In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/21 Report--

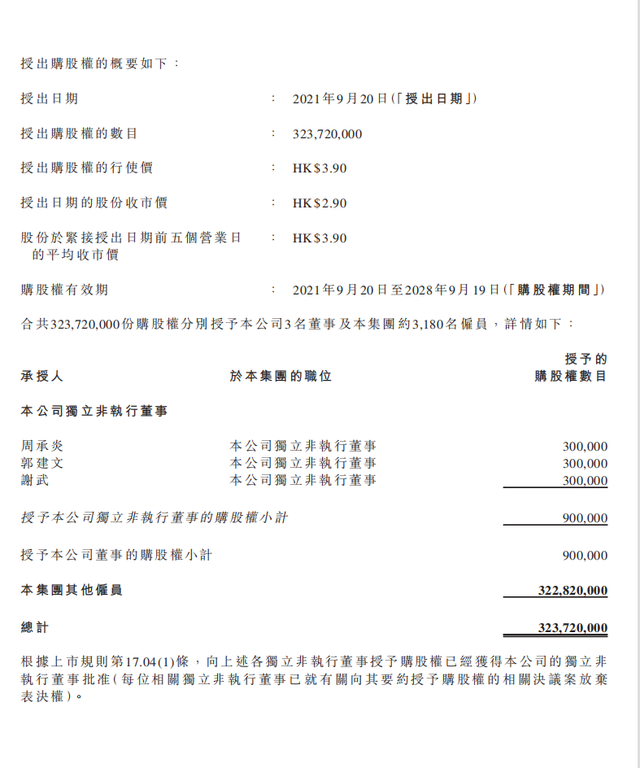

On September 21, Evergrande announced on the Hong Kong Stock Exchange that the company had granted share options to a number of independent non-executive directors of the company and some scientific and technical employees of the group under the share option plan it adopted on June 6, 2018. after the grantee accepts the share option, these share options will grant the grantee the right to subscribe for a total of 323.72 million new shares in the company. It is equivalent to about 3.31% of all issued shares of the company as at the date of this announcement, involving 3 directors and 3180 employees.

In addition, the announcement shows that the Board considers that the share options are mainly granted to certain independent non-executive directors of the Company and the scientific research and technical personnel of the Group, it will help to continue to promote and support the development of the Company and ensure the overall interests and long-term development stability of the Group, and strive to enhance the corporate value of the Company and achieve the long-term objectives of the Company. Therefore, the Board considers that the grant of this share option is in the interests of the Company and all shareholders as a whole. No share options will be granted to any non-scientific technical personnel who belong to the vice president level or above of the Group.

Evergrande insiders said in an interview with China Business that the company was in troubled times and that the move was conducive to stabilizing the company's core technical team. It is worth noting that recently, Evergrande Group has been exposed a series of negative information, not only in the operation of major problems, but also related to financial management can not be cashed, stocks plummeted, investors protect their rights and other situations. Evergrande has also been affected, and its market capitalization has fallen sharply. Since September 13, Evergrande Group announced that it expects sales to continue to decline sharply in September, resulting in the continued deterioration of the Group's sales rebates, further putting tremendous pressure on cash flow and liquidity. Evergrande closed down 24.66% at HK $3.88 per share, with a total market capitalization of HK $37.904 billion. On September 17, according to several media reports, according to documents filed by the Hong Kong Stock Exchange, the couple, a close friend of Xu Jiayin and a wealthy Hong Kong businessman, reduced their holdings in China Evergrande 24.436 million shares at an average price of HK $3.58 per share, reducing their shareholding from 8.96% to 7.96%. Earlier, the couple reduced their holdings of 6.312 million shares at an average price of HK $4.48 per share on Aug. 26, falling from 9.01 per cent to 8.96 per cent. On the two occasions, calculated at the average price, the total reduction and cash out was about HK $116 million. Or affected by the news, China Evergrande reported HK $2.54 per share, down 3.42%, with a total market capitalization of 33.66 billion yuan, while Evergrande Motor fell 15.58% to HK $2.98 per share, with a total market capitalization of 29.11 billion yuan.

