In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-24 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/17 Report--

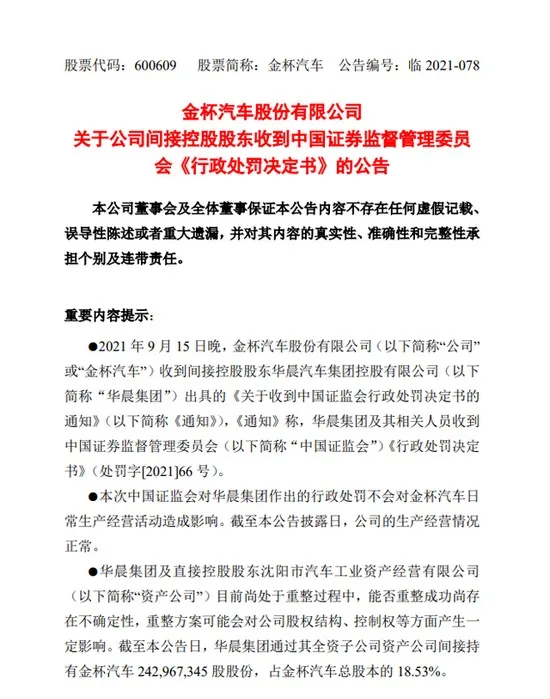

On September 16, Jinbei Automobile and Shenhua Holdings issued announcements one after another, saying that brilliance Group, the company's indirect controlling shareholder, had received the CSRC's "administrative penalty decision". Brilliance Group was fined a total of 53.6 million yuan by the CSRC for a number of illegal acts such as illegal information disclosure in the interbank bond market. In addition, the relevant personnel were fined between 80, 000 yuan and 600000 yuan. In addition, both Jinbei Automobile and Shenhua Holdings said that the administrative penalty imposed by the China Securities Regulatory Commission on brilliance will not affect the company's daily production and operation activities.

It is understood that on November 20, 2020, the China Securities Regulatory Commission (CSRC) filed an investigation into brilliance Group's alleged illegal disclosure of information. At present, the case has been investigated and the trial has been concluded. According to the "decision", brilliance Group has the following illegal facts: first, there are false records in the annual reports of 2017 and 2018 disclosed by brilliance Group; second, brilliance Group fraudulently obtained approval of public issuance of corporate bonds with false declaration documents; third, brilliance Group non-public offering corporate bonds disclosure documents false records; fourth, brilliance Group inter-bank bond market information disclosure illegal. Fifth, brilliance Group failed to disclose relevant information in time in accordance with the regulations. According to the facts, nature, circumstances and social harm of the illegal acts of the parties, a total fine of 53.6 million yuan was imposed on brilliance Group, 600000 yuan on Qi Yumin, 200000 yuan on Yan Bingzhe, 400000 yuan fine on Ye Zhenghua and Liu Pengcheng, 300000 yuan fine on Liu Tongfu and Xing Rufei, 200000 yuan fine on Chi Ye, and 100000 yuan fine on Yang Bo, Dongfeng and Liu Xuemin respectively. A fine of 80,000 yuan was imposed on high-tech.

It is understood that brilliance Group was established in 2002 with a registered capital of 800 million yuan. Liaoning SASAC and Liaoning Social Security Fund Council hold 80% and 20% respectively, and have a number of shareholding companies. The main business income is vehicle manufacturing. Brilliance Group directly or indirectly controls and participates in four listed companies, including brilliance China, Shenhua Holdings, Jinbei Automobile and Xinchen Power. At present, brilliance Group has three independent brands of China, Golden Cup and Huasong and two joint venture brands of brilliance BMW and Huachen Renault.

