In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/24 Report--

Liu Luanxiong, Xu Jiayin's best ally, could not bear it because of the Evergrande Group debt crisis.

On November 23rd, Chinese real estate announced the clearance of 751 million shares of Evergrande. The announcement said, "depending on market conditions at that time, the Group will sell up to 751 million authorised shares in the market or through block transactions in one or a series of transactions from time to time during the authorisation period." The Sale license will be valid for a period of 12 months from September 23, 2021 to September 22, 2022.

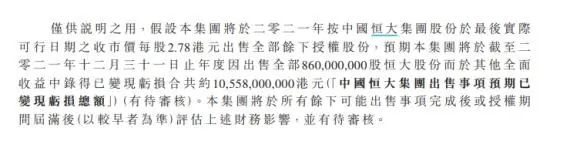

The company bought a total of 860 million shares in China Evergrande from 2017 to 2018 at a total cost of HK $13.596 billion, with an average cost of HK $15.80 per share, according to the Chinese property notice. However, if the company sells a total of 860 million shares of China Evergrande at HK $2.78 per share in accordance with the relevant conditions, the company is expected to lose HK $10.558 billion.

In response to the reason why Chinese real estate will clear Evergrande shares in the coming year, Chinese real estate said: investing in China Evergrande lost more than HK $11 billion. Given the significant adverse changes in the group's financial position since June 30 this year, the outlook is likely to be difficult.

And clearance of China Evergrande, on September 23, Chinese property also announced that a total of 109 million shares of China Evergrande were sold through the Hong Kong Stock Exchange from August 30 to September 21, with a total consideration of about 247 million Hong Kong dollars. Chinese Real Estate said it may sell its remaining 751 million shares in China Evergrande, which is expected to lose HK $9.5 billion.

As of November 23, the total market value of Chinese property was HK $7.06 billion.

According to public information, Chinese property is an important asset platform of Hong Kong tycoon Joseph Lau and his wife. As of the first half of 2021, the company's rental income was about HK $161 million, compared with HK $212 million in the same period in 2020.

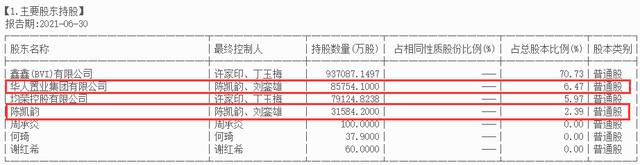

In addition, Mr. and Mrs. Liu Luanxiong were once important shareholders of China Evergrande. According to Evergrande's 2020 financial report, Chen Kaiyun, Liu Luanxiong's wife, held a total of 8.86% of China Evergrande shares as both an individual and a company, making him the second largest shareholder in China Evergrande after Xu Jiayin.

Luanxiong Lau is the best ally of Xu Jiayin, chairman of Evergrande Group, which originated in 2008, when Xu Jiayin went to the Hong Kong Stock Exchange with Evergrande, but the listing plan fell through because of the financial crisis. After the successful listing of Evergrande in 2009 with the help of Joseph Lau, Joseph Lau became a "loyal fan" of Evergrande, and since then he has generously unpacked Xu Jiayin many times.

The cost of buying 860 million shares in China Evergrande between 2017 and 2018 was about HK $13.596 billion, with a paper profit of nearly HK $10 billion at the peak of Evergrande's market capitalization. At the end of 2019, Mr. and Mrs. Lau also received a dividend of 1.7 billion yuan from China's Evergrande.

This year, Evergrande shares fell sharply as a result of the debt crisis.

According to media reports, since July 1 this year, Xu Jiayin has raised funds by selling personal assets or pledged equity in order to maintain the group's liquidity, and has injected more than 7 billion yuan of cash into the group in order to save itself and maintain huge basic operations. on the 16th of this month, it was reported that Xu Jiayin was selling his assets for Evergrande self-rescue.

On Sept. 24, Evergrande said it suspended some of its daily expenses and the group ran into financial difficulties.

On October 4, China Evergrande, Evergrande property and Hesheng Chuangchuang all suspended trading pending a major announcement. China Evergrande said in an announcement on October 20th that it planned to sell a 51 per cent stake in Evergrande property at a price of HK $20.04 billion to Hesheng Technology Group Co., Ltd., a subsidiary of Hesheng Innovation and Development Group.

In November, the Evergrande crisis did not improve after months of self-rescue, and now, at a time of crisis, Liu Luanxiong, Xu Jiayin's most determined business partner, decided to quit. In this way, Evergrande's problem may be more than just a debt crisis.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.