In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/01 Report--

Today, according to the official WeChat account of Evergrande Group, Evergrande Group held a "Baojiaolou" military writ signing meeting. Xu Jiayin and eight vice presidents of Evergrande signed the military writ of Baojiaolou. Evergrande Group said that under the leadership of Xu Jiayin, chairman of the board of directors of Evergrande Group, all the staff of the group vowed to ensure the construction of the project with the greatest determination and efforts to complete the delivery of the property with quality and quantity. As of September 1, Hong Kong shares closed down HK $4.22 per share, down 3.21%, for a total market value of HK $55.91 billion; Evergrande Motor closed at HK $6.15 per share, up 3.71%, for a total market capitalization of HK $60.08 billion; Evergrande Properties closed at HK $5.74 per share, down 1.71%, with a total market capitalization of HK $62.05 billion

Due to the recent exposure of Evergrande Group due to liquidity and financial constraints, some properties across the country have been shut down. According to the semi-annual report released by China Evergrande on Aug. 31, the company achieved operating income of 222.69 billion yuan in the first half of this year, down 16.5 percent from the same period last year, while net profit was 10.499 billion yuan, down 28.87 percent from the same period last year. Of this total, the real estate development business lost 4.1 billion yuan. It said that some payables related to real estate development were overdue, resulting in the suspension of some of the company's projects, and the company was in talks with suppliers and construction contractors to resume work on the project by delaying payment or offsetting arrears with property. China Evergrande will try its best to continue its operation and strive to deliver the building on time.

In this regard, netizens have also said: pay progress payment on the line, do not do so much. Normal operation, countersign every year, guarantee the opening of the property guarantee, but now the situation is different.

Recently, there was a lot of news about Evergrande on August 19, when responsible comrades of relevant departments of the people's Bank of China and the Banking and Insurance Regulatory Commission interviewed senior executives of Evergrande Group. The people's Bank of China and the CBIC pointed out that as the leading enterprise in the real estate industry, Evergrande Group must conscientiously implement the central strategic plan for the stable and healthy development of the real estate market, strive to maintain operational stability, and actively resolve debt risks. maintain real estate market and financial stability; do a good job in disclosing true information on major matters in accordance with the law, and do not disseminate and clarify false information in a timely manner. Subsequently, Evergrande Group responded: in response to the interview between the Central Bank and the Bancassurance Regulatory Bureau, Evergrande Group accepted the interview by the people's Bank of China and the Bancassurance Regulatory Commission. Evergrande Group will fully implement the interview requirements, unswervingly implement the central government's strategic plan for the stable and healthy development of the real estate market, earnestly fulfill the main responsibility of the enterprise, and do everything possible to ensure the construction of the project. complete the delivery of the real estate in quality and quantity; resolutely disclose information on major issues in accordance with the rules and regulations, never disseminate and clarify false information in a timely manner With the greatest determination and maximum efforts to maintain the company's operational stability, resolve debt risks, and maintain the real estate market and financial stability.

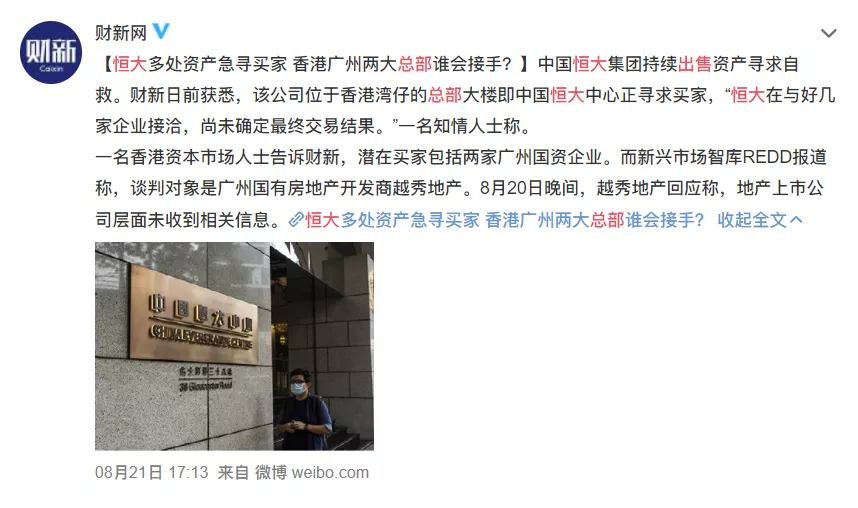

It is worth noting that Evergrande has accelerated the disposal of its assets since June. According to relevant data: as of August 27, Evergrande has dealt with shares including Hengteng Network, Shengjing Bank, Evergrande Bingquan, Shenzhen High-tech Investment and five real estate projects, with a total sale value of 16.6 billion yuan. On August 25, China Evergrande announced that it expected its first-half net profit to be 90-10.5 billion yuan, down 29% from a year earlier. China Evergrande pointed out in its announcement that the decline in profits in the first half of the year was mainly due to the decline in real estate sales prices and rising expenses in the first half of the year. From the contents of the announcement, we can see that in the first half of this year, its real estate development business lost about 4 billion yuan. China Evergrande New Energy Automobile Group Co., Ltd. lost about 4.8 billion yuan. According to relevant media reports, the residential project in Yuen long in the New Territories held by China Evergrande will also be sold to the market in the form of a dark market in the near future, with an intended price of about HK $8 billion, which is lower than the HK $8.9 billion spent by Evergrande when it acquired the project. In addition, it was revealed that Evergrande was preparing to sell its Hong Kong headquarters, which was picked up by Yuexiu Real Estate. It is understood that the office building was bought by Evergrande in 2015 for HK $12.5 billion, has just paid the price of the transaction in 2021, and now sells for only HK $10.5 billion. It is not difficult to see that in the face of falling real estate sales prices and rising costs, Evergrande has been forced to deal with its assets with recovered funds to solve its looming debt problem.

Under the situation of weak real estate development business and serious losses of new energy vehicles, Evergrande has to take relevant measures to resolve debt risks. On August 30, Evergrande released its interim results report. Data show that Evergrande posted a net loss of 4.822 billion yuan in the first half of 2021. Earlier, Evergrande announced that it intended to sell part of the interests of China Evergrande New Energy Automobile Group Co., Ltd. and Evergrande property Group Co., Ltd. In response, Reuters has analyzed that Evergrande has been unable to raise funds because of concerns about its financial health. Data show that Evergrande's losses from 2018 to 2020 were 1.428 billion yuan, 4.426 billion yuan and 7.74 billion yuan respectively, with a pre-loss of 4.8 billion yuan in the first half of this year, compared with a net loss of 2.45 billion yuan in the same period last year. Evergrande Automobile is a high-quality asset recognized by the capital market, especially the automobile business, as an industry heavily invested by Evergrande Group, it is seen by the outside world that it will not be abandoned easily. Due to the pressure of debt, Evergrande can only sell part of the interests of China Evergrande New Energy Automobile Group Co., Ltd. and Evergrande property Group Co., Ltd.

For Xu Jiayin with eight vice presidents of Evergrande to sign a military writ to guarantee the delivery of the building, some industry insiders said: recently, there have been frequent doubts about Evergrande Group, which is conducive to reassuring people. Evergrande Group is still facing cash flow and debt pressure. It remains to be seen whether the crisis can be resolved.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.