In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)10/24 Report--

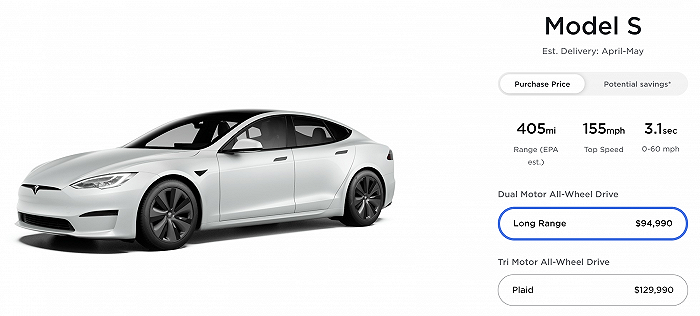

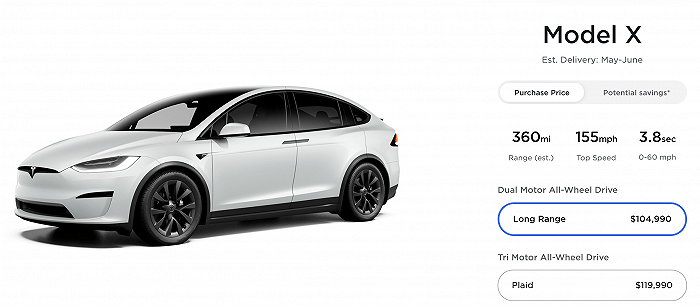

According to Tesla's US website, Tesla raised the price of the Model S long-lasting version and Model X long-lasting version by $5000 respectively to $94990 (606400 yuan) and $104990 (670200 yuan) respectively. In addition, the price of the standard battery life upgrade version of Model 3 and the long-lasting version of Model Y have been raised by $2000 to $43990 (RMB 280800) and $56990 (RMB 363800) respectively.

The overseas market adjusts prices more frequently than the Chinese market, and this is Tesla's second price increase in this month. On October 7, according to Tesla's US official website, both the standard continued version and the high-performance version of Tesla Model 3 were raised by $1000 (about RMB 6445), and now the prices are $41990 and $57990 (about RMB 270600 and 373800), while the price of the long-lasting version remains the same. The long-range and high-performance versions of Model Y have been raised by $1000 and are now priced at $54990 and $61990 (about 354400 yuan and 399500 yuan).

Why does Tesla adjust prices frequently overseas? It is mainly due to the shortage of chips and the rise in the price of raw materials. Due to the shortage of spare parts, the production of Tesla Automobile Factory was affected. According to the US website, with the exception of the Model 3 and Model Y, the delivery of other models has been delayed to the end of this year or even next year. The shortage of chips has affected production, and the rise in raw material costs has also made Tesla, who adopts the direct sales model, more vulnerable to the impact of the market, such as battery raw material costs, chip supply and so on may directly lead to price adjustment.

Compared with overseas markets, the Chinese market does not adjust prices so frequently. At present, the domestic parts rate of the Model 3 and Model Y models produced by Tesla in the Shanghai factory has reached more than 90 per cent, or because of the continuous improvement of the localization rate of the supply chain, domestic models are less affected by component costs. It is understood that Tesla's last price increase in China was on August 4, when the prices of the 2021 Model S long-lasting version and the 2021 Model X long-lasting version were both raised by 30, 000 yuan. After adjustment, the long-lasting version of Model S will be sold at $859990 and the long-lasting version of Model X will be sold at $909990.

The problem of slowing production caused by a shortage of spare parts is not unique to Tesla. French carmaker Renault said Wednesday it expects to cut production by 500000 vehicles this year, far more than the market had expected, Reuters reported. Nissan will cut its global production plans for October and November by 30 per cent because of a global chip shortage. Nissan has told suppliers it will produce 263000 cars in October and 320000 in November, both of which are 30 per cent lower than previously expected. In addition to Nissan, Toyota and Honda have previously announced production cuts. According to the latest data from Auto Forecast Solutions quoted by foreign media, as of August 29, the global automobile production has been reduced by 6.887 million vehicles, an increase of 445000 over last week, due to the intensification of the global shortage of automotive chips. AFS also predicts that car production will be reduced by 8.107 million this year.

However, although the automotive industry has been affected by the shortage of chips, Tesla's financial data have not been affected. Tesla released its latest quarterly financial report on October 21, showing that operating income in the third quarter of 2021 was $13.757 billion, an increase of 57% over the same period last year, and the market was expected to be $13.914 billion. The net profit of shareholders belonging to the parent company was $1.659 billion, an increase of 389% over the same period last year. The market is expected to be $1.257 billion. In terms of vehicle delivery, a total of 241300 electric vehicles were delivered worldwide in the third quarter of 2021, of which 232025 were delivered for Model 3 and Model Y and 9275 for Model X and Model S.

By the end of October 22nd, Tesla's share price had returned to a record high of $900. it closed at $909.68, up 1.75%, with a total market capitalization of $911.3 billion, ranking first among auto companies in the world.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.