In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/28 Report--

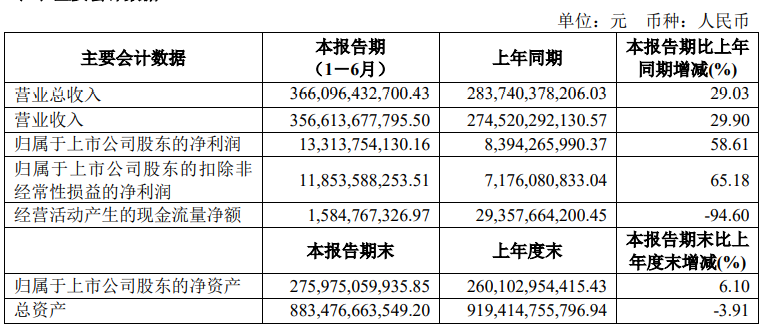

On August 27th, SAIC released its interim results report, showing that SAIC realized operating income of 356.696 billion yuan in the first half of 2021, an increase of 29.9% over the same period last year. Net profit belonging to shareholders of listed companies was 13.314 billion yuan, up 58.61% from the same period last year. After deduction, the net profit of shareholders of listed companies was 11.854 billion yuan, an increase of 65.18% over the same period last year.

SAIC said that the increase in revenue and profit was mainly due to the effective control of the epidemic, the obvious recovery effect of the domestic automobile market, which led to an increase in the company's sales volume compared with the same period last year. The company's insistence on "steady growth, retail sales, and structural adjustment" achieved remarkable results. While achieving sales growth, it also optimized the production and marketing structure and improved the level of gross profit. According to the financial report, SAIC's wholesale sales in the first half of the year were 2.297 million, up 12.1% from the same period last year, while retail sales were 2.945 million, up 29.7% from the same period last year.

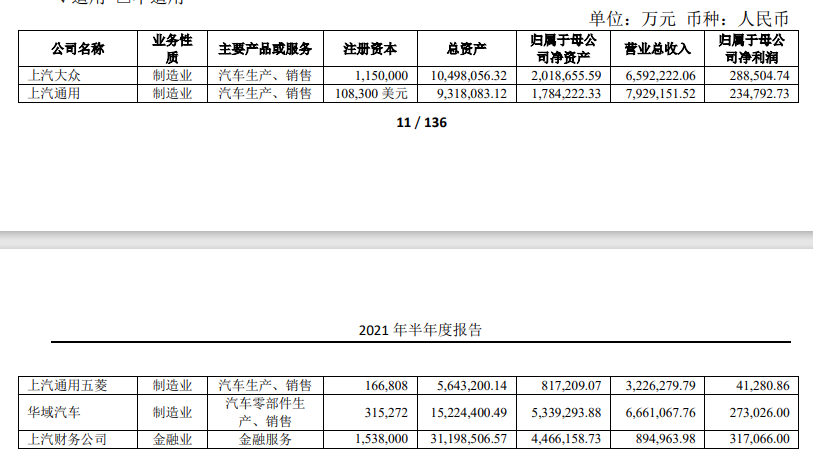

SAIC Volkswagen and SAIC General Motors are still SAIC's profit sources. Data show that SAIC-Volkswagen wholesale sales in the first half of the year was 532400 vehicles, down 7.79% from the same period last year, and the net profit was 2.885 billion yuan, down 59.22% from the same period last year. The performance of SAIC GM and SAIC GM Wuling has improved, with sales of 581800 vehicles and 661300 vehicles respectively in the first half of the year, with net profits of 2.348 billion yuan and 413 million yuan respectively. In other words, SAIC-Volkswagen and SAIC-GM account for nearly 40% of SAIC's profit performance, but if SAIC-Volkswagen does not show a sharp decline, SAIC's overall profits will also rise sharply.

As the profit cow of SAIC, SAIC Volkswagen has had a hard time in the past year. Judging from last year's performance, SAIC Volkswagen's sales declined mainly due to the impact of the epidemic, while the Passat brand myth collapsed, product quality was controversial, and sales plummeted after the Passat research "overturned". Although it later passed the test again to restore its reputation, but excellent results are difficult to dispel consumers' doubts about product quality. After entering 2021, although the impact of the domestic epidemic has been reduced to the lowest, the epidemic abroad is still grim. In this case, the problem of chip defects continues to affect global auto companies, and SAIC-Volkswagen, as a joint venture, is no exception. Sales performance continues to be affected.

In the short term, the shortage of chips will continue to affect the automotive industry. Although domestic chips are being laid out continuously, it is impossible to achieve full replacement in a short time. It takes a lot of time for domestic chips to replace imported chips. In the future, the production of domestic automobile industry and the layout of domestic chips will face great challenges. SAIC said that in the second half of the year, it will closely follow the recovery of chip supply, find ways to promote the surge in chip supply, make good arrangements for resource allocation and production organization, speed up the progress of wholesale production, and alleviate the current situation that terminal "supply exceeds demand". Meet user demand and sprint annual business targets.

Although SAIC ranks first in terms of sales, revenue and profits in China, the stock price performance of SAIC also remains depressed. As of the 27th close, SAIC closed at 18.89 yuan, an increase of 2.83 percent over the same period last year, with a total market capitalization of 220.7 billion yuan, lower than BYD, Great Wall and other auto companies. Earlier, at the SAIC shareholders' meeting held on June 30, a shareholder asked that since last year, new energy vehicles have become a super tuyere. The share prices of BYD and Great Wall have risen five or six times, Jianghuai Motor has increased more than 10 times, and Chang'an has also more than tripled, but no one is interested in SAIC, which has the largest sales volume. As of June 30, SAIC fell 1.96% to 21.56 yuan per share, with a total market capitalization of 252.36 billion yuan.

Chen Hong, chairman of SAIC, also responded positively, saying, of course, we are aware of this situation, but not only SAIC, but also Volkswagen, Mercedes-Benz and BMW all have a certain gap compared with the share prices of car-building new forces. With the increase in the proportion of the new track, I believe SAIC's share price will come, in the eyes of consumers, we are still the traditional carmaker, but we are already changing.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.