In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/29 Report--

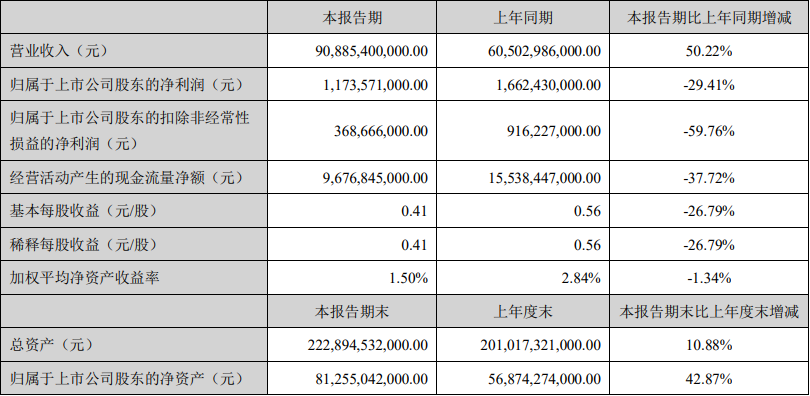

Recently, BYD released its interim performance report for 2021, showing that operating income in the first half of 2021 was 90.885 billion yuan, an increase of 50.22% over the same period last year; net profit was 1.174 billion yuan, down 29.41% from the same period last year, including government subsidies of 957 million yuan; net profit after deduction was 369 million yuan, down 59.76% from the same period last year

For the decline in net profit, BYD said in the financial report that the company's gross profit margin fell due to changes in product structure. At the same time, the overall profitability of the company has been affected to a certain extent by the rise in raw materials such as commodities.

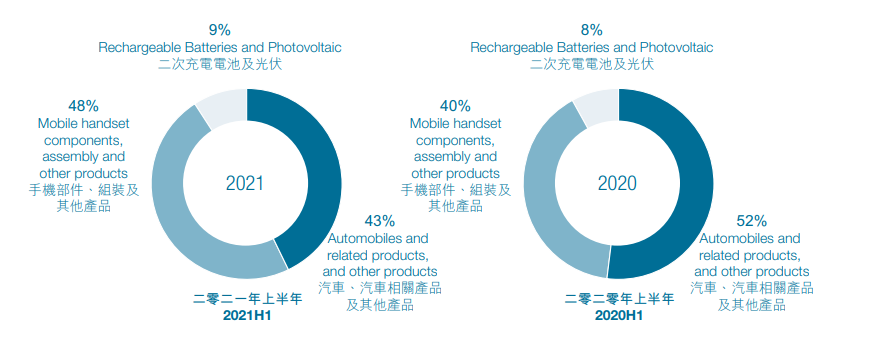

From the perspective of major sectors, revenue from rechargeable batteries and photovoltaics reached 8.287 billion yuan, up 82.87 percent over the same period last year; revenue from mobile phone components, assemblies and other products reached 43.132 billion yuan, up 84.48 percent from the same period last year; and revenue from cars, automobile-related products and other products reached 39.157 billion yuan, up 22.09 percent from the same period last year. The three major businesses accounted for 9.12%, 47.46% and 43.08% of the total revenue, respectively.

Although BYD's auto business revenue has increased, its share has declined, to 43.08% from 53.01% last year. According to KuaiBao, BYD's production and marketing, BYD's cumulative car sales reached 247000 in the first half of this year, up 55.51 per cent from a year earlier. Of these, fuel vehicle sales totaled 92100, down 5.96 percent from the same period last year, while new energy vehicles sold 154600, up 154.76 percent from the same period last year.

In terms of sales volume, new energy vehicles have gradually become dominant by BYD cars. In January this year, BYD launched the self-developed "DM-i Super plug-in" system, while announcing the pre-sale and launch of three models, including Qin PLUS DM-i, Song PLUS DM-i and Tang DM-i. BYD's DM-i model has been sought after by consumers since its launch.

At today's Chengdu Auto Show, BYD Dolphin was also officially launched, with a price range of 9.38-121800 yuan for the four models. In terms of power, BYD dolphin will be equipped with a drive motor codenamed TZ180XSF, with a maximum power of 70kW and a peak torque of 180N ·m. In terms of battery type, the new car is equipped with lithium iron phosphate blade battery, which provides 301km and 405km mileage options.

According to the plan, BYD aims to sell 400000 new energy vehicles in 2021, of which EV and DM hybrid account for half. Looking back at BYD's latest sales, the proportion of its fuel-powered cars is declining, narrowing to 12.05% in July. In other words, BYD needs to sell 205000 new energy vehicles in the next five months.

In addition to launching a number of new cars, BYD's high-end brands are also in full swing. Li Yunfei, general manager of BYD's public relations department, revealed in an interview with the media that BYD will launch a new high-end brand in the fourth quarter of this year. The car will be sold in a price range of 50-800000 yuan under a new BYD brand.

Some securities companies pointed out that BYD's capacity expansion, new products on the market, sales are expected to continue to rise. According to BYD's official WeChat account, orders for more than 100000 dmi models remain undelivered, and sales of DM-i models are expected to continue to rise with the release of production capacity. With the accelerated growth of the company's new energy vehicle sales, the company's bicycle profits are expected to continue to rise, so the company is expected to achieve a volume-profit rise in 2021. BYD's car sales and performance for the whole year are more optimistic.

At present, BYD is not only the highest market capitalization car company in China, but also the leading enterprise of new energy vehicles. As of August 27, BYD closed at 288.15 yuan per share, with a total market capitalization of 824.4 billion yuan, ahead of SAIC, Great Wall Automobile and other auto companies. Is BYD overrated? There is a market view that compared with Tesla, Lulai and other car companies, BYD, whether photovoltaic, battery, or new energy vehicles, all belong to the dividend track, and the current new energy vehicles are still in the stage of burning money. Although BYD's semi-annual report falls short of expectations, compared with other Internet car manufacturing companies with a solid supply chain and sales chain, and which is also the domestic mainstream new energy automobile enterprises, there will be more room for development in the future.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.