In addition to Weibo, there is also WeChat

Please pay attention

WeChat public account

AutoBeta

2024-11-22 Update From: AutoBeta autobeta NAV: AutoBeta > News >

Share

AutoBeta(AutoBeta.net)11/29 Report--

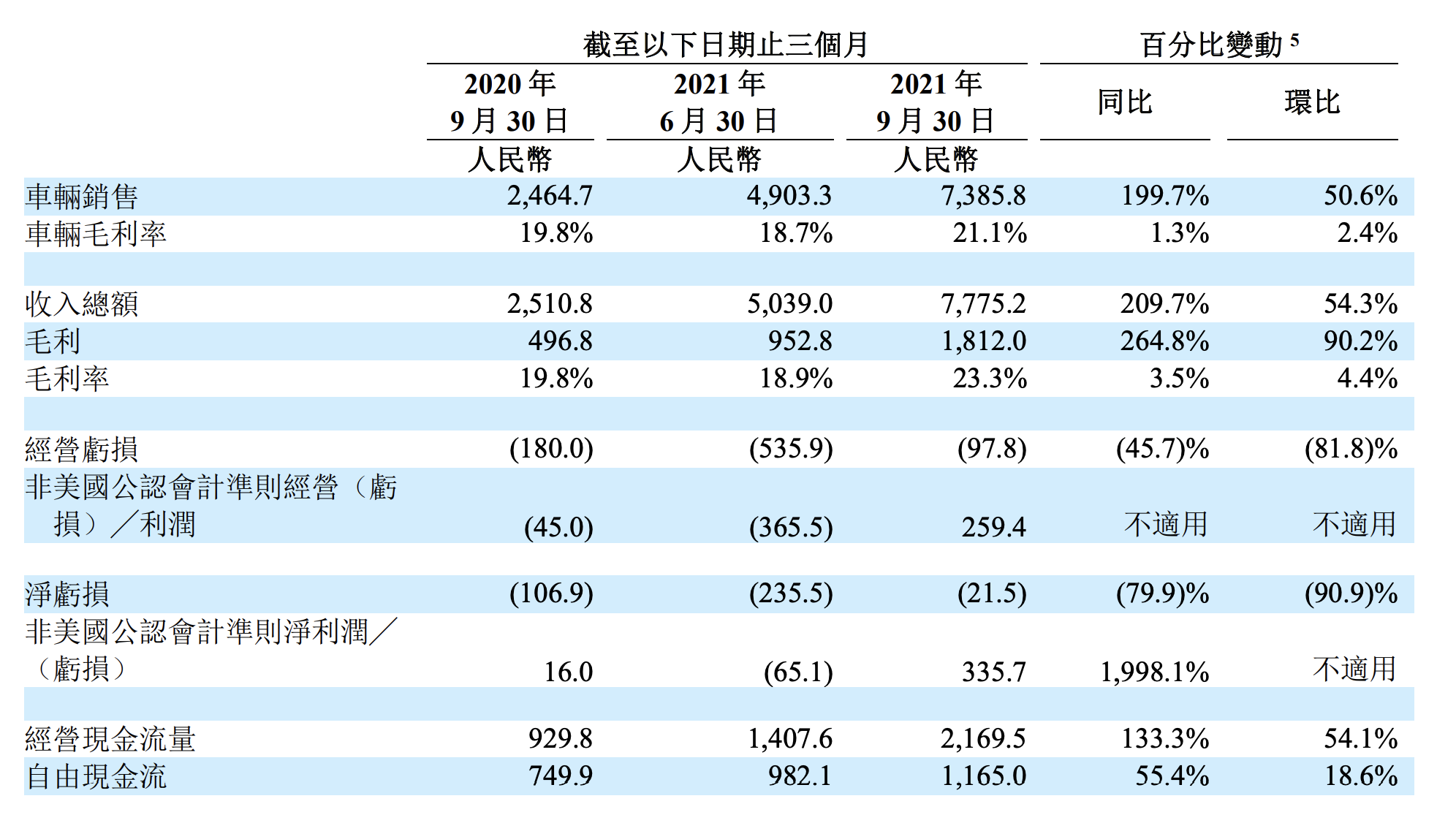

On November 29th, ideal Motor released its results for the third quarter of 2021, showing that its revenue in the third quarter was 7.775 billion yuan, an increase of 209.7% over the same period last year. The net loss of ideal car in the third quarter was 21.5 million yuan, which narrowed by 79.9% compared with the same period last year. As of September 30, 2021, the total amount of ideal car cash and cash equivalents, restricted cash, time deposits and short-term investments is 48.83 billion yuan.

