In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/27 Report--

On the evening of September 26, Hong Kong-listed Evergrande Motor issued an announcement on "terminating the proposal to issue RMB shares under special authorization." Evergrande Motor said in the announcement that after careful consideration, both the company and Haitong Securities Co., Ltd. agreed to terminate the listing counseling agreement and will report to the Shenzhen Regulatory Bureau of the China Securities Regulatory Commission. Therefore, the proposed issuance of RMB shares will not continue.

The only thing missing is Evergrande. Evergrande is renamed from Evergrande Health, which includes health business and new energy vehicle business. In the field of new energy vehicles, Evergrande Group realizes the industrial layout of new energy vehicle R & D and manufacturing, power battery, powertrain and so on through a series of acquisitions.

On September 18, 2020, Evergrande issued an announcement seeking the listing of Science and Technology Innovation Board. At that time, Evergrande's market capitalization soared under the tuyere of new energy vehicles, and its share price rose fivefold in two months, with a market capitalization of HK $320.1 billion.

Evergrande also made a fixed increase before announcing the landing of the Kechuang board. On September 15, 2020, Evergrande raised HK $4 billion in Hong Kong shares through a placement and introduced no less than six investors, including Tencent, Sequoia Capital, Yunfeng Fund and DiDi, at the placing price of HK $22.65 per share. Investors accounted for 2% of the total number of shares issued after the placement was completed. In January 2021, Evergrande offered another private offering of 952 million shares at a price of HK $27.30 per share. Chengyu Holdings, Shangyu Co., Ltd., Heyirong International Trading Co., Ltd., Cuilin Global Investment Co., Ltd. participated in the increase, raising a total of HK $26 billion.

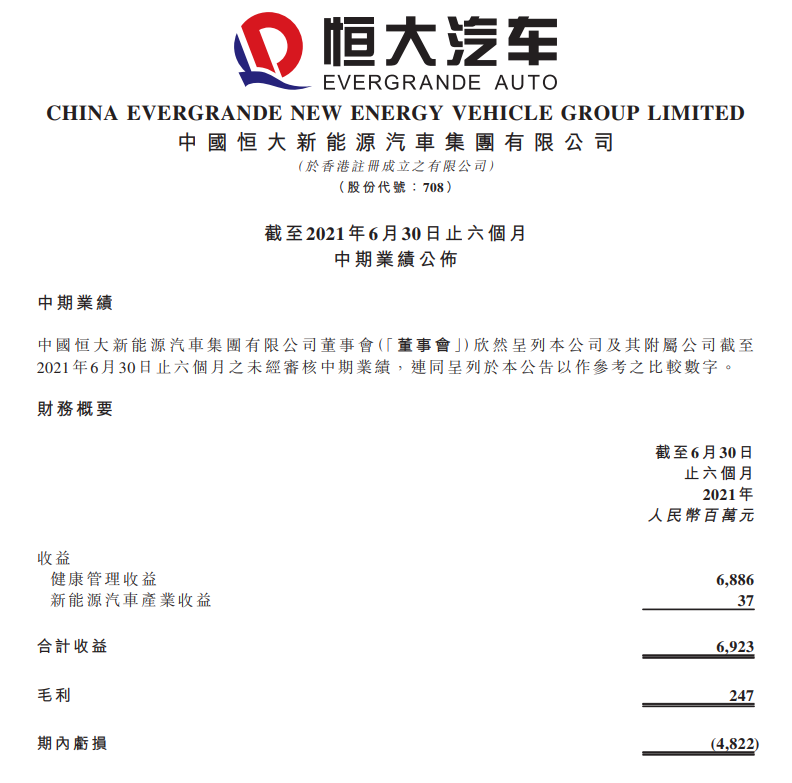

According to the financial report, Evergrande's operating income in the first half of 2021 was 6.923 billion yuan, an increase of 53.43 percent over the same period last year, including 6.886 billion yuan for the health management division and 37 million yuan for the new energy vehicle division. Due to continuous investment in car construction, Evergrande made a net loss of 4.822 billion yuan in the first half of the year, down 96.25% from the same period last year.

Evergrande at the bottom of the decline. In February, Evergrande's share price reached an all-time high of HK $72.45, with a total market capitalization of HK $640 billion, surpassing BYD to become the largest car company in China by market capitalization. Evergrande's share price has fallen all the way. Evergrande's share price has plummeted in the past six months. As of today, Evergrande has a market capitalization of only $20 billion.

The trough of Evergrande has something to do with the current situation of Evergrande Group. Against the backdrop of Evergrande Group's debt crisis, China Evergrande announced on August 10 that it was in contact with several potential independent third-party investors to discuss the sale of some of its assets, including, but not limited to, the sale of some interests in the company's listed subsidiaries, China Evergrande New Energy Automobile Group Co., Ltd. And Evergrande property Group Co., Ltd.

On the evening of September 24, Evergrande announced that due to liquidity problems, in the "Evergrande Health Valley" and the living space of new energy vehicles, there were delays in the payment of suppliers and project payments, resulting in the suspension of some related projects. As of the date of this announcement, Evergrande Group has not made significant progress in resuming work for some projects.

Evergrande is still in contact with different potential strategic investors to introduce new investors for the group, and is still in the process of due diligence and consultation as of the date of this announcement, the announcement said. Evergrande is also actively discussing with potential investors the sale of some of its health valley projects and overseas assets to enhance the overall efficiency of the group and replenish its working capital. As of the date of this announcement, Evergrande has not signed any legally valid agreement with investors, and it is uncertain whether the potential sale can be realized.

Evergrande said that if the introduction of the above strategic investment and / or the sale of potential assets do not make any progress in the short term, it will lead to a lack of further financial investment, which is expected to affect Evergrande's daily operation. as a result, the payment of wages and / or other expenses of the employees of the Group will continue to deteriorate, while affecting the progress of research and development of new energy vehicles. It has a significant negative impact on the mass production of new energy vehicles in the Group.

Once upon a time, Xu Jiayin used to use "buy, buy, circle, big, good" to sum up Evergrande's road of "changing lanes and overtaking". In view of the development and positioning of Evergrande New Energy, Xu Jiayin has also publicly stated that he wants to become the largest and strongest new energy vehicle group in the world in 3-5 years. Perhaps Evergrande is really building cars. As of December 2020, Evergrande has invested 47.4 billion yuan in the new energy vehicle industry, of which 24.9 billion yuan has been invested in research and development. However, even with the support of huge amounts of money, mass production of Evergrande is a long way off. At present, Evergrande Group has encountered unprecedented challenges, Evergrande Automobile is also difficult to be left alone, part of the shares will be sold, which aggravates the difficulties of mass production of models.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.