In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/13 Report--

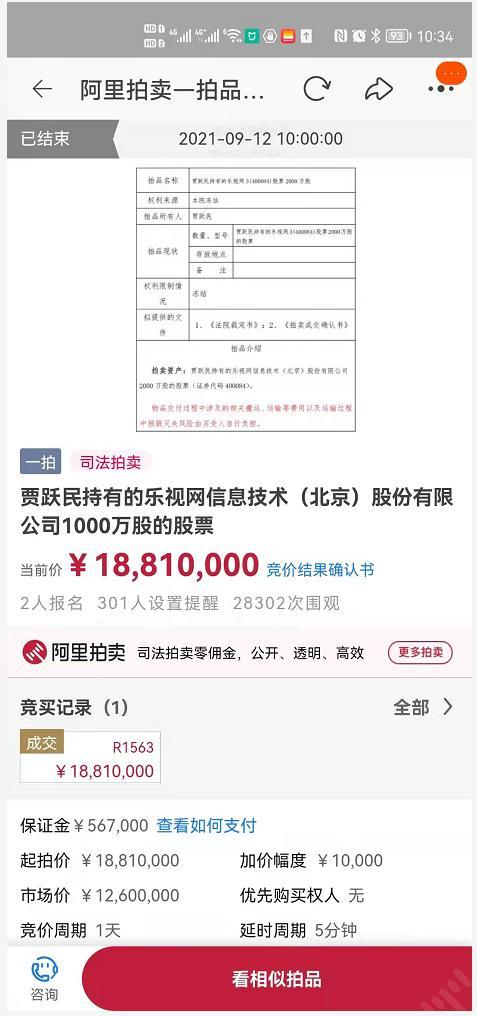

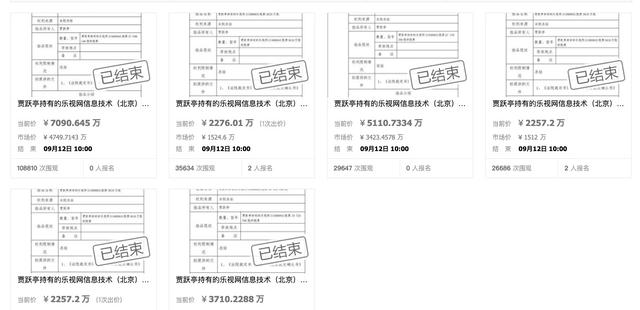

On September 12, the 141 million shares held by the Jia Yueting brothers ended their public auction. It is understood that 141 million Leeco shares were divided into eight tenders, of which four were successfully auctioned for 44.1 million shares, with a corresponding price of 82.9521 million yuan. A total of 96.59 million shares of the remaining four equity targets have been declared unsuccessful. According to the ruling of the third Intermediate people's Court of Beijing, the applicants involved in the auction include Minsheng Trust, Ping an Bank, Guotai Junan and Huafu Securities.

The details of the auction are as follows. Jia Yueting holds about 120 million Leeco shares, which are divided into six targets for auction. Among them, two bids were successful, including a total of 24.1 million shares, 12 million shares were auctioned by user Li Zhenzhong at a price of 22.572 million yuan, 12.1 million shares were auctioned by user Xu Junkang at a price of 22.7601 million yuan, and four unsuccessful bids, including a total of 96.5912 million shares. Jia Yuemin's 20 million Leeco shares were auctioned into two bids, each containing 10 million shares, and the final bidding price was 18.81 million yuan, which was sold by users Zhu Hongbin and Luo Chengtong respectively. So far, the above auction of the four people do not have the relevant public information, the background is mysterious. According to relevant data, Jia Yueting currently holds about 898 million shares, accounting for 22.52% of the total share capital, among the top 10 shareholders of Leeco Information Technology (Beijing) Co., Ltd., while his brother Jia Yuemin holds about 24.5134 million shares, accounting for 0.61% of the total share capital.

