In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-17 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/18 Report--

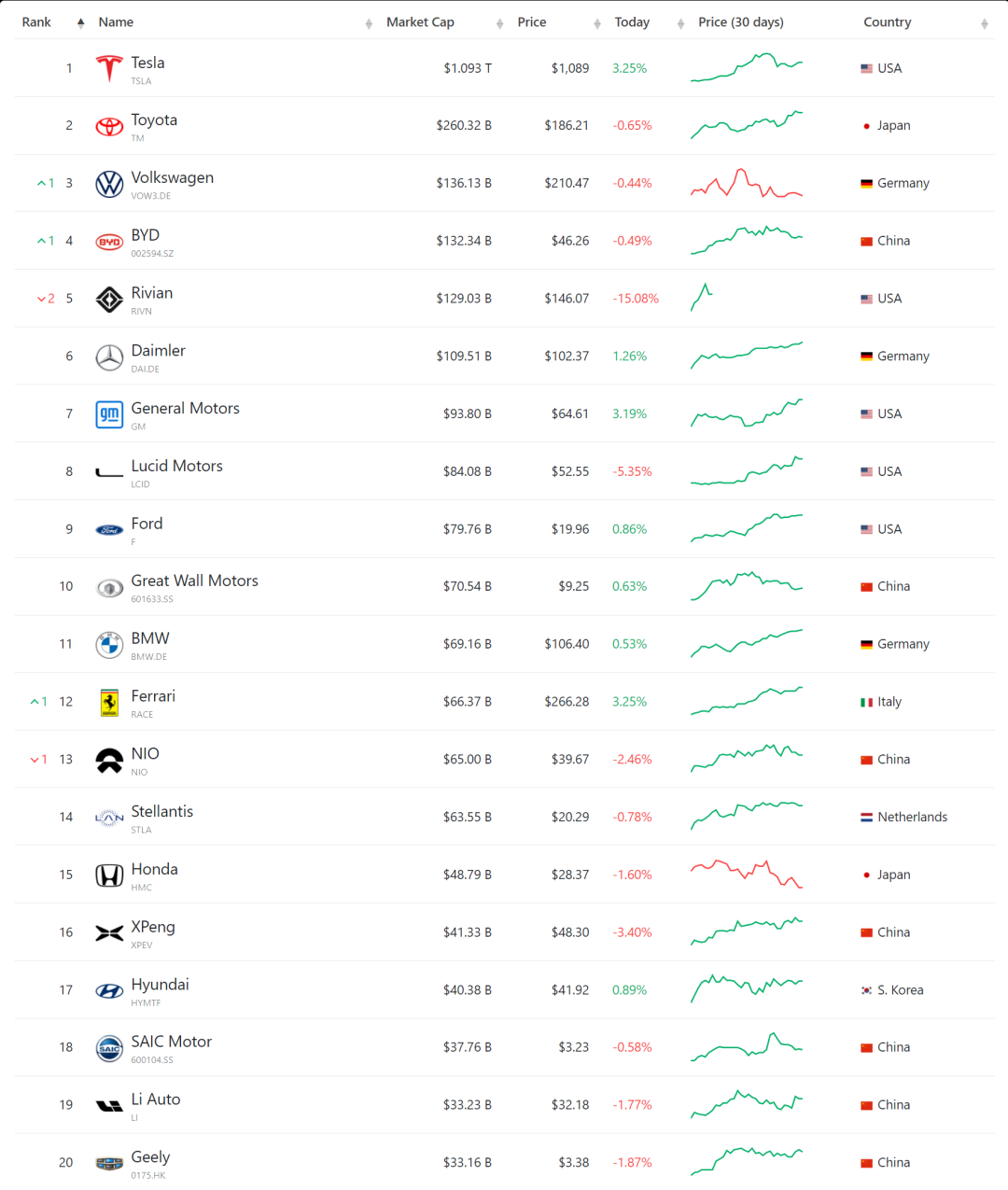

Tesla, an American electric car company, ranks first today, with a market capitalization of $1.093 trillion, according to the latest ranking of global car companies by market capitalization. Toyota is not far behind, with a total market capitalization of $262.3 billion. In third place is Volkswagen, with a total market capitalization of $136.1 billion. In addition, the fourth to tenth place are BYD, Rivian, Mercedes-Benz parent company Daimler, GM, Lucid Motors, Ford, Great Wall and other car companies.

When new energy vehicles become tuyere, new car brands quickly become a new direction of investment. Judging from the list, Tesla, who ranked No. 1, has risen the fastest in the past month. Hertz, a US car rental company, announced on October 25th that it plans to order 100000 Tesla cars and some charging facilities. Starting in November, US users can rent Tesla Model 3 at airports and nearby stores in major US cities, while Tesla rental services are also available in some European cities. Affected by the news, Tesla's stock rose 12.66% on the same day, and its market capitalization exceeded 1 trillion US dollars for the first time, reaching 1.03 trillion US dollars (about RMB 6.58 trillion). It has become another listed company with a market capitalization of more than one trillion US dollars in the United States after Apple, Amazon, Microsoft and Google, leading global car companies. Judging from Tesla's current market capitalization, it exceeds the combined market capitalization of 11 traditional auto giants, including Volkswagen, General Motors, Ford, Honda and so on, by $807 billion. In terms of time line, Tesla began to deliver domestic models in China in early January 2020, which led to a rapid increase in stock price. On January 23, the market capitalization exceeded US $100 billion for the first time, with a total market capitalization of US $102.66 billion. It became the first US automaker with a market capitalization of more than 100 billion, and became the second automaker in the world after Toyota. Tesla's share price rose 5% on June 10, 2020, with a market capitalization of US $183 billion, surpassing Toyota's market capitalization of US $180 billion, becoming the world's largest car company by market capitalization for the first time, and once leading the way to this day. At present, according to Tesla's market capitalization, although Toyota is still the second car company, it is out of reach to catch up with and surpass Tesla.