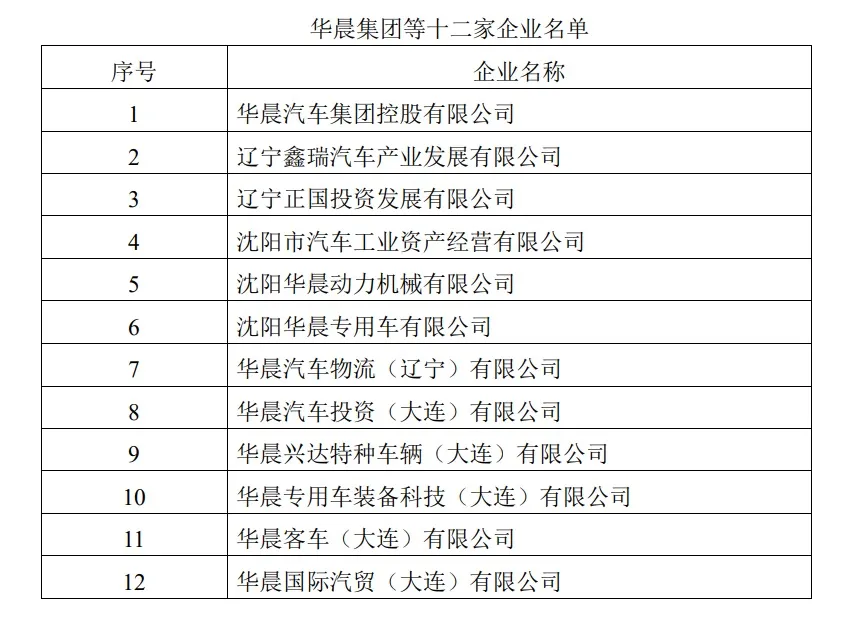

On January 26, 2021, the manager of brilliance Group applied to Shenyang Intermediate people's Court to hear 12 enterprises, including brilliance Group, by means of substantive merger and reorganization. On April 21, the first creditors' meeting of the substantive merger and reorganization of 12 enterprises, including brilliance Group, was held through the National Enterprise bankruptcy reorganization case Information Network. A total of 2825 creditors logged on to the website to watch the meeting, representing claims of about 44.454 billion yuan. At the second creditors' meeting, brilliance Group said that as of August 13, 2021, a total of 6005 creditors had declared their claims to the manager, with the amount of claims about 54.313 billion yuan. The amount of claims initially determined and suspended by the manager is about 49.983 billion yuan. In addition, according to the survey, it is estimated that the employee's creditor's rights and undeclared claims are about 12.001 billion yuan. As a result, the total estimated liabilities of 12 enterprises, including brilliance Group, are 61.984 billion yuan.

Brilliance Group, as one of the important provincial enterprises in Liaoning, mainly derives its profits from brilliance BMW in recent years. Without the profit support of brilliance BMW, brilliance is expected to be in a difficult position. According to relevant data: from 2015 to 2019, excluding the profit share of BMW brilliance, brilliance lost a total of 3.484 billion yuan, with losses of 540 million yuan, 600 million yuan, 860 million yuan, 420 million yuan and 1.064 billion yuan respectively in the past five years. It is not difficult to see that brilliance's losses are increasing year by year. According to industry insiders, brilliance BMW alone can not help brilliance get rid of the huge debt problem. After relaxing the restrictions on the joint venture share ratio, BMW's shareholding in brilliance BMW will increase from 50% to 75%, which means that brilliance's profits will be greatly affected. Shenhua Holdings announced on September 7 that after the application of 12 enterprises, including brilliance Group, the Shenyang Intermediate people's Court ruled that the submission of the draft reorganization plan for the substantive merger and reorganization of 12 enterprises, including brilliance Group, was extended to December 3, 2021.

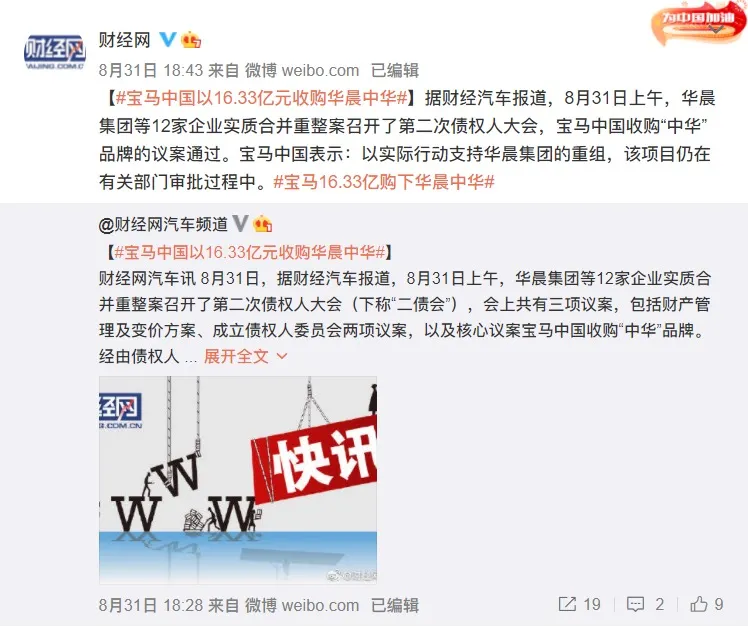

Earlier, media reported that the second creditors' meeting of the substantive merger and reorganization of 12 enterprises, including brilliance Group, passed three motions: property management and price change plan, the establishment of a creditor committee, and the acquisition of "Zhonghua" automobile assets by BMW China. And BMW China acquired "Zhonghua" automobile assets for 1.633 billion yuan. In response, the relevant BMW China official said in response to the media: "with the strong support of Liaoning Province and Shenyang Municipal Government, BMW Group has established a strong cooperative relationship with brilliance Group over the past 18 years. For BMW, Liaoning Province and Shenyang have become key innovation and production bases in China, as well as the cornerstone of our future success in China. " "We hope to support the restructuring of brilliance with concrete actions and are committed to further expanding our business in Liaoning Province. We hope to use the existing production capacity of brilliance Automobile Manufacturing Co., Ltd. However, the project is still in the approval process of the relevant departments. Please understand that we are unable to provide detailed information at this time. More information will be released later. "

It is worth mentioning that both Jinbei Automobile and Shenhua Holdings said that the administrative penalty imposed by the CSRC on brilliance will not affect the company's daily production and operation activities. However, as of press time, Jinbei Automobile shares fell 0.82% to 6.06 yuan per share, while Shenhua Holdings shares fell 1.93% to 2.03 yuan per share.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.