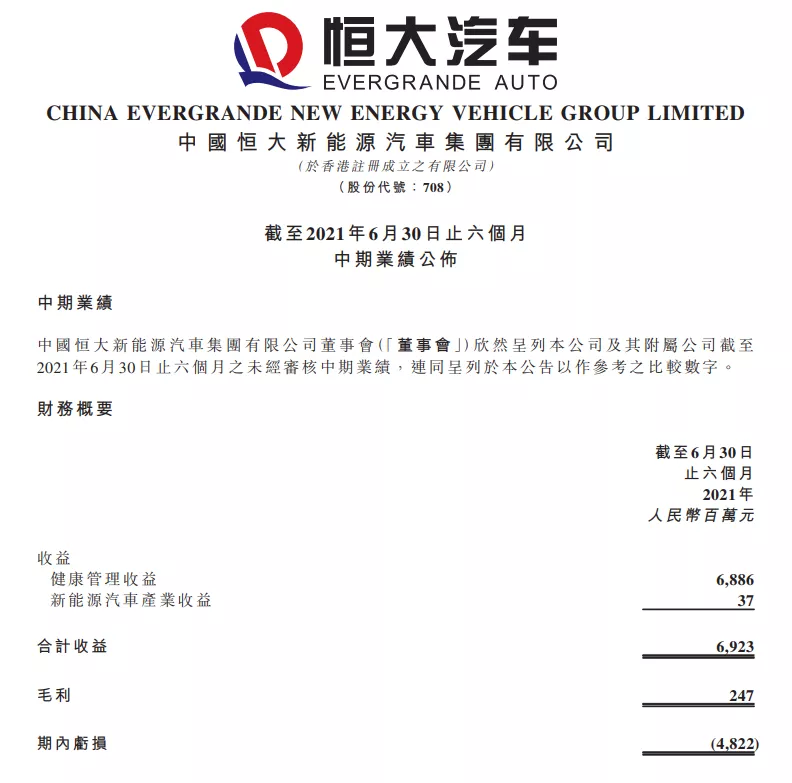

In order to solve the debt crisis, Evergrande Group of China announced on August 10 that the company was in contact with several potential independent third-party investors to discuss the sale of some of its assets, including, but not limited to, the sale of some interests in China Evergrande New Energy Automobile Group Co., Ltd., and Evergrande property Group Co., Ltd., the company's listed subsidiaries. On the evening of August 30, Evergrande officially released its interim results report. Data show that Evergrande's operating income in the first half of 2021 was 6.923 billion yuan, an increase of 53.43 percent over the same period last year, including 6.886 billion yuan for health management and 37 million yuan for new energy vehicles, and gross profit was 247 million yuan, down 80.42 percent from the same period last year. Net loss 4.822 billion yuan, down 96.25% year-on-year. Evergrande said in its financial report that Hengchi's mass production is entering the final sprint. Evergrande will continue to strengthen R & D investment, consolidate R & D strength, speed up the research and development of core technologies, and continue to develop new models at the same time. Strive to promote the formal commissioning of Tianjin, Shanghai, Guangzhou and other vehicle development bases and Yangzhou, Zhengzhou and other spare parts development bases, and strive to successfully achieve the production capacity target.

On September 3, Evergrande Group officially announced the successful conclusion of Hengchi's summer tests of 1, 3, 5, 6 and 7. In addition, recently, the road test photos of Hengchi 7 and Hengchi 5 have been exposed online, and neither of the cars is in disguise, which also means that they may be prepared for mass production. However, Evergrande has said that Hengchi is in the stage of mass production. However, the company still faces the challenge of cash flow, and the timetable for mass production of new energy vehicles may need to be postponed due to the lack of further capital investment in the short term. At present, although Evergrande emphasizes that mass production has entered the sprint stage, Evergrande Group is mired in a debt crisis, which will also have a certain impact on Evergrande's liquidity.

Or affected by the news that Evergrande has granted 324 million share options within Evergrande, Evergrande's Hong Kong stock trading has not fallen sharply today, but there has been a small increase. Although as of the end of the report, Evergrande reported an increase of 0.34%, with a total market capitalization of HK $28.43 billion. However, compared with the previous market capitalization in February, it has "evaporated" more than HK $600 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.