Toyota, which ranks second, has a relatively stable market capitalization, leading Volkswagen, which ranks third with a market capitalization of $260.3 billion. Toyota has announced production cuts many times this year due to parts shortages, and it will still suffer from parts supply problems for a long time in the future, but the most difficult time has passed. Toyota said on November 12th that all 14 factories and 28 production lines in Japan would resume normal operations in December, with plans to produce 800000 vehicles worldwide in December and maintain an earlier forecast of 9 million for the current fiscal year.

In third place is Volkswagen, which has stopped production several times, also affected by a shortage of parts. According to relevant data released by Volkswagen, due to the shortage of chips, Volkswagen Group's revenue, operating profit and operating profit margin all showed a downward trend in the third quarter compared with the same period last year. Its third-quarter operating income was 56.931 billion euros, down 4.1% from the same period last year; operating profit was 2.798 billion euros, down 12.1% from the same period last year; operating profit margin was 4.9%, compared with 5.4% in the same period last year. Global delivery was 1.97 million vehicles in the third quarter, down 24 per cent from a year earlier.

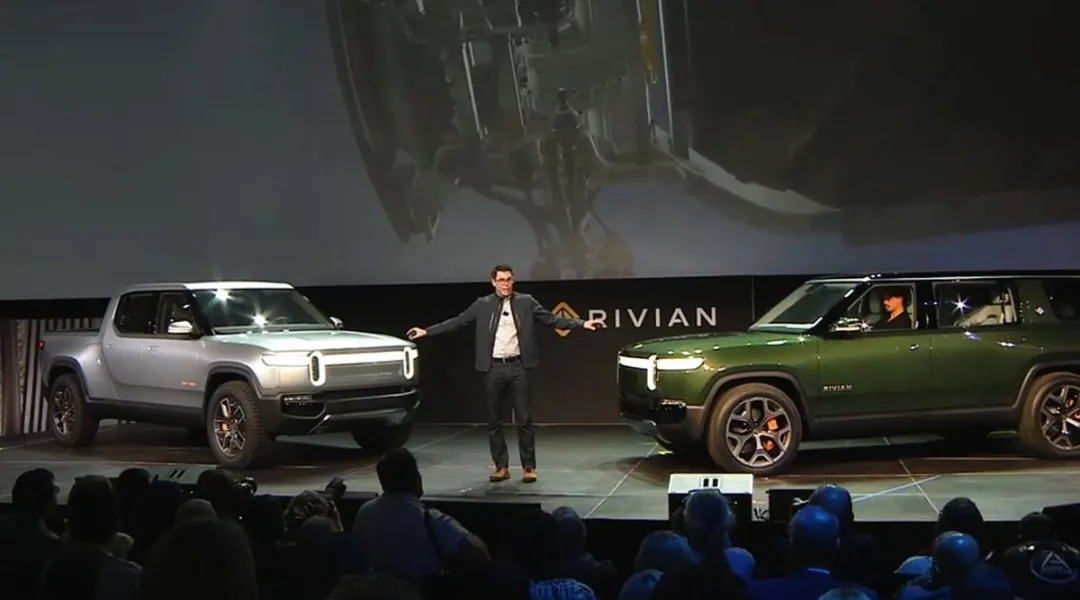

What is surprising about this market capitalization ranking is the new power of car-building Rivian, because shortly after its listing, its total market capitalization surpassed traditional automakers such as Daimler, Ford and General Motors, and even surpassed Volkswagen into the top three. In addition, Rivian has not yet started large-scale delivery, and only about a thousand vehicles have been delivered. According to relevant data, Rivian, founded by Scarlinch in 2009, previously focused on the production of high-performance sports cars, and now begins to focus on market segments such as trucks, SUV and crossovers. Rivian currently has bookings of 55400 R1s SUV and R1T pickups. As of the end of October, Rivian's production and delivery figures were only 180 and 156, respectively. For Rivian market capitalization of more than 100 billion US dollars, Tesla Musk has also said: mass production first.

In fourth place is China's BYD, whose share price has been relatively volatile for nearly a month, falling again after a market capitalization of more than one trillion yuan. However, BYD's delivery of new energy vehicles has shown an increasing trend in recent months, with 88898 passenger vehicles sold in October, of which 80003 are new energy passenger vehicles, including Qin PLUS DM-i, Han EV, Song DM and Qin PLUS EV, while the share of fuel vehicles is shrinking. Not long ago, BYD made it clear that it would stop producing fuel cars by 2040.

On the whole, due to the COVID-19 epidemic and lack of cores this year, the sales and performance of many car companies have declined, and the market capitalization of car companies has also shrunk, but with the improvement of the shortage of spare parts, the market capitalization of some car companies, such as Daimler, also shows a growing trend. General Motors, Ford, BMW, etc. In a sense, although the performance of market capitalization does not fully reflect the real strength of a car company, from the perspective of market performance, under the influence of the COVID-19 epidemic, most multinational car companies face challenges such as factory shutdowns, supply chain disruptions, and pressure on sales, which reflect that their market capitalization performance is not satisfactory in the capital market. As the market recovers, the auto market will also rebound.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.