The growth of ideal automobile revenue is inseparable from the growth of new car delivery. According to the financial report, the ideal car delivery volume in the third quarter of 2021 is 25116, of which vehicle sales revenue is 7.39 billion yuan, an increase of 199.7% over the same period last year. For future development, ideal expects delivery of 30000-32000 vehicles in the fourth quarter, an increase of 107.4% 121.2% over the same period in 2020. Total revenue is expected to be 88.2-9.41 billion yuan, an increase of 112.7 percent over the same period in 2020.

With the release of the ideal auto earnings report, the new Chinese car-building brand Wei Xiaoli has released all the results. By comparison, in the third quarter, NIO, Xiaopeng and ideal operating income were 9.805 billion yuan (116.6%), 5.712 billion yuan (187.4%) and 7.775 billion yuan (209.7%), respectively, and the net losses were 835 million yuan, 1.595 billion yuan and 21.5 million yuan respectively.

In terms of revenue, NIO is still in the lead in Wei Xiaoli, but due to the shortage of chips, its delivery volume in the third quarter is the lowest. According to the delivery data released by the above three new car-building forces, Lulai delivered a total of 24439 new cars in the third quarter, 25666 Xiaopeng cars and 25116 ideal cars.

Judging from the financial results, the gross profit margins of the three new car-building forces are all positive. In the third quarter, the gross profit margin of NIO is 20.3%, Xiaopeng is 14.4%, and the ideal car is 23.3%. However, "Wei Xiaoli" has not yet reached the profit critical point and is still in a state of loss, especially Xiaopeng Automobile, although its delivery volume is the highest in the third quarter, its net loss is the highest. This is equivalent to a loss of about 62000 yuan for every car sold.

Of course, Xiaopeng Motor suffered a large loss, mainly because of the increase in R & D costs. The financial report shows that the research and development cost of Lai Automobile in the third quarter is 1.193 billion yuan, Xiaopeng Motor is 1.264 billion yuan, and ideal car is 889 million yuan. As for the reason, Xiaopeng said in the financial report that the increase in expenditure related to the research and development of new models G9 and P5 and the development of software technologies related to supporting future growth.

