In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/17 Report--

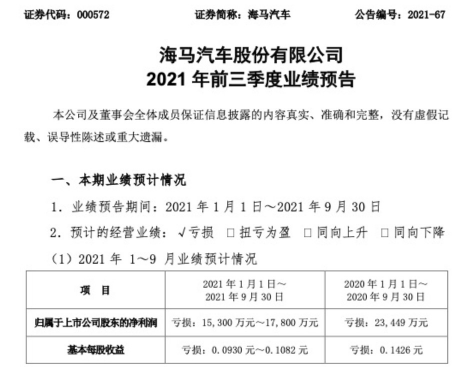

On October 14, Haima issued a performance forecast for the first three quarters of 2021, which is expected to achieve a net profit loss of about 153 million yuan to 178 million yuan for shareholders belonging to listed companies from January to September in 2021, compared with a loss of about 234 million yuan in the same period last year. It is worth noting that this is not the first time that Haima Motor has lost money, as its net loss has exceeded 2 billion yuan in the past two years. As for the loss, Haima Motors said in the announcement: the product market performance has not met expectations. In addition, since the third quarter, the seahorse car base in Zhengzhou has encountered the epidemic situation and extreme rainstorm disaster weather, which has affected the normal production and operation activities to a certain extent, resulting in continuous losses in the company's operating performance.

It is worth noting that as early as 2016, Haima Motor achieved annual sales of 216000 vehicles with Haima S5, with annual operating revenue of 13.89 billion yuan, an increase of 17.05% over the same period last year. The net profit reached 230 million yuan, an increase of about 41.71% over the same period last year. But in 2017, it was a turning point for seahorse cars from prosperity to decline. In 2017, the annual operating income of seahorse was about 9.683 billion yuan, down 30.29% from the same period last year. The net profit loss of shareholders belonging to listed companies reached 994 million yuan, compared with the net profit of 230 million yuan in 2016, a decrease of more than 1.2 billion yuan, a decrease of 531.9 percent from the same period last year. In 2018, the annual revenue of seahorse fell again to 5.047 billion yuan, down 47.88% from the same period last year, and the net profit loss of shareholders belonging to listed companies reached 1.637 billion yuan, a sharp drop of 64.5%. Although it achieved a net profit of 85 million yuan in 2019, the net profit was recovered through the sale of idle real estate, company equity and government subsidies. In 2020, Haima Motors sold another 145 properties so that in June of the same year, the securities were changed from "* ST seahorse" to "ST seahorse" for short. On February 5, 2021, ST Haima announced that its controlling subsidiary, Haima Finance, plans to sell its 7 per cent stake in Hainan Bank to China Railway Investment at a transfer price of 329.7 million yuan.

According to relevant data, the cumulative sales of seahorse cars from January to September in 2021 was 22279, an increase of 171.76 percent over the same period last year. It is worth mentioning that the sales figures disclosed by Haima Motor also include Xiaopeng G3G3, which is to be produced by Xiaopeng Automobile, with a cumulative sales of 14277 vehicles from January to September. Excluding the sales of Xiaopeng G3, it is not difficult to see that the main business of Haima Motor is still worrying. On March 19, 2020, Xiaopeng Motor acquired the production qualification through the acquisition of Guangdong Fudi Automobile Co., Ltd., to which Haima Motors said that the cooperative production relationship between Haima Automobile and Xiaopeng Automobile would expire at the end of this year. The cooperation between Xiaopeng Motor and Haima Motor is not over, so Xiaopeng G3 will continue to be mass produced in Haima Automobile Zhengzhou Company, while Xiaopeng P7 can be produced and sold by itself. Without Xiaopeng car, where should seahorse car go? In addition, apart from the imminent "breakup" with Xiaopeng, FAW is also "breaking up" with Haima. On July 20, Haima announced that China first Automobile Co., Ltd. plans to transfer 49% of its holding subsidiary FAW Haima Automobile Co., Ltd., and 50% of Hainan FAW Haima Automobile sales Co., Ltd., to Hainan Development Holdings Co., Ltd.

![1634459528504252.png TXMHHB45B1REY]AXNKXH)C2.png](https://www.autochat.com.cn/uploadfile/ueditor/image/202110/f518fec543.png)

Haima Automobile, as the only car company in Hainan, under the environment of vigorously implementing the policy of new energy vehicles in Hainan, it also increases the possibility of the development of Haima new energy vehicles. However, due to the lack of well-known models, the lack of key technical support and the lack of clear development goals, it remains to be seen whether Haima can turn around in the case of continuous losses.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.