This auction is not the first time that Jia Yueting's Leeco shares have been held by judicial auctions. as early as June 2020, Jia Yueting's 22.1 million Leeco shares were auctioned at a starting price of 55.471 million yuan, with a corresponding share price of 2.51 yuan per share. However, on the day of the auction, Leeco's closing price was only 0.9 yuan per share, which caused many people to watch the auction, but no one signed up to participate in the auction. As for this time, Letv's equity can sell more than 40 million shares or related to the recent soaring share price of Letv. On July 21, 2020, Leeco delisted from A shares, and the delisting price was 0.18 yuan at that time. Since February 3, 2021, Leeco has conducted share transfer transactions in the national share transfer system for small and medium-sized enterprises by means of collective bidding. Leeco's share price has been rising all the way, rising 1247% for more than half a year. As of the latest close, the increase is still as high as 1068.42%, with a total market capitalization of nearly 8.9 billion yuan.

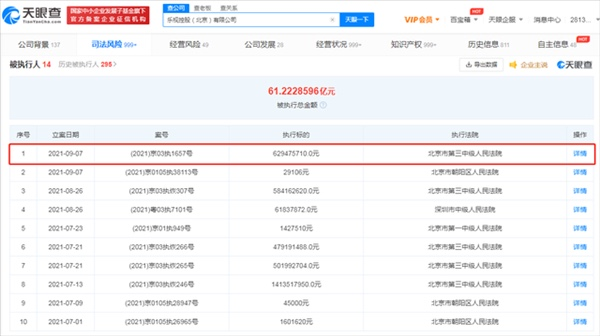

On August 31st, according to Leeco's semi-annual report, the company had assets of 4.021 billion yuan, liabilities of 21.638 billion, asset-liability ratio of 645.33%, revenue of 196 million yuan in the first half of the year, an increase of 38.55% over the same period last year, and a net profit loss of 187 million yuan, which was 30.65% lower than that of the same period last year. It is not difficult to see that although the loss has been reduced, but Leeco as a whole has been in an insolvent situation. According to relevant data, Letv Holdings (Beijing) Co., Ltd. again became the person subject to execution, the subject matter of execution was 629475710 yuan, the case number (2021) Jing03 held No. 1657, and the enforcement court was the Beijing No. 3 Intermediate people's Court. The related case is a dispute over the guarantee contract between the company and Yizhuang International Holdings (Hong Kong) Co., Ltd. Up to now, the total amount of execution of Letv Holdings (Beijing) Co., Ltd. has exceeded 6.1 billion yuan.

In addition, the amount of money executed by Jia Yueting in 2021 also exceeded 6.7 billion yuan. The cash flow from this auction is the tip of the iceberg. In January, 30 million of Jia Yueting's properties were auctioned, and in July, "Shimaogong III", owned by Jia Yueting, was auctioned at a "jump price". Shimaogong 3 is located in the heart of Sanlitun business district. Letv bought it for 2.972 billion yuan in 2016 and held its first auction in 2019. The starting price was 2.302 billion yuan, went through four failed auctions, and finally sold for 1.645 billion yuan, nearly halving the price. On September 9, the Lerong Building, once Letv's headquarters, was auctioned, with a starting price of 570 million yuan, and finally suspended the auction due to dissent from outsiders.

It is not difficult to see that the only thing left in front of Jia Yueting is to build a car to pay off debts. On July 22nd, Faraday, founded by Jia Yueting, was listed on Nasdaq in the future. The stock symbol is "FFIE". After the launch of FFIE, FF got a lot of good news. First, a limited edition of 300 FF 91 units had been sold out. In addition, it was announced that it had completed 3653 kilometers of long-distance road testing in the United States, long-distance road testing and durability testing of battery and powertrain components. But FF is not doing as well as Jia Yueting thought, with a cumulative net loss of $289 million between 2019 and 2020, according to a financial report released by FF. It said the loss was expected to last until 2022, with a cumulative loss of $1.217 billion.

For the future of Faraday, it is not just a loss problem, FF production problems will also make many investors back down. It has been seven years since FF was founded, and there are no mass-produced models to be delivered, but it continues to spend money. If FF91 fails to mass-produce the line as soon as possible, Faraday's future situation will be even more difficult.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.