In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/21 Report--

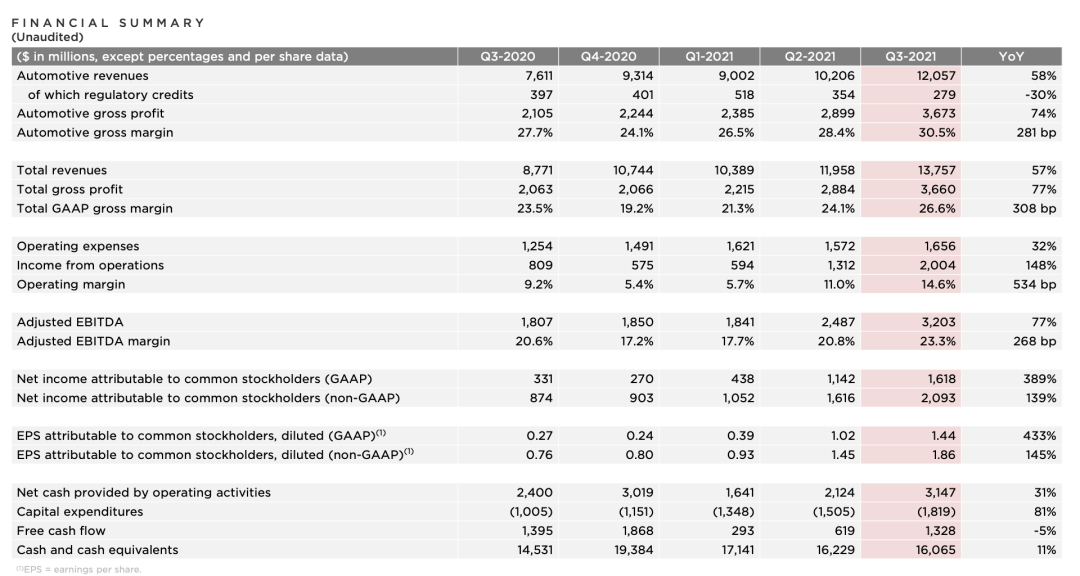

On October 21, Tesla, an American electric vehicle company, released its latest quarterly earnings report showing that operating income in the third quarter of 2021 was $13.757 billion, up 57% year-on-year, with market expectations of $13.914 billion; net profit attributable to shareholders of parent company was $1.659 billion, up 389% year-on-year, with market expectations of $1.257 billion.

For Tesla's excellent performance, Tesla Vice President of External Affairs Tao Lin said on Weibo: Thank you for your support.

Tesla is not just a car company. Tesla's auto business revenue was $12.06 billion, including sales of carbon points to automakers, which generated $279 million in revenue in the third quarter, which can be converted almost entirely into profits, according to earnings reports. In addition, Tesla earned $806 million in revenue from its energy business, which includes solar panels and energy storage products for homes and utilities, and $894 million in revenue from its services and other businesses, including fully autonomous driving kits, car maintenance and repair, and auto insurance.

