In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)08/31 Report--

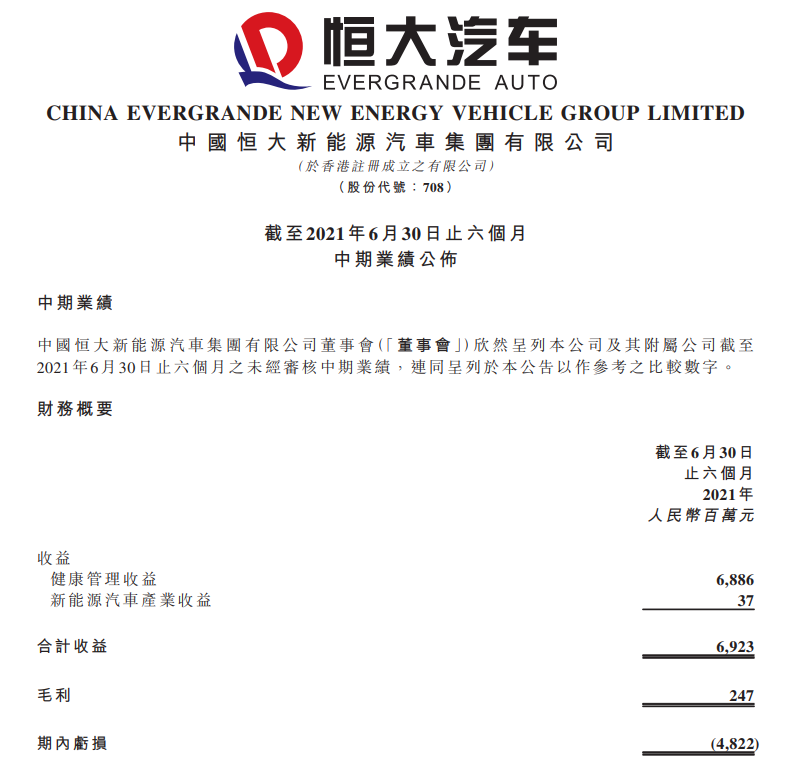

On the evening of August 30, Evergrande officially released its interim results report. Data show that Evergrande's operating income in the first half of 2021 was 6.923 billion yuan, an increase of 53.43 percent over the same period last year, including 6.886 billion yuan for health management and 37 million yuan for new energy vehicles, and gross profit was 247 million yuan, down 80.42 percent from the same period last year. Net loss 4.822 billion yuan, down 96.25% year-on-year.

Evergrande explained that the decrease in revenue from the new energy vehicle business was mainly due to the reduction in battery sales revenue. The Carney factory was upgraded in accordance with the transformation of new battery products and continued to clean up the inventory of old models of batteries during the reporting period. As for the substantial expansion of losses, Evergrande said it was mainly due to a reduction in gross profit of its health business, and that the company was in the investment stage of expanding its new energy vehicle business, resulting in an increase in marketing expenses and R & D investment in the new energy vehicle business.

According to the data, the health management division accounts for 99.47% of Evergrande's total revenue, while the new energy vehicle division accounts for less than 1%. Judging from the data, Evergrande derives most of its revenue from the health management division, and the founder of Weima Motors has directly complained that "Evergrande is short of cars."

In fact, Evergrande is not a "serious" car company, Evergrande is renamed from "Evergrande Health". According to the data, Evergrande Health Group is a large-scale health industry group under Evergrande Group, which takes the development and construction of the Health Valley project as the carrier and the membership system as the service mode. a large-scale comprehensive health industry group that provides multi-level medical care, full-age health care, high-precision health management, diversified pension and other services, was listed on the main board of the Hong Kong Stock Exchange in May 2015. In September 2020, Evergrande Health announced that the name of the company has been changed from Evergrande Health Industry Group Co., Ltd. to China Evergrande New Energy Automobile Group Co., Ltd. The reason is that "new energy vehicles have become the most important business of Evergrande Health Industry Group." Although Evergrande Health has changed its name to Evergrande Automobile, the health management business has not been divided into Evergrande Group, which is why Evergrande has achieved 7 billion yuan in revenue.

