In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/04 Report--

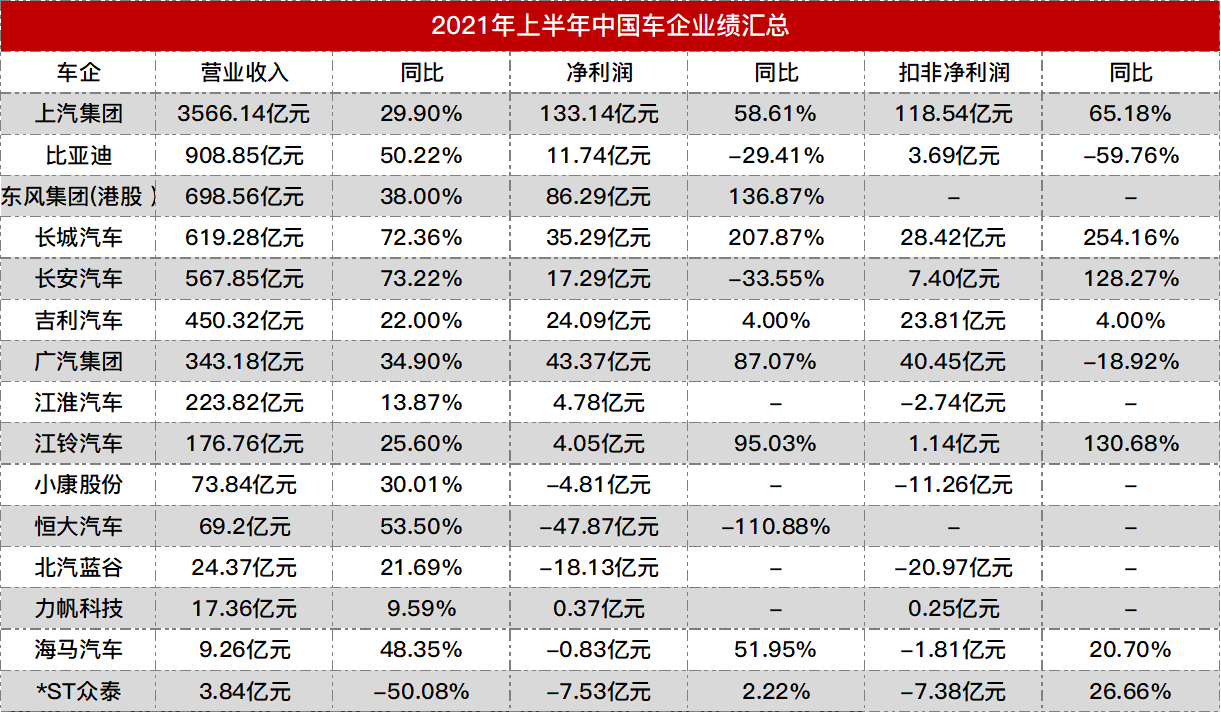

According to the interim performance summary statistics of a number of listed car companies, revenue and profit rose sharply compared with the same period last year, of which SAIC made a net profit of 13.314 billion yuan. Listed car companies were able to hand over gratifying transcripts, the biggest reason is that the impact of last year's epidemic led to a low base, according to the Federation of passengers retail sales data, narrow passenger car sales in the first half of 2021 accumulated 9.943 million units, an increase of 28.9% over the same period last year.

According to the statistical summary of the mid-term results in 2021, the revenue and profits of Chinese auto companies generally increased, with SAIC, BYD and Dongfeng holding the top three in a row.

SAIC is the largest automobile enterprise in China, and its revenue and profit are in the forefront of the industry. Data show that SAIC achieved revenue of 356.614 billion yuan, net profit of 13.314 billion yuan and non-net profit of 11.854 billion yuan in the first half of 2021. SAIC said that the increase in revenue and profit was mainly due to the effective control of the epidemic, which not only achieved sales growth, but also optimized the production and marketing structure and improved the gross profit level. According to the financial report, SAIC sold 2.297 million wholesale vehicles and 2.945 million retail vehicles in the first half of the year.

Data show that SAIC-Volkswagen made a net profit of 2.885 billion yuan, compared with 6.906 billion yuan in the same period last year. SAIC General Motors made a net profit of 2.348 billion yuan, compared with 1.795 billion yuan in the same period last year. Judging from the data, the profit performance of SAIC-Volkswagen and SAIC-GM accounts for nearly 40% of SAIC's level, and the sharp decline in SAIC-Volkswagen net profit directly lowers the group's performance.