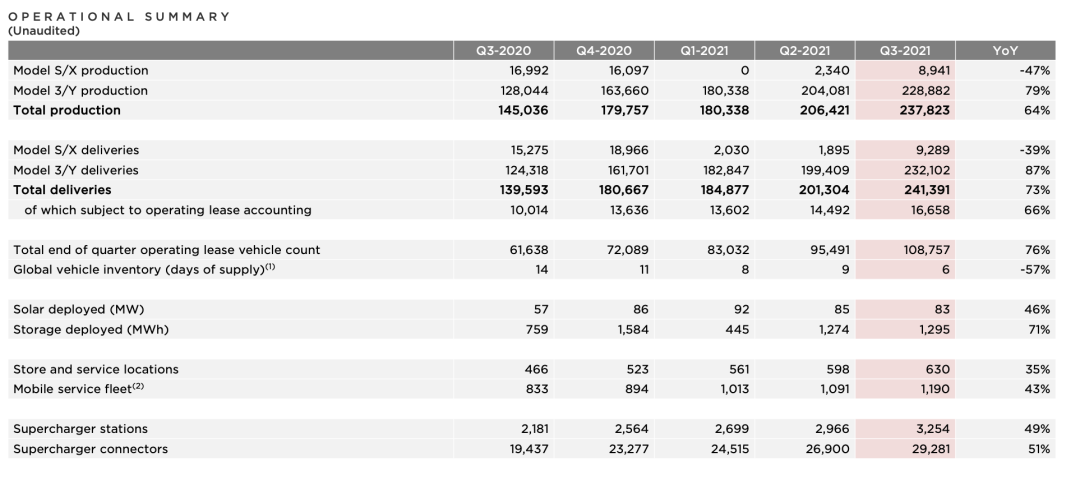

In terms of automotive business, Tesla previously released delivery data showing that 241300 electric vehicles were delivered worldwide in the third quarter of 2021, of which 232025 were delivered for Model 3 and Model Y, and 9275 for Model X and Model S. As an important market for Tesla, Tesla China sold 133,238 vehicles in the third quarter, accounting for 55.22% of Tesla's total global sales. It is understood that Tesla expects to deliver 900,000 vehicles in 2021, compared with 627,427 electric vehicles delivered in the first three quarters, which means Tesla needs to deliver 273,000 vehicles in the fourth quarter to meet the target. However, Tesla's ability to meet its delivery targets is relatively conservative amid a global wave of core shortages. Tesla CEO Musk said at the annual shareholders 'meeting that Tesla's supply chain faces huge cost pressures, not only chips, but many of the company's supply chains are limited by component shortages.

Tesla stressed the importance of the Shanghai plant in its earnings report. Tesla said China remained our primary export hub throughout the third quarter. Production growth at China's Super Factory is good and we are pushing improvements to further increase productivity. In addition, Tesla also pointed out that for standard mileage vehicles, it is turning to lithium iron phosphate batteries worldwide.

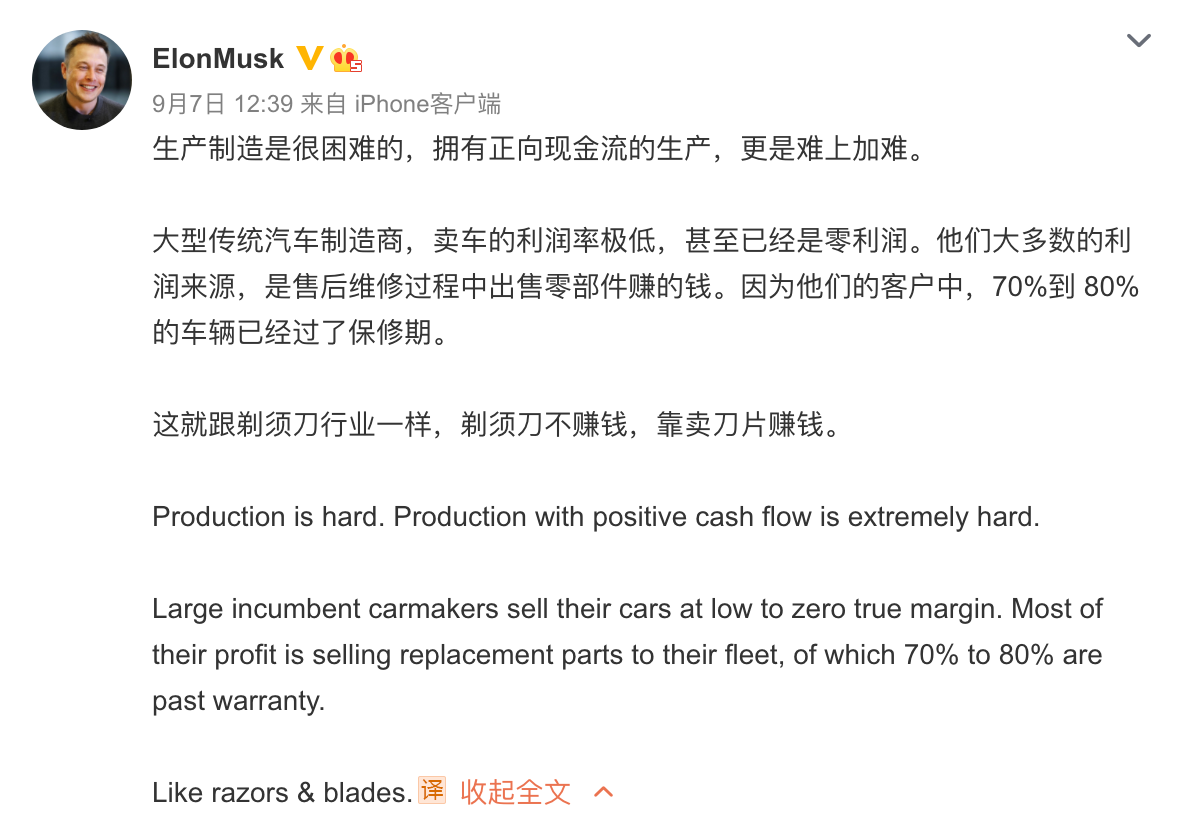

It is worth mentioning that Tesla's auto business in the third quarter profit margin as high as 30.5%, this is what concept? For example, BMW Group's EBIT margin in the second quarter was 15.8%, Daimler's automobile and truck division EBIT margin was 12.2%, Volkswagen Group's EBIT margin in the first half was 8.8%, and Stellantis Group's EBIT margin was 11.4%. By contrast, Tesla's profit margins in the first four quarters were 28.4%, 26.5%, 24.1% and 27.7%, respectively. It is not difficult to see that the profit margin of traditional car giants is basically around 10%, Tesla's profit margin performance is equivalent to three times that of traditional car companies. Earlier, Musk also publicly said on Weibo that large traditional car manufacturers sell cars with extremely low profit margins, or even zero profits. Most of their profits come from selling parts in the after-sales maintenance process. Because 70% to 80% of their customers are out of warranty.

