In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/09 Report--

Since Zhongtai Automobile announced bankruptcy reorganization, the progress of Zhongtai Automobile restructuring has also been concerned by the industry. If Zhongtai Automobile can smoothly implement restructuring, optimize the debt structure, and continue to operate, then Zhongtai can get back on the right track. If the restructuring fails, Zhongtai Motor will only face the road of bankruptcy.

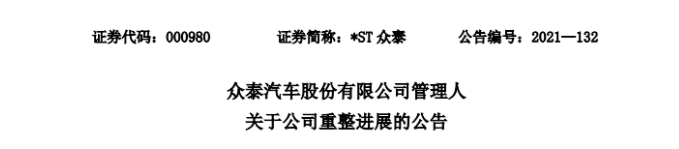

According to the announcement issued by * ST Zhongtai, on September 30th, 2021, Jiangsu Shenshang holding Group Co., Ltd. was finally selected as the restructuring investor, and Shanghai Titanium Kai Automotive Technology Partnership (Limited Partnership) and Hunan Zhibo Zhi car Equity Investment Partnership (Limited Partnership) were selected as the second-ranking investors of the company. On the same day, the company and its managers signed the "Zhongtai Automobile Co., Ltd. Restructuring Investment Agreement" with Jiangsu Shenzhen Merchants, with a restructuring investment of 2 billion yuan. The recruitment of restructuring investors need to be approved by the court after Zhongtai Automobile's restructuring plan (draft) was decided by the court before it was finally confirmed as the official restructuring investor of Zhongtai Automobile. On the same day, Jiangsu Shenzhen Merchants transferred 550 million yuan to the designated account as a performance deposit, and the remaining 1.45 billion yuan for restructuring investment should be paid before October 25, 2021 according to the agreement.

On June 9, 2021, the Intermediate people's Court of Jinhua City ruled to accept the application for restructuring of Zhongtai Motor. On July 1, 2021, Zhongtai Automobile issued a notice saying that in order to promote the restructuring of Zhongtai Automobile and related enterprises in accordance with the law, managers openly recruited restructuring investors in accordance with the Enterprise bankruptcy Law of the people's Republic of China and relevant laws. Finally, within the prescribed registration period (before 17:00 on August 10, 2021), a total of three prospective investors, namely, Shanghai Titanium Kai Automotive Technology Partnership (Limited Partnership), Jiangsu Shenshang Holdings Group Co., Ltd., and Hunan Zhibo Intelligence vehicle Equity Investment Partnership (Limited Partnership), submitted application materials to the manager. The follow-up company and manager will organize to determine the final restructuring investor through commercial negotiation or competitive selection. After the intended restructuring investors are determined, the company and managers will speed up the consultation and communication with the intended restructuring investors, creditors and other stakeholders in the light of the progress of the restructuring work.

According to relevant data, Huang Jihong, a legal person of Jiangsu Shenzhen Merchants Company, was established in September 2020, with a registered capital of 200 million yuan, mainly engaged in investment activities, domestic trade agents, car leasing, new car sales, and so on. Huang Jihong, the legal representative of Jiangsu Shenshang Company, successfully managed the reorganization of the huge group in 2019 and is now the chairman of the huge group. Some industry insiders said that Jiangsu Shenzhen Merchants participated in the restructuring of Zhongtai Automobile and probably wanted to invest in the automobile industry with Shenzhen Merchants holding as the main body. Although from the technical level, Zhongtai Automobile lacks the core technology accumulation, Zhongtai Automobile has the dual production qualification of fuel vehicles and new energy vehicles, in addition, there are production bases in Zhejiang, Hunan, Hubei, Shandong, Chongqing, Guangxi and so on. If Jiangsu Shenzhen Merchants participate in the restructuring successfully, they can quickly have Zhongtai's R & D and manufacturing resources. At that time, Jiangsu Shenzhen Merchants will also become enterprises with sales channels and vehicle R & D and manufacturing. This operation is very consistent with the trend of real estate enterprises' layout of the automobile industry in recent years. Cui Dongshu, secretary general of the Federation of passengers, also said: "now Zhongtai is worthless, but if we make good use of it, tens of billions or hundreds of billions of yuan of value can be created, and the key is who can control Zhongtai's resources well."

