In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-18 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)09/29 Report--

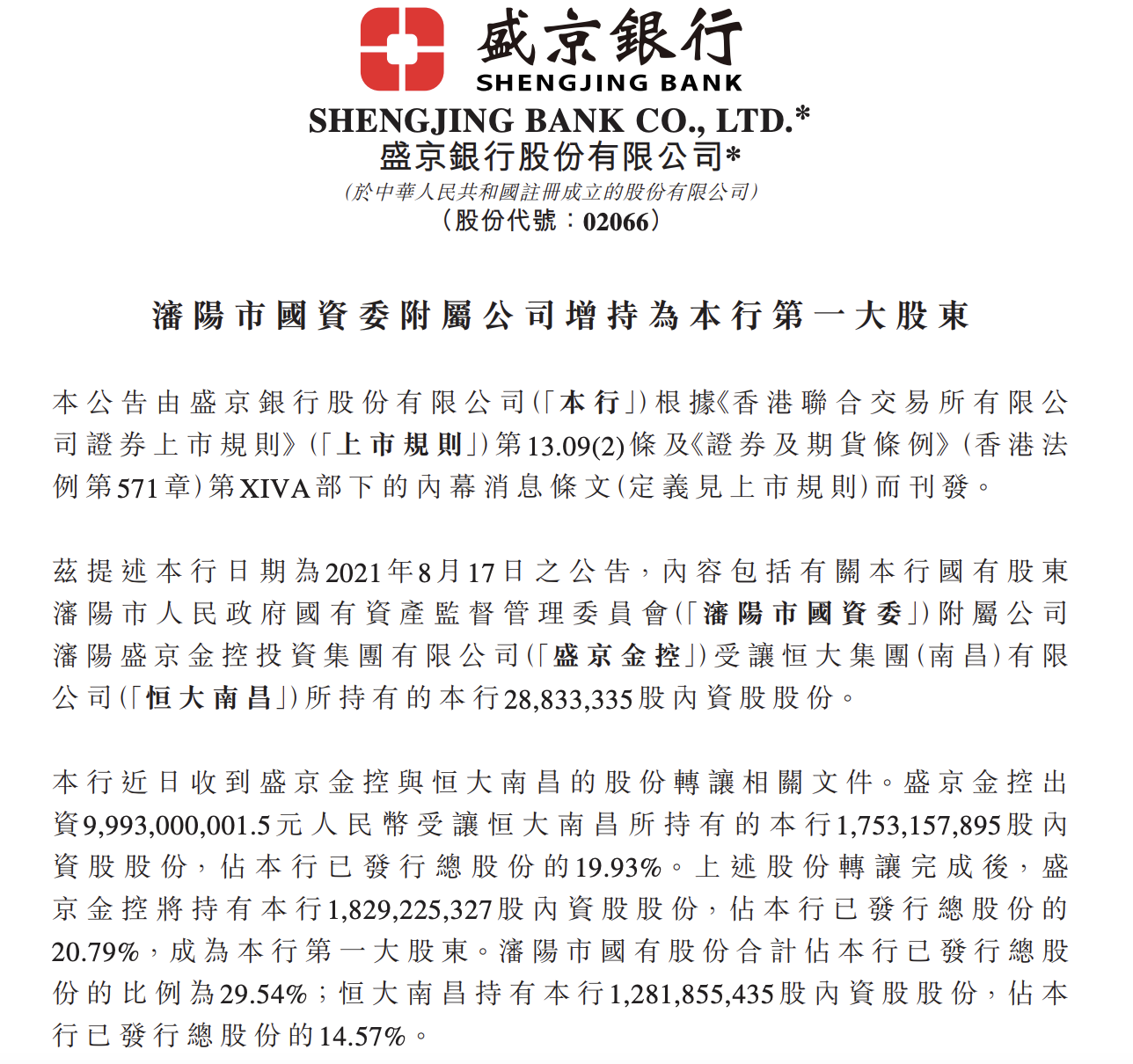

On September 29th, Evergrande Group announced that its wholly-owned subsidiary, Evergrande Group (Nanchang) Co., Ltd. (hereinafter referred to as "Evergrande Nanchang"), will transfer its 1.753 billion shares (19.93% of the total share capital) of Shengjing Bank. The transferee is Shenyang Shengjing Financial Control Investment Group Co., Ltd. (hereinafter referred to as "Shengjing Financial Control") at a transfer price of 9.993 billion yuan.