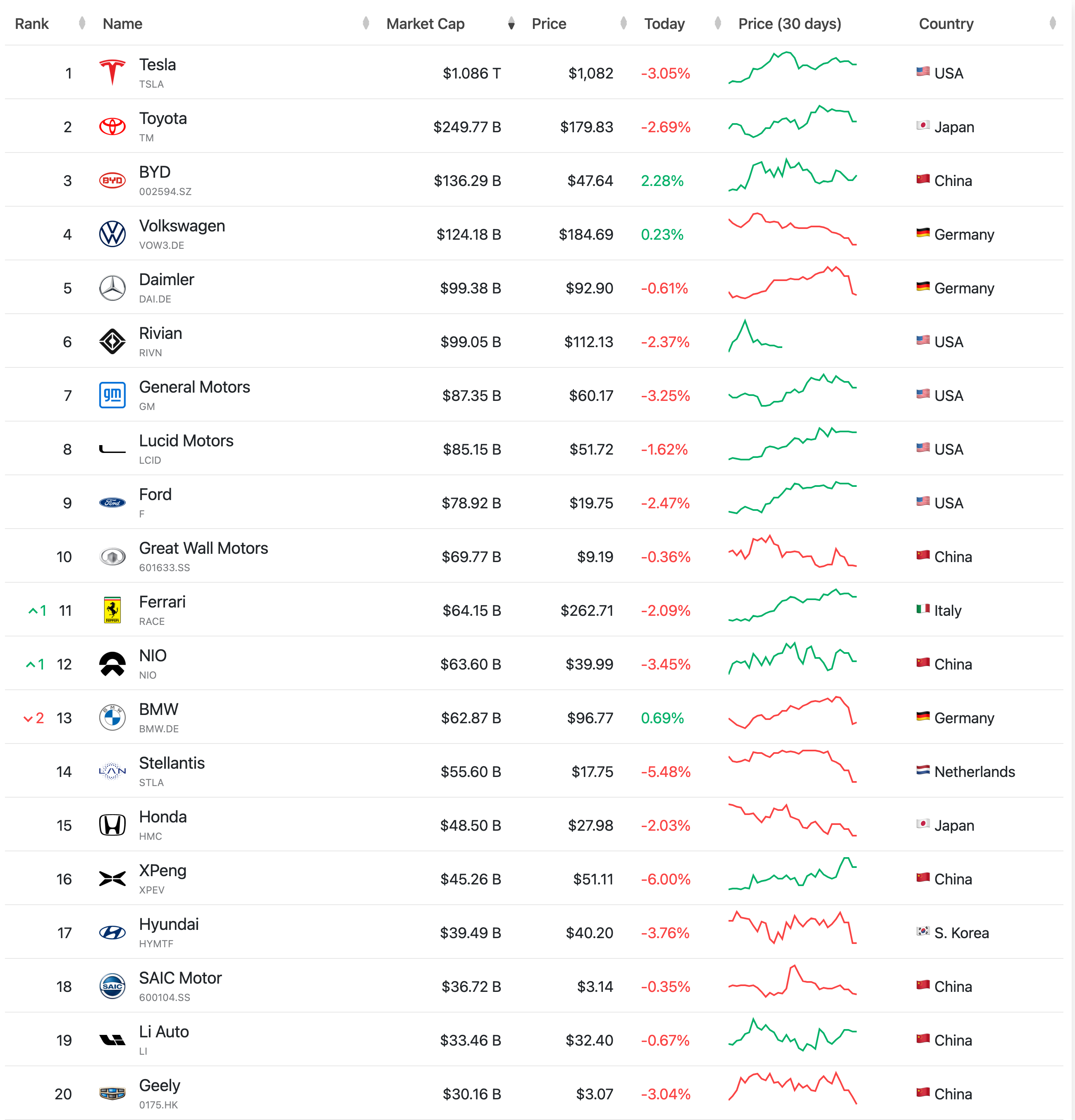

At present, Wei Xiaoli is listed in the United States, of which Xiaopeng and ideal are listed on the Hong Kong Stock Exchange at the same time. According to the latest market capitalization statistics, the current total market capitalization of Lulai is US $63.58 billion, ranking 11th in the global auto market, second only to BYD and the Great Wall in China, and Xiaopeng Motor currently has a total market capitalization of US $45.26 billion, ranking 16th in the global auto market. second only to the above three car companies in China, it has just finished surpassing SAIC, while ideal Automobile has a total market capitalization of US $33.46 billion, ranking 19th in the global market. Second only to BYD, Great Wall, NIO, Xiaopeng and SAIC.

Of course, market capitalization may not represent a substantive issue, but at least to some extent reflects the capital's recognition of the future development of the brand. Looking at the domestic market, apart from Tesla and BYD, the brands with the best development in the field of new energy vehicles, Ulay, Xiaopeng and ideal are also on the list, and at present they are also on the rising channel. but the three car companies are still in a state of loss, where is the turning point for turning losses into profits? This is also a difficult problem for long-term development.

Welcome to subscribe to the WeChat public account "Automotive Industry Focus" to get the first-hand insider information on the automotive industry and talk about things in the automotive circle. Welcome to break the news! WeChat ID autoWechat

Views: 0

*The comments in the above article only represent the author's personal views and do not represent the views and positions of this website. If you have more insights, please feel free to contribute and share.

© 2024 AutoBeta.Net Tiger Media Company. All rights reserved.