![1633753250215366.png ~CW415ZF`E]Q_$O6M~0W$SR.png](https://www.autochat.com.cn/uploadfile/ueditor/image/202110/a6f6732903.png)

It is worth noting that the reorganized Zhongtai Motors also had a period of highlight. As early as 2003, Zhongtai holding Group was officially established, and at the beginning of 2006, Zhongtai Automobile realized its vehicle production through Chengdu Xindi Automobile Company. In January 2006, it launched its first car, Zhongtai 2008. Subsequently, Zhongtai Automobile implemented "reverse development", imitating from Volkswagen, Audi, and then to Porsche, Zhongtai Motors went further and further on the road of imitation. As the imitation satisfied the "luxury car dream" of many car lovers, Zhongtai Automobile was sought after by many car friends in a short period of time. In 2016, Zhongtai SR9 went public, creating a sales record of 20,000 orders in three days. But the good times did not last long. Due to the lack of core technology, Zhongtai Motor's revenue dropped sharply to 2.986 billion yuan in 2019 from 14.764 billion yuan in 18 years, and its net profit fell to-11.19 billion yuan, down 1498.98%. By 2020, Zhongtai Motor collapsed as new energy subsidies ran out of food and cars that lacked the sixth national standard. According to relevant financial reports, Zhongtai Motor's operating income in the first half of 2021 was 380 million yuan, a decrease of 50.08 percent over the same period last year, and the net profit attributed to shareholders of listed companies was-750 million yuan. Zhongtai Motor lost 10.801 billion yuan in 2020, with net assets of-4.423 billion yuan at the end of the period.

![1633753246529716.png U]O)K{JB$M8RP`U_TES_9UF.png](https://www.autochat.com.cn/uploadfile/ueditor/image/202110/cf53803281.png)

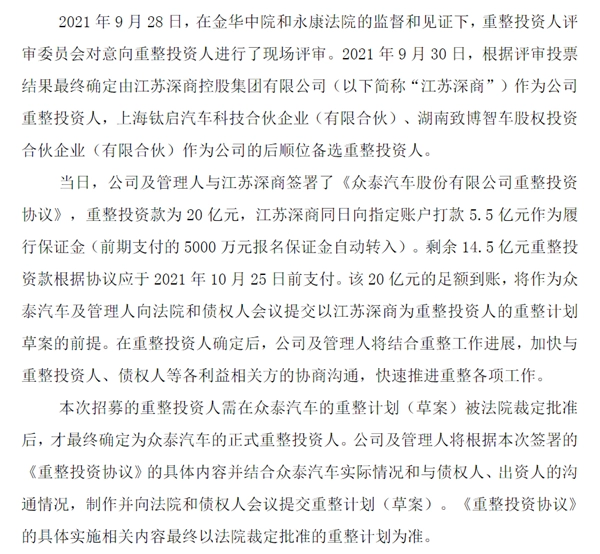

With the announcement of the investors of the final restructuring, the restructuring of Zhongtai Automobile may have come to an end. However, the current debt problem facing Zhongtai Motor will also be a major obstacle to its follow-up progress. According to the earlier disclosure of Zhongtai Automobile, a total of 33 creditor applications were received during the claim reporting period, with a total amount of 7.525 billion yuan. In this regard, Zhongtai Automobile has said that investors are required to issue a credit certificate of not less than 1 billion yuan or other proof of performance ability to participate in the restructuring with a commitment of not less than 2 billion yuan. After obtaining the qualification of restructuring investor and becoming the controlling shareholder, we need to continue to inject funds and resources to lead Zhongtai Automobile in the field of vehicle manufacturing. It remains to be seen whether Jiangsu Shenshang's 2 billion yuan offer can put Zhongtai back on the right track.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.