At the same time, Shengjing Bank also announced that after the completion of the deal, Shengjing Investment will hold a total of 1.829 billion shares, accounting for 20.79% of the shares, making it the largest shareholder of Shengjing Bank.

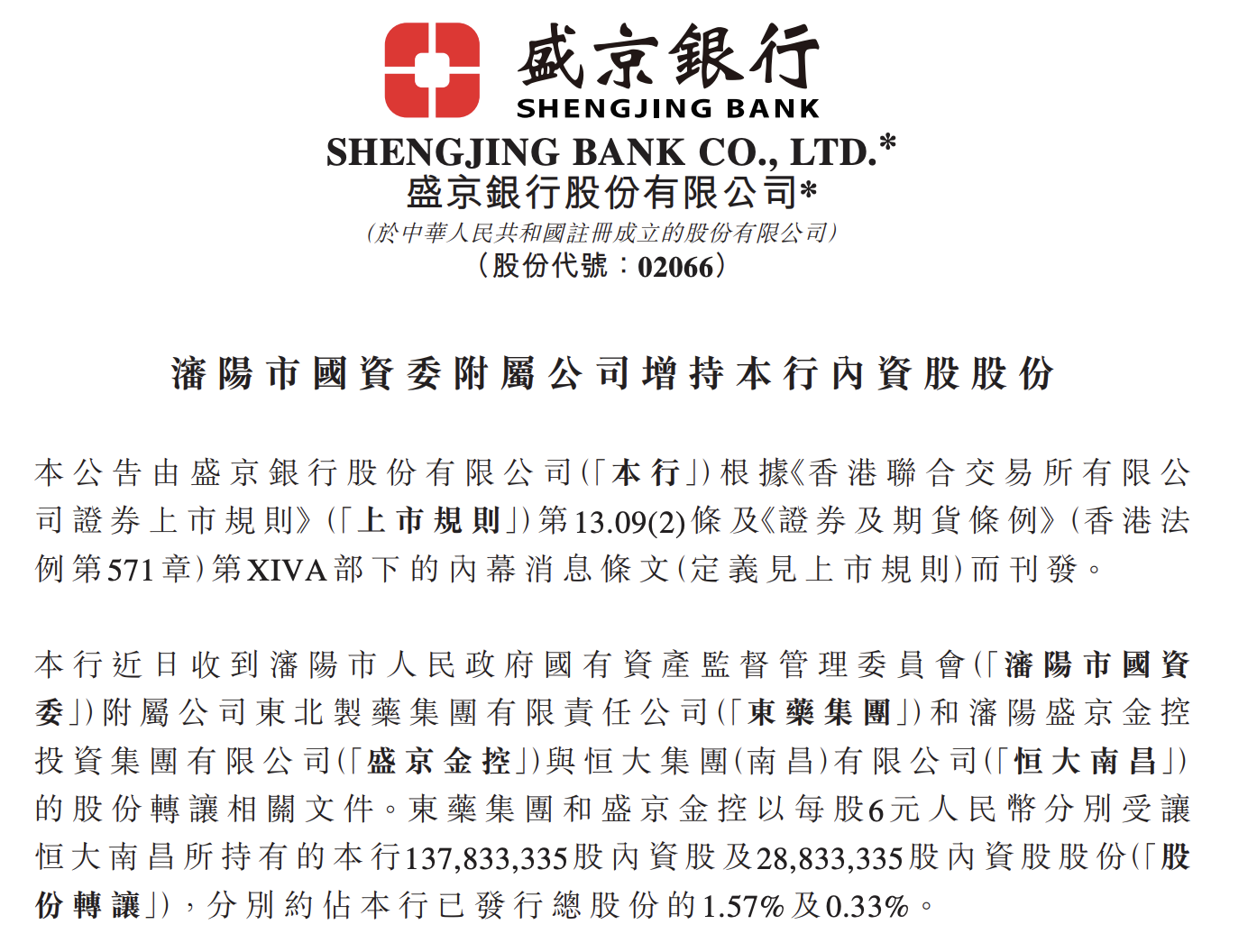

It is worth mentioning that this is not the first time Evergrande has sold a stake in Shengjing Bank. On August 17, Shengjing Bank announced that two affiliated enterprises of Shenyang SASAC intend to transfer about 167 million domestic shares held by Evergrande Group (Nanchang) Co., Ltd. at a transfer price of 6 yuan per share. Evergrande will cash out more than 1 billion yuan this time. According to the announcement, Northeast Pharmaceutical Group, affiliated to Shenyang SASAC, and Shenyang Shengjing Financial Investment Group will be transferred to about 138 million domestic shares and about 28.8333 million domestic shares held by Evergrande Nanchang at a price of 6 yuan per share, accounting for 1.57% and 0.33% of the total issued shares of Shengjing Bank, respectively.

At present, Evergrande has indeed encountered unprecedented challenges. With regard to the sale of shares in Shengjing Bank, China Evergrande said in an announcement that the company's liquidity problems had a huge negative impact on Shengjing Bank, and the introduction of the transferee of state-owned enterprises as major shareholders would help stabilize the operation of Shengjing