic plan for the stable and healthy development of the real estate market, earnestly fulfill the main responsibility of the enterprise, and do everything possible to ensure the construction of the project. complete the delivery of the real estate in quality and quantity; resolutely disclose important information in accordance with the rules and regulations, and never disseminate and clarify false information in a timely manner. With the greatest determination and maximum efforts to maintain the company's operational stability, resolve debt risks, and maintain the real estate market and financial stability. At the end of June this year, three trees, a listed company, announced that China Evergrande's overdue bills were worth 51.3706 million yuan by the end of March 2021. However, the two sides later confirmed that the bill had been paid.

On August 17, the national enterprise credit information publicity system showed that Xu Jiayin was no longer chairman of Evergrande Real Estate, and the new chairman and general manager were Zhao Changlong. However, in response to this change, the Shanghai Stock Exchange issued the latest announcement that the completion of internal personnel changes in Evergrande Real Estate Group does not involve changes in the company's management structure and equity, and Xu Jiayin is still the actual controller of Evergrande Automobile Group. Or affected by this news, Hong Kong stocks "Evergrande" stocks fell sharply in the secondary market. It is worth noting that Evergrande has accelerated the disposal of its assets since June. On June 20, China Evergrande transferred 739 million shares of Hengteng Network for a total of HK $4.433 billion; on June 21, it transferred 29.9% shares of Jiakai City for a total price of about 2.762 billion yuan. On August 1st, China Evergrande sold its stake in Hengteng Network again for a total price of HK $3.25 billion, reducing its shareholding to 26.55%. On August 2, Evergrande withdrew from Shenzhen High-tech Investment shareholders and transferred 7.08% of its shares to Vanke subsidiaries. On August 5, according to a number of financial media reports, cases related to Evergrande were transferred to the Guangzhou Intermediate people's Court for trial.

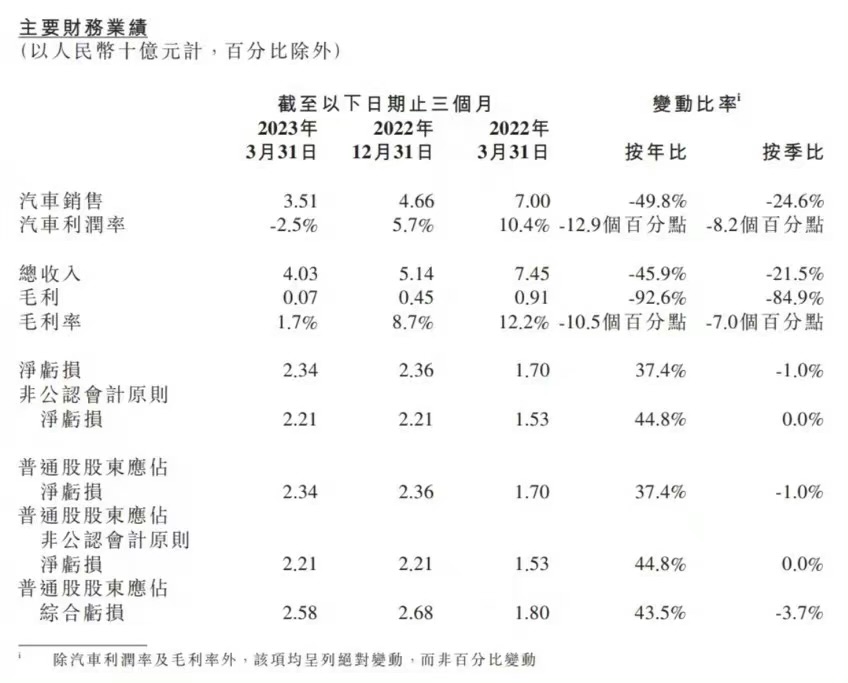

On August 9, Evergrande issued a forecast of half-year results for 2021, which is expected to record a net loss of about 4.8 billion yuan in the first half of this year, compared with a net loss of about 2.45 billion yuan in the same period last year. Evergrande said it expected to record a net loss in the first half of this year, mainly because it was still in the investment stage and increased spending on fixed assets and equipment and technological research and development. On the evening of August 10, Evergrande announced that it was in contact with several potential independent third-party investors to discuss the sale of some of its assets, including, but not limited to, the sale of interests in Evergrande Motor and Evergrande Properties, the company's listed subsidiaries. According to relevant data, from 2018 to 2020, Evergrande's annual losses are 1.428 billion yuan, 4.426 billion yuan and 7.74 billion yuan respectively. For car-making, Evergrande belongs to cross-border car-building and has no experience in the car-building field, but thanks to its "banknote ability", Evergrande has gained a lot of attention in the industry.

According to the plan announced earlier by Evergrande, Evergrande's first model will be in mass production in 2021 and 1 million will be produced and sold by 2025. However, the recent financial crisis of Evergrande Group has also added more uncertainty to Evergrande's future. Xia Haijun, vice chairman and president of China Evergrande, sold 10 million Evergrande property shares at HK $7.30 per share on Aug. 11, falling from 1.61 per cent to 1.51 per cent, according to HKEx filings. Xia Haijun also sold 3 million Evergrande shares at HK $14.18 per share, so that his shareholding could be reduced from 0.15% to 0.12%. In addition, Shi Junping and Huang Xiangui, two executive directors of China Evergrande, respectively sold Evergrande shares, cashing out HK $22.53 million and HK $742000 respectively. While Evergrande is in debt risk, company executives are eager to cash out, which makes the market worried about the future development of Evergrande and Evergrande.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.