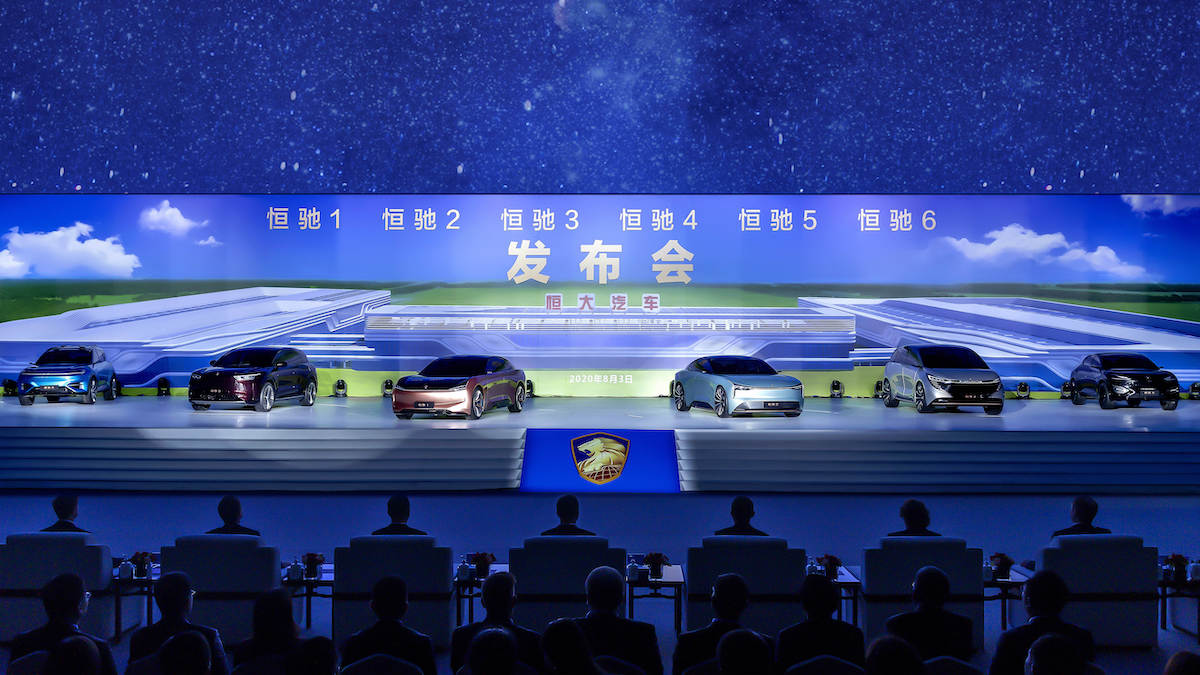

After changing its name to Evergrande, Evergrande released a total of nine models from Hengchi 1 to Hengchi 9, and publicly tested Hengchi cars in summer and winter. During this period, Evergrande's share price soared, from HK $6 to HK $72.45, at one point surpassing Great Wall Motor and BYD to become the most valuable car company in China. However, although Evergrande launched nine models, it has been slow to mass production, and investors seem to have lost confidence. Evergrande's share price fell all the way down from HK $70 to HK $5 after Evergrande's debut at the Shanghai auto show.

Evergrande said in its financial report that Hengchi's mass production is entering the final sprint. Evergrande will continue to strengthen R & D investment, consolidate R & D strength, speed up the research and development of core technologies, and continue to develop new models at the same time. Strive to promote the formal commissioning of Tianjin, Shanghai, Guangzhou and other vehicle development bases and Yangzhou, Zhengzhou and other spare parts development bases, and strive to successfully achieve the production capacity target. Evergrande will continue to promote the mass production of Hengchi series products and strive to continuously develop and expand the model matrix to meet the differentiated needs of different automobile markets at home and abroad as well as the broad masses of customers.

However, the current controlling shareholder Evergrande Group is mired in a debt crisis, which has a certain impact on Evergrande's liquidity. Evergrande said in its financial report that the "Evergrande Health Valley" and the living space of new energy vehicles had delays in paying suppliers and project payments, resulting in the suspension of some projects. At present, with the coordination and support of the government, the group is actively striving for the resumption of the project. Evergrande said there was a risk of loan default and litigation outside its normal business. The company said that it will continue to actively contact potential investors to discuss skilled assets, and at the same time further increase project sales. Measures such as adjusting the project development schedule, strictly controlling costs, vigorously promoting sales and remittance, striving for loan renewal and extension, selling equity and assets and introducing investors, strive to further improve liquidity, ease financial pressure and reduce debt.

According to a previous announcement by China Evergrande, it is now in contact with potential independent third-party investors to discuss the sale of assets, including a stake in Evergrande.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.