Bank. at the same time, it helps to increase the value of the 14.57% stake in Shengjing Bank that the company still holds. The settlement of the sale requires the cooperation of Shengjing Bank, which requires that all proceeds from the disposal should be used to repay the Group's relevant debts to Shengjing Bank.

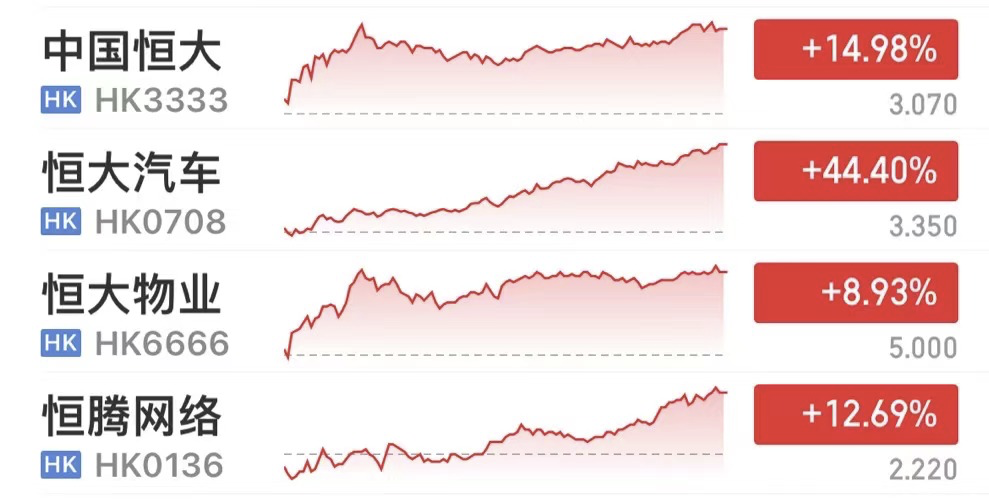

The sale of shares in Shengjing Bank alleviated Evergrande's funding difficulties to some extent, and the Hong Kong-listed Evergrande stock group rose sharply on the news. By the close, China Evergrande was up 14.98%, Evergrande Motor was up 44.40%, Evergrande property and Hengteng Network were up 8.93% and 12.69%, respectively.

By the end of June 2021, the interest-bearing debt of China Evergrande Group was 571.775 billion yuan. Of this total, the current liability due within one year is 240.049 billion yuan; in the same period, the deposit balance of China Evergrande Bank is 161.627 billion yuan, of which 78.455 billion yuan is restricted cash.

In the first half of 2021, China Evergrande achieved revenue of 222.69 billion yuan, down 16.48 percent from the same period last year; net profit was 10.499 billion yuan, down 28.87 percent from the same period last year; gross profit was 28.835 billion yuan, down 56.75 percent from the same period last year; and gross profit was 12.9 percent, 25.01 percent for the same period last year.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.