BYD's revenue growth and profit decline. Data show that BYD achieved operating income of 90.885 billion yuan in the first half of the year, up 50.22% from the same period last year; net profit was 1.174 billion yuan, down 29.41% from the same period last year; net profit after deduction was 369 million yuan, down 59.76% from the same period last year; as for the decline in net profit, BYD said in the financial report that the company's gross profit margin declined due to changes in product structure. At the same time, the overall profitability of the company has been affected to a certain extent by the rise in raw materials such as commodities.

It should be noted that BYD's revenue comes not only from cars, but also from mobile phone components and assembly, secondary charging and photovoltaic. In the automobile and automobile-related products sector, BYD achieved revenue of 39.157 billion yuan, an increase of 22.09% over the same period last year. Although BYD achieved revenue growth, its revenue share fell to 43.08% from 53.01% last year.

Great Wall Motor, Changan Automobile, Geely Automobile and GAC GROUP also performed well. Data show that Great Wall Motor achieved revenue of 61.928 billion yuan in the first half of the year, an increase of 72.36% over the same period last year. The net profit was 3.529 billion yuan, an increase of 207.87% over the same period last year, and the revenue of Changan Automobile was 56.785 billion yuan, an increase of 73.22% over the same period last year. The net profit was 17.29%, down 33.55% from the same period last year. The deduction of non-net profit was 740 million yuan, an increase of 128.47% over the same period last year. According to the financial results for the first quarter of 2021, the net profit of Changan Automobile was 853 million yuan, an increase of 35.26% over the same period last year, while the non-net profit was 720 million yuan, an increase of 140% over the same period last year. In other words, whether it is net profit or deducting non-net profit, Changan's performance in the second quarter of 2021 is significantly lower than that in the first quarter. Geely Automobile achieved revenue of 45.032 billion yuan, an increase of 73.22% over the same period last year. Net profit reached 2.409 billion yuan, an increase of 4.00% over the same period last year. GAC GROUP achieved revenue of 34.318 billion yuan, an increase of 34.90% over the same period last year. GAC GROUP achieved net profit of 43.37%, up 87.07% from a year earlier, mainly due to the profit support of Guangzhou Auto Toyota and Guangzhou Automobile Honda, which performed better than other car companies in the first half of the year.

Of course, there are individual enterprises that are not profitable, such as Evergrande Automobile, Zhongtai, BAIC Langu, well-off shares, Haima Motor. Take Evergrande as an example, revenue in the first half of the year was 6.923 billion yuan, an increase of 53.43% over the same period last year, and a net loss of 4.822 billion yuan, down 96.25% from the same period last year. As for the substantial expansion of losses, Evergrande said it was mainly due to a reduction in gross profit of its health business, and that the company was in the investment stage of expanding its new energy vehicle business, resulting in an increase in marketing expenses and R & D investment in the new energy vehicle business.

Although Evergrande has revenue of 6.9 billion yuan, most of it comes from health management business. According to the data, the health management division accounts for 99.47% of Evergrande's total revenue, while the new energy vehicle division accounts for less than 1%.

Since entering 2020, Zhongtai vehicle business has basically stagnated under the influence of the epidemic. In the first half of this year, Zhongtai realized operating income of 384 million yuan, down 50.08% from the same period last year, and a net loss of 753 million yuan, an increase of 2.22% over the same period last year. Although Zhongtai's vehicle business has stalled, the performance of the capital market is very "weird". Since January 11, Zhongtai's share price has risen 479.69%, with a total market capitalization of 15.78 billion yuan.

Compared with Evergrande and Zhongtai, the "worst" listed car companies are BAIC Langu. BAIC Langu's operating income in the first half of the year was 2.437 billion yuan, an increase of 21.69 percent over the same period last year, but the net loss reached 1.813 billion yuan, making it the traditional car company with the worst profit decline on the list. The current market performance of BAIC New Energy is saddening. With its high performance-to-price ratio and rich products, BAIC New Energy ranked first in domestic pure electric vehicle sales for seven consecutive years from 2013 to 2019, and changed its name to "BAIC Blue Valley" to complete its backdoor listing in 2018. However, BAIC's new energy sales fell sharply in 2020, with a net loss of 6.482 billion yuan in 2020, with a total sales of only 25900 vehicles, down 82.79 percent from the same period last year. More importantly, even though the base was low because of the epidemic last year, BAIC Blue Valley showed no sign of warming up and increased its losses.

Judging from the list, the vast majority of car companies have achieved good results and good profit performance in the first half of this year. Of course, the performance of some car companies is still disappointing, including SAIC, BYD and BAIC New Energy, which has been the top seller of new energy vehicles for seven years in a row. The major automobile companies will achieve good results in the first half of this year, but there are also many hidden worries in the domestic automobile industry, such as the chip crisis, the high inventory early warning index of dealers, and so on, which are not small challenges for the operation of automobile companies.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.