In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/26 Report--

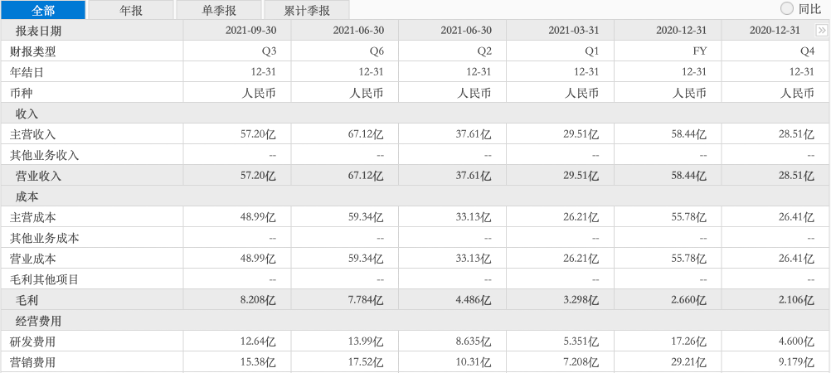

On November 23rd, Xiaopeng Motor, a new energy vehicle brand, released its third-quarter financial results. According to its financial report, Xiaopeng Motor's total revenue in the third quarter was 5.72 billion yuan, of which car sales revenue was 5.46 billion yuan, net profit was-1.595 billion yuan, and Xiaopeng Motor lost 3.58 billion in the first three quarters.

Xiaopeng delivered 25666 cars in the third quarter, equivalent to a loss of about 62000 yuan for every car sold. Compared with the net profit of the second quarter of 2021-1.195 billion yuan. Xiaopeng's losses are further increasing, but even so, its listing prices in Hong Kong and the United States have continued to rise after it announced its results. On a recent US stock trading day, Xiaopeng's share price closed at US $54.37, up 5.98% on that day. Its US stock market capitalization was equivalent to 297.3 billion yuan on that day. With the ideal advantage of surpassing Xilai in delivery volume in the third quarter, its share price reached its highest level in nearly a year, higher than SAIC's latest market capitalization of 240 billion yuan, and GAC GROUP's market capitalization of 166 billion yuan.

On July 7, 2021, Xiaopeng Motor listed in Hong Kong. On that day, Xiaopeng Motor Hong Kong shares opened up 1.82%, then fluctuated all the way down to HK $159.3 per share, closing at HK $165.00 per share, up 0 per cent. However, with a total market capitalization of HK $279.1 billion, Hong Kong stocks still surpass traditional car companies such as Geely and Great Wall Motors. At present, it ranks second among Chinese new energy vehicle brands, second only to Lulai Motor.

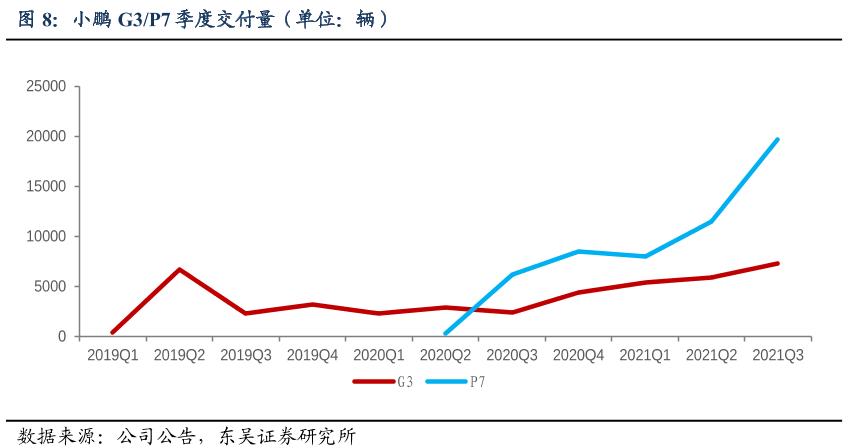

Why does the stock price continue to grow when the net profit of Q3 is not satisfactory? According to some analysts, first, Xiaopeng's revenue is growing, with revenue of 5.72 billion yuan in the third quarter, an increase of 187.4% over the same period last year, an increase of 52.1% month-on-month, exceeding the analysis forecast of 5.21 billion yuan; second, Xiaopeng's order volume is increasing, and the car delivery volume in the third quarter is 25666, an increase of 199.2% over the same period last year and 47.5% over the 17398 in the second quarter of this year. Third, Xiaopeng's cash reserve is increasing. Xiaopeng's cash reserve in the third quarter is 45.36 billion yuan, which is higher than that of 32.87 billion yuan in the second quarter. It has a strong ability to resist risks and expand its business.

Daiwa, a research institution, released a research report today reiterating Xiaopeng's "buy" rating on Hong Kong stocks, doubling the forecast for new car delivery next year from 90, 000 to 185000, with a target price up 10.53% from HK $209 to HK $231.

Even so, SAIC sold more than 4 million vehicles from January to October this year, making a profit of 20.35 billion yuan in the first three quarters, while GAC GROUP made a profit of about 5.3 billion in the first three quarters, which is lower than Xiaopeng's market capitalization.

Xiaopeng sold only more than 60,000 cars from January to October, and the value gap between the two makes many netizens say it is elusive.

Xiaopeng Automobile, named after its founder and chairman, he Xiaopeng, is said to be too rustic on the Internet. At a brand conference on November 18, he Xiaopeng once again responded to the question of "Xiaopeng's car name is too corny", saying frankly that he began to think about "Xiaopeng's name is too corny" since last year. However, after careful consideration, the decision was made, "We will not change the name." He cited Ford, Toyota, Tesla and other car companies named after their surnames as examples, saying that naming brands after names is an expression of recognition and responsibility for Xiaopeng's brand. "We should be confident to go out," he said. " .

New power cars can compete with traditional car companies in terms of market capitalization, mostly because the new power is more capable of depicting the future. Xiaopeng Automobile released its fourth mass production model Xiaopeng G9 at the Guangzhou Auto Show, which is also the first medium-and large-scale SUV under Xiaopeng Automobile. Among the earlier products, the performance of the low-priced G3 is not very satisfactory, and there are some problems with the product itself. due to problems with the inverter, a total of 13399 G3 vehicles were recalled from March 27, 2019 to September 27, 2020, while the total sales of 2019Q2 to 2020Q3 G3 reached 19828, accounting for 67.6% of the recalled vehicles. In April 2020, Xiaopeng Motor made a comprehensive comparison with Tesla's Model S and Model 3 at the press conference of its mid-and high-end sports sedan P7, and promoted the product to Tesla. P7 became Xiaopeng's exploding star.

The newly released Xiaopeng G9 will be the first model with the new LOGO logo. According to available information, the Xiaopeng G9 is equipped with Xpilot 4.0driving assist system, lidar, as well as intelligent chassis and air suspension system.

In terms of price, Xiaopeng G9 is positioned between Xiaopeng P7 ordinary model and Xiaopeng P7 Peng wing version, that is, 30-400000 yuan, including Lantu FREE, ideal ONE, ID.6 X/ID.6 CROZZ and other models. Xiaopeng executives said at a conference call on the third quarterly report: "compared with the size and positioning of the ES8,G9, it is closer to the NIO ES6. The G9 takes the lead in ultra-fast charging technology, EE architecture and so on. " Can Xiaopeng car with the traffic password be able to turn the G9 delivered in the third quarter of next year into the next popular style, and how far will the new power leave behind the traditional market capitalization at that time? Let's wait and see.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.