In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-21 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

Recently, Evergrande was affected by a series of negative news from its parent company, China Evergrande. On September 13, Evergrande Group announced that it expected sales to continue to decline sharply in September, which led to the continued deterioration of the group's sales payback. further put tremendous pressure on cash flow and liquidity. After the announcement of Evergrande Group, Evergrande closed down 24.66% to HK $3.88 per share, with a total market capitalization of HK $37.904 billion.

According to documents filed by the Hong Kong Stock Exchange, Mr. and Mrs. Joseph Lau, a close friend of Xu Jiayin and a wealthy Hong Kong businessman, reduced their holdings of 24.436 million shares of China Evergrande from 8.96% to 7.96% at an average price of HK $3.58 per share, according to several media reports today. Earlier, the couple reduced their holdings of 6.312 million shares at an average price of HK $4.48 per share on Aug. 26, falling from 9.01 per cent to 8.96 per cent. On the two occasions, calculated at the average price, the total reduction and cash out was about HK $116 million. According to the annual report released by China Evergrande in 2020, as of December 31, 2020, Chinese property owned 789 million shares of China Evergrande, accounting for 5.96 per cent. It is worth noting that the actual control of Chinese home ownership is Chen Kaiyun, the wife of Hong Kong businessman Joseph Lau. In addition, according to listed companies, Chen Kaiyun holds a total of 8.86% of China Evergrande shares as both an individual and a company, while Xu Jiayin, who holds only 76.76%, is the second largest shareholder in China Evergrande.

Or affected by this news, Evergrande suffered another slump today. As of press time, China Evergrande reported HK $2.32 per share, down 11.79%, with a total market capitalization of 30.74 billion yuan, while Evergrande Motor fell 13.31% to 29.89 billion yuan, compared with Evergrande's market capitalization in February this year. has "evaporated" more than HK $600 billion. According to relevant data, Evergrande Motor has soared from HK $6 per share in June 2020 to HK $72.45 per share in February 2021, an increase of more than 1000%. Its share price has soared more than 10 times in eight months, and its market capitalization has exceeded HK $640 billion. However, after Evergrande unveiled nine Evergrande models at the Shanghai Auto Show on April 19, Evergrande's share price continued to fall, and even though there was a lot of good news in the market, it was still unable to recover the current situation of continuous decline. in addition, affected by the news face of Evergrande Group, it also undermined market confidence to a certain extent.

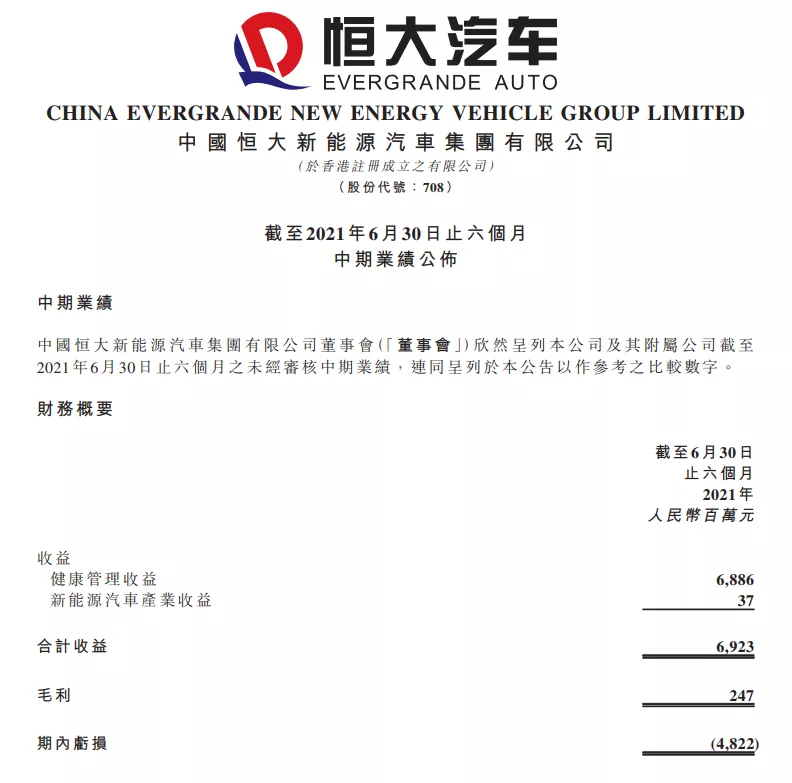

Evergrande announced on Aug. 9 that it expects a net loss of about 4.8 billion yuan in the first half, compared with a net loss of about 2.45 billion yuan in the same period in 2020. Evergrande said in its announcement that the loss in the first half of the year was mainly because the company was still in the investment stage and increased spending on fixed assets, equipment and technology research and development. According to Evergrande's financial report for 2020 released earlier, Evergrande invested a total of 47.4 billion, of which 24.9 billion was spent on core technology and research and development, and another 22.5 billion was spent on plant construction. At present, the investment of 47.4 billion has far exceeded the total market value of Evergrande. According to relevant data, from 2018 to 2020, Evergrande's annual losses are 1.428 billion yuan, 4.426 billion yuan and 7.74 billion yuan respectively.

Evergrande Motor is also affected by the frequent revelations that its parent company, China Evergrande Group, is mired in a debt crisis. On August 10, China Evergrande announced that it was in contact with several potential independent third-party investors to discuss the sale of some of its assets, including, but not limited to, the sale of some interests in the company's listed subsidiaries, China Evergrande New Energy Automobile Group Co., Ltd. And Evergrande property Group Co., Ltd. So far, however, there has been no substantial progress in Evergrande's proposed sale of its assets. On the evening of August 30, Evergrande officially released its interim results report. Data show that Evergrande's operating income in the first half of 2021 was 6.923 billion yuan, an increase of 53.43 percent over the same period last year, including 6.886 billion yuan for health management and 37 million yuan for new energy vehicles, and gross profit was 247 million yuan, down 80.42 percent from the same period last year. Net loss 4.822 billion yuan, down 96.25% year-on-year. Evergrande said in its financial report that Hengchi's mass production is entering the final sprint. Evergrande will continue to strengthen R & D investment, consolidate R & D strength, speed up the research and development of core technologies, and continue to develop new models at the same time. Strive to promote the formal commissioning of Tianjin, Shanghai, Guangzhou and other vehicle development bases and Yangzhou, Zhengzhou and other spare parts development bases, and strive to successfully achieve the production capacity target. On September 3, Evergrande Group officially announced the successful conclusion of Hengchi's summer tests of 1, 3, 5, 6 and 7. In addition, recently, the road test photos of Hengchi 7 and Hengchi 5 have been exposed on the Internet, and neither of the two cars is in camouflage, meaning they may be ready for mass production.

Although the mass production of Evergrande is constantly advancing, because Evergrande itself needs to rely on the financial support of Evergrande Group, Evergrande Group is deeply in debt crisis, and shareholders and executives have cashed out on a large scale, at this time, it is not realistic to want Evergrande Group to focus on Evergrande cars. Previously, Evergrande had announced that it would "start mass production in the second half of the year and deliver it in 2022", but it is uncertain whether it can be mass produced and delivered.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.