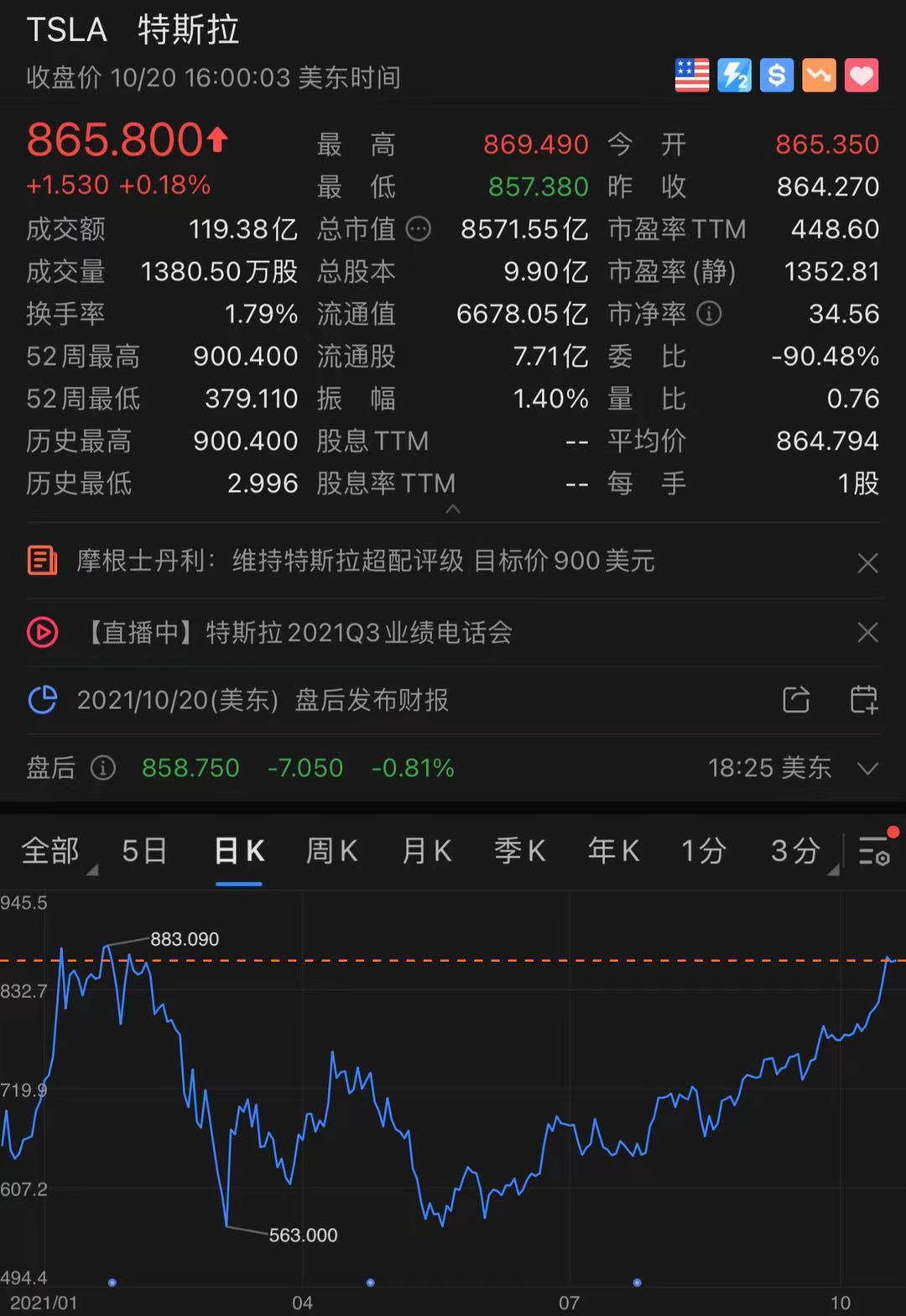

On the market side, Tesla opened lower and higher on Wednesday, up 0.6% to $867, closer to the intraday high of more than $900 set in January and the closing high of $883.09. At the close, shares were up 0.18 percent at $865, with the latest market capitalisation of